Question: Homework: Week 13 Homework - Chapter 11 Save Score: 0 of 1 pt 3 of 10 (3 complete) HW Score: 8%, 2 of 25 pts

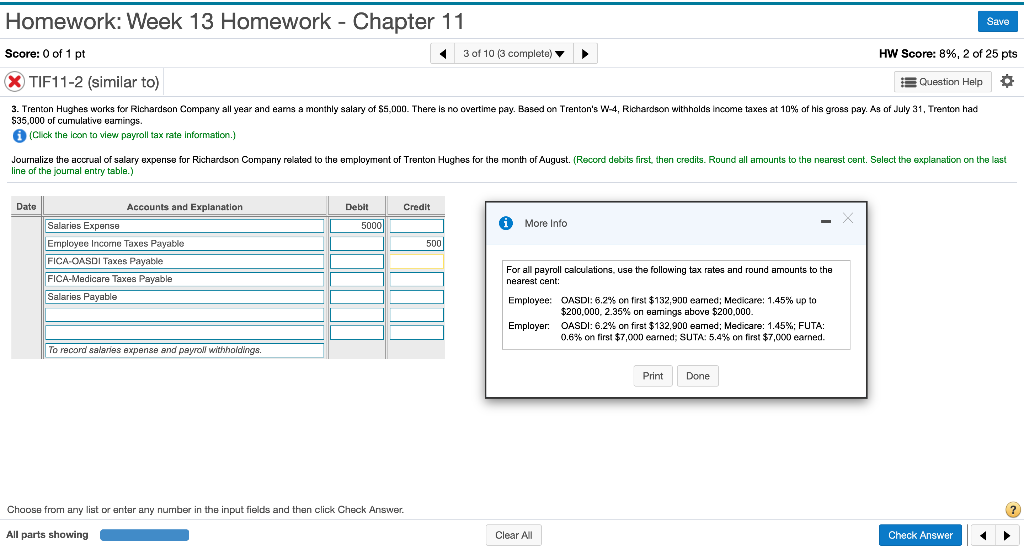

Homework: Week 13 Homework - Chapter 11 Save Score: 0 of 1 pt 3 of 10 (3 complete) HW Score: 8%, 2 of 25 pts X TIF11-2 (similar to) B Question Help 3. Trenton Hughes works for Richardson Company all year and eams a monthly salary of SS,000. There is no overtime pay. Based on Trenton's W-4, Richardson withholds income taxes at 10% of his gross pay. As of July 31, Trenton had $35,000 of cumulative earnings. (Click the loon to view payroll tax rate information.) Journalize the accrual of salary expense for Richardson Company related to the employment of Trenton Hughes for the month line of the journal entry table.) August. (Record debits first, then credits. Round all amounts to the nearest cent. Select the explanation on the last Date Credit Debit 5000 i More Info 500 Accounts and Explanation Salarios Expense Employee Income Taxes Payable FICA OASDI Taxes Payable FICA-Medicare Taxes Payable Salaries Payable For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned: Medicare: 1.45% up to $200,000, 2.35% on earings above $200,000. Employer. OASDI: 6.2% on first $132.900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. To record salaries expense and peyroll withholdings. Print Done Choose from any list or enter any number in the input fields and then click Check Answer. ? All parts showing Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts