Question: Homework Saved Help Save & Exit Submit Check my work Fes Company is making adjusting journal entries for the year ended December 31, 2018. In

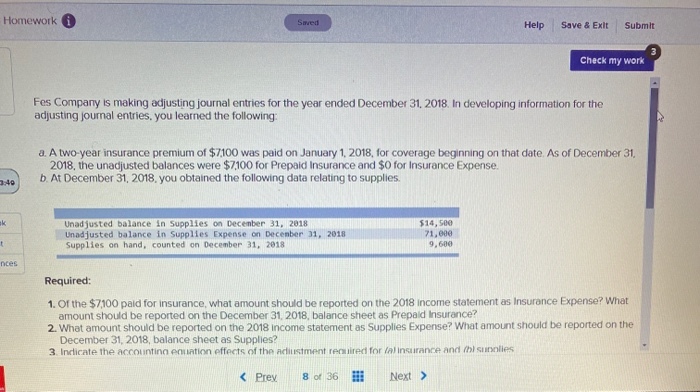

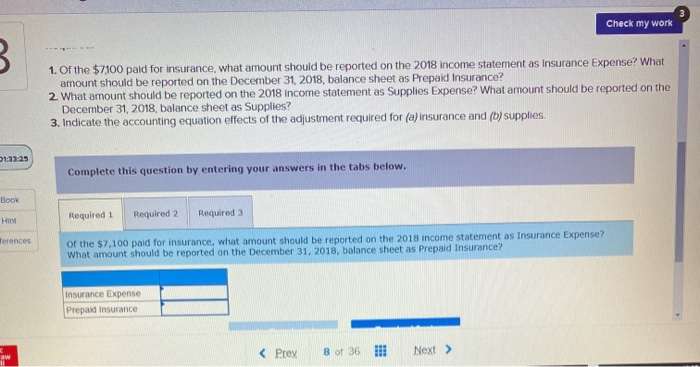

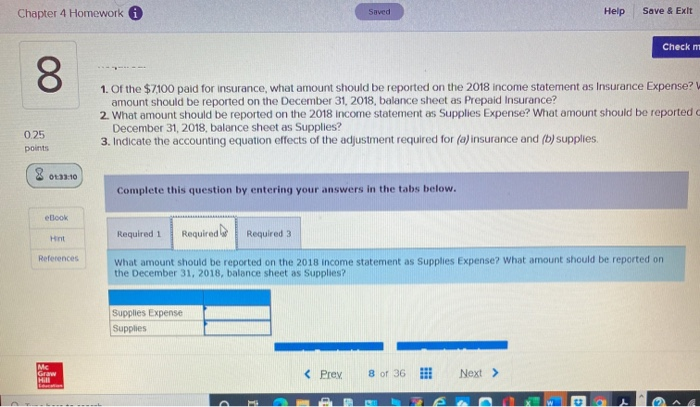

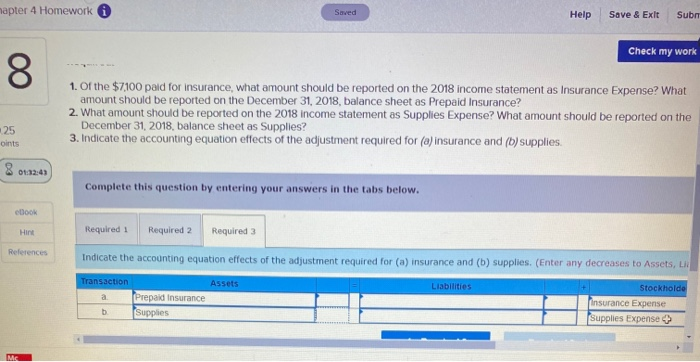

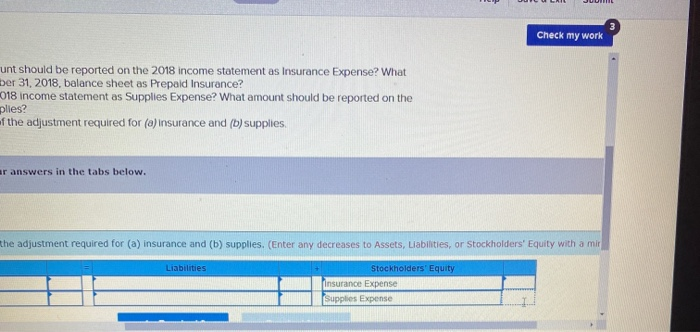

Homework Saved Help Save & Exit Submit Check my work Fes Company is making adjusting journal entries for the year ended December 31, 2018. In developing information for the adjusting journal entries, you learned the following: a. A two-year insurance premium of $7100 was paid on January 1, 2018, for coverage beginning on that date. As of December 31 2018, the unadjusted balances were $7100 for Prepaid Insurance and so for Insurance Expense. b. At December 31, 2018. you obtained the following data relating to supplies. 7.40 Unadjusted balance in Supplies on December 31, 2018 Un adjusted balance in Supplies Expense on December 31, 2018 Supplies on hand, counted on December 31, 2018 $14,500 71,000 9,600 nces Required: 1. Of the $7100 paid for insurance, what amount should be reported on the 2018 income statement as Insurance Expense? What amount should be reported on the December 31, 2018, balance sheet as Prepaid Insurance? 2. What amount should be reported on the 2018 income statement as Supplies Expense? What amount should be reported on the December 31, 2018, balance sheet as Supplies? 3. Indicate the accounting ouation effects of the adiestment required for tal insurance and il sules Check my work B. 1. Of the $7100 paid for insurance, what amount should be reported on the 2018 income statement as Insurance Expense? What amount should be reported on the December 31, 2018, balance sheet as Prepaid Insurance? 2. What amount should be reported on the 2018 income statement as Supplies Expense? What amount should be reported on the December 31, 2018, balance sheet as Supplies? 3. Indicate the accounting equation effects of the adjustment required for (a)insurance and (b) supplies. 1:33:25 Complete this question by entering your answers in the tabs below. BOOK Hiru Required 1 Required 2 Required 3 Terences of the $7,100 paid for insurance, what amount should be reported on the 2018 income statement as Insurance Expense? What amount should be reported on the December 31, 2018, balance sheet as Prepaid Insurance? Insurance Expense Prepaid Insurance aw Chapter 4 Homework Saved Help Save & Exit Check m 8 1. Of the $7100 paid for insurance, what amount should be reported on the 2018 income statement as Insurance Expense? amount should be reported on the December 31, 2018, balance sheet as Prepaid Insurance? 2. What amount should be reported on the 2018 income statement as Supplies Expense? What amount should be reported December 31, 2018, balance sheet as Supplies? 3. Indicate the accounting equation effects of the adjustment required for (a) insurance and (b) supplies. 0.25 points 0133:10 Complete this question by entering your answers in the tabs below. eBook Hint Required Required 1 Required 3 References What amount should be reported on the 2018 income statement as Supplies Expense? What amount should be reported on the December 31, 2018, balance sheet as Supplies? Supplies Expense Supplies Mc Graw Hill mapter 4 Homework i Saved Help Save & Exit Sub Check my work 8 1. Of the $7100 paid for insurance, what amount should be reported on the 2018 income statement as Insurance Expense? What amount should be reported on the December 31, 2018, balance sheet as Prepaid Insurance? 2. What amount should be reported on the 2018 income statement as Supplies Expense? What amount should be reported on the December 31, 2018, balance sheet as Supplies? 3. Indicate the accounting equation effects of the adjustment required for (a) insurance and (b) supplies. 25 oints 01:32:43 Complete this question by entering your answers in the tabs below. cBook Hint Required 1 Required 2 Required 3 References References Indicate the accounting equation effects of the adjustment required for (a) insurance and (b) supplies. (Enter any decreases to Assets, Liabilities Transaction Assets a Prepaid Insurance b Supplies Stockholde insurance Expense Supplies Expense + M Check my work unt should be reported on the 2018 income statement as Insurance Expense? What ber 31, 2018, balance sheet as Prepaid Insurance? 018 income statement as Supplies Expense? What amount should be reported on the plies? f the adjustment required for (a) insurance and (b) supplies. ar answers in the tabs below. the adjustment required for (a) insurance and (b) supplies. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a mir Liabilities Stockholders' Equity insurance Expense Supplies Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts