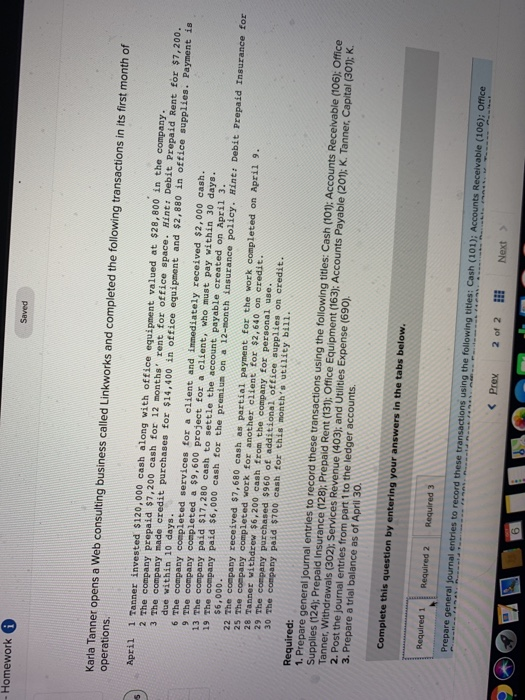

Question: - Homework Saved operations. Karla Tanner opens a Web consulting business called Linkworks and completed the following transactions in its first month of April 1

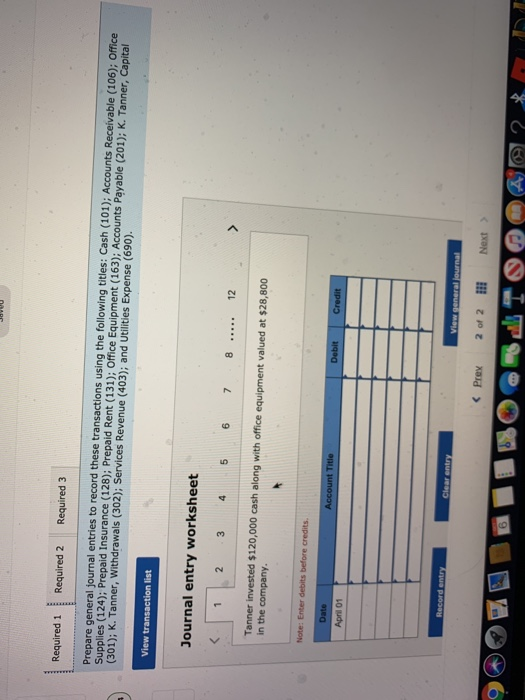

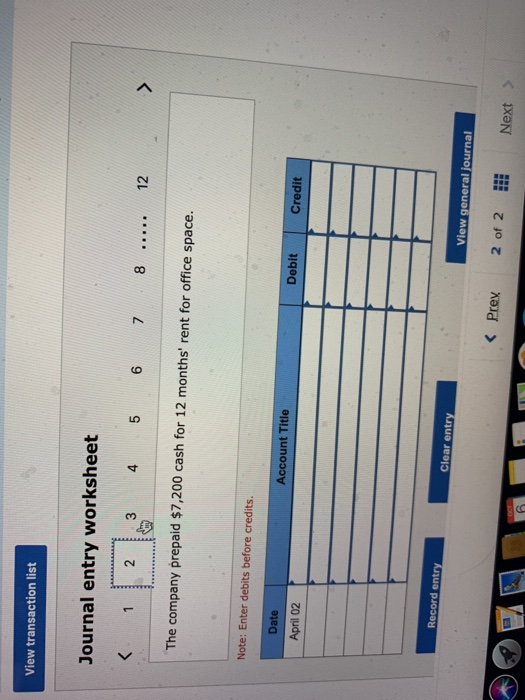

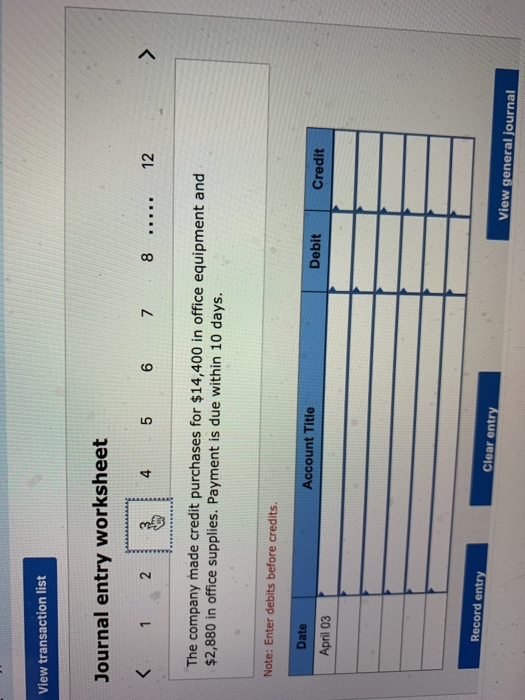

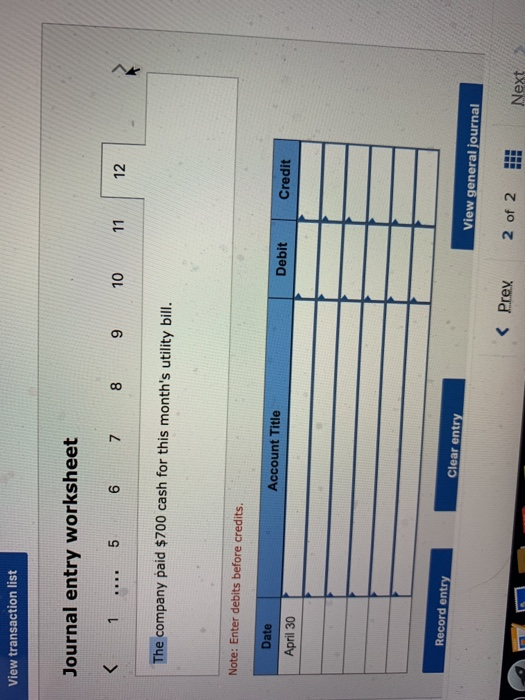

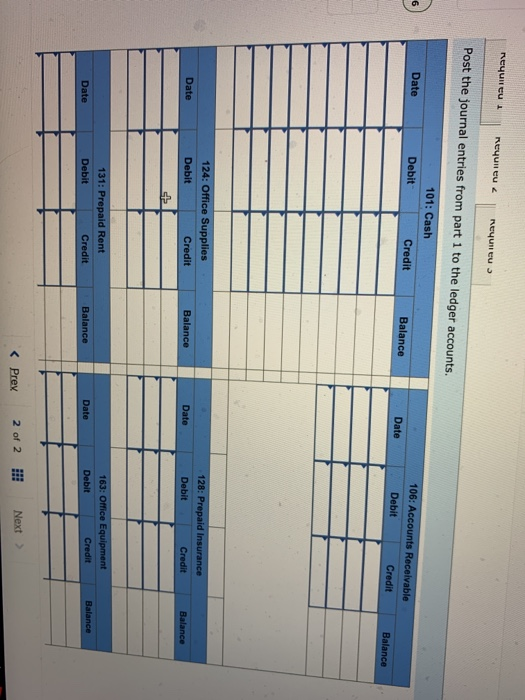

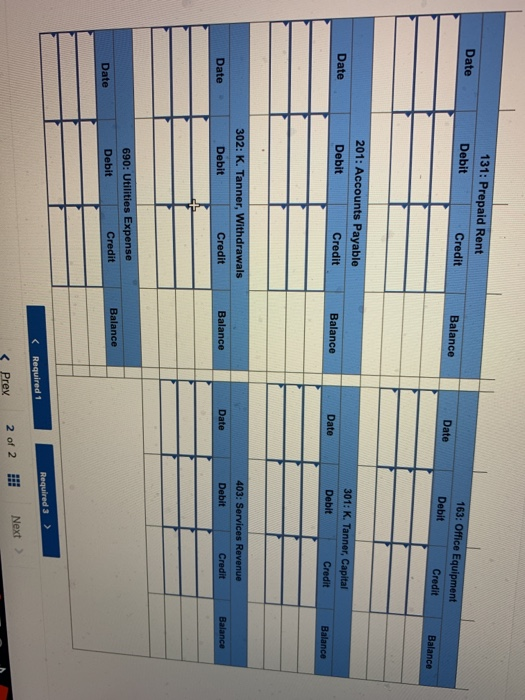

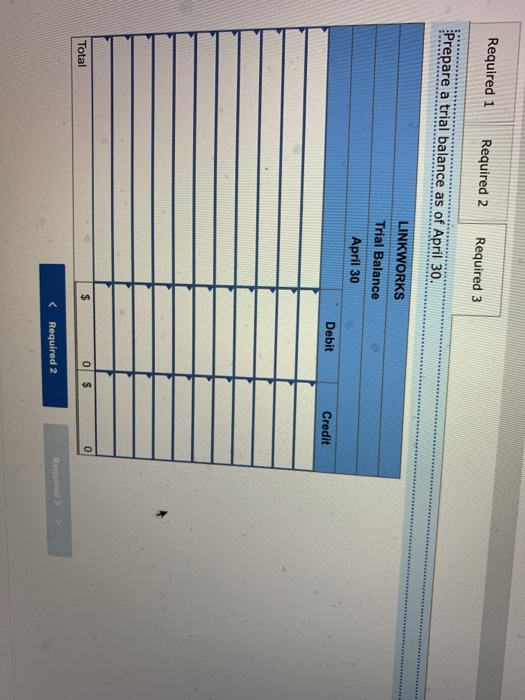

- Homework Saved operations. Karla Tanner opens a Web consulting business called Linkworks and completed the following transactions in its first month of April 1 Tanner invested $120,000 cash along with office equipment valued at $28,800 in the company. 2 The company prepaid $7,200 cash for 12 months' rent for office space. Mint: Debit Prepaid Rent for $7.200. 3 The company made credit purchases for $14,400 in office equipment and $2,880 in office supplies. Payment is doe within 10 days. 6 The company completed services for a client and immediately received $2,000 cash. 9 The company completed a $9,600 project for a client, who must pay within 30 days. 13 The company paid $17,280 cash to settle the account payable created on April 3. 19 The company paid $6,000 cash for the premium on a 12-month insurance policy. Hint: Debit Prepaid Insurance for $6,000. 22 The company received $7,680 cash as partial payment for the work completed on April 9. 25 The company completed work for another client for $2,640 on credit. 28 Tanner withdrew $6,200 cash from the company for personal use. 29 The company purchased 5960 of additional office supplies on credit. 30 The company paid $700 cash for this month's utility bill. Required: 1. Prepare general Journal entries to record these transactions using the following titles: Cash (101): Accounts Receivable (106): Office Supplies (124): Prepaid Insurance (128); Prepaid Rent (131): Office Equipment (163): Accounts Payable (201): K. Tanner, Capital (301): K Tanner, Withdrawals (302); Services Revenue (403), and Utilities Expense (690). 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of April 30. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare general journal entries to record these transactions using the following titles: Cash (101): Accounts Receivable (106); Office Required 1 Required 2 Required 3 Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); K. Tanner, Capital (301); K. Tanner, Withdrawals (302); Services Revenue (403); and Utilities Expense (690). View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 ..... 12 Tanner invested $120,000 cash along with office equipment valued at $28,800 in the company. Note: Enter debits before credits Date Account Title Debit April 01 Credit Record entry _ Clear entry View general journal View transaction list Journal entry worksheet The company prepaid $7,200 cash for 12 months' rent for office space. Note: Enter debits before credits. Date April 02 Account Title Debit Credit Record entry Clear entry View general journal View transaction list Journal entry worksheet 4 5 6 7 8 ..... 12 The company made credit purchases for $14,400 in office equipment and $2,880 in office supplies. Payment is due within 10 days. Note: Enter debits before credits. Date April 03 Account Title Debit Credit Record entry Clear entry View general journal View transaction list Journal entry worksheet 6 36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts