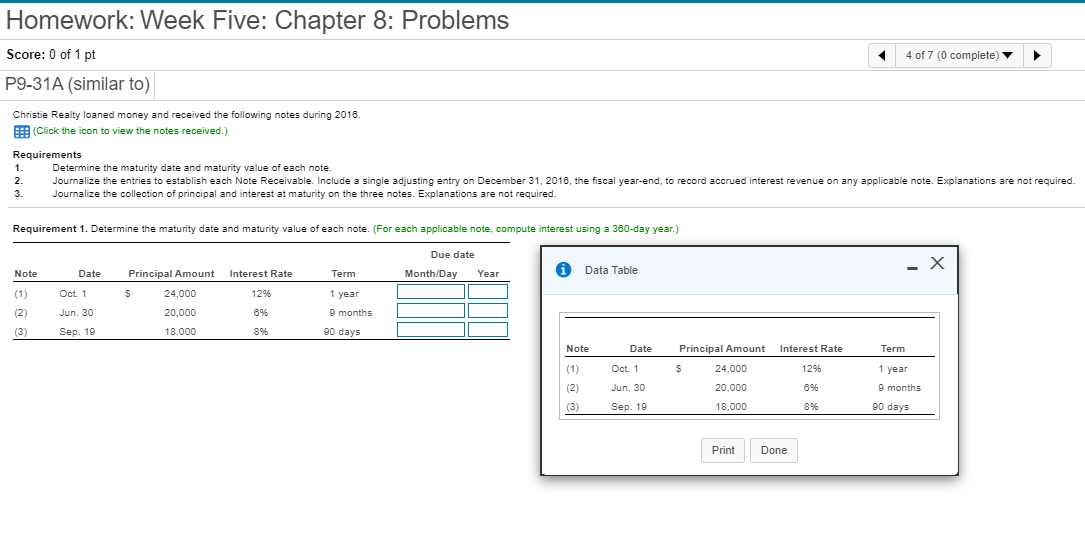

Question: Homework: Week Five: Chapter 8: Problems 4 of 7 (0 complete Score: 0 of 1 pt P9-31A (similar to) Christie Realty loaned money and received

Homework: Week Five: Chapter 8: Problems 4 of 7 (0 complete Score: 0 of 1 pt P9-31A (similar to) Christie Realty loaned money and received the following notes during 2016, (Click the icon to view the notes received.) Requirements 1. Determine the maturity date and maturity value of each note. 2. Journalize the entries to establish each Note Receivable. Include a single adjusting entry on December 31, 2018, the fiscal year-end, to record accrued interest revenue on any applicable note. Explanations are not required. 3. Journalize the collection of principal and interest at maturity on the three notes. Explanations are not required. Requirement 1. Determine the maturity date and maturity value of each note. (For each applicable note, compute interest using a 360-day year.) Due date Month/Day Year Note -X Date Principal Amount Interest Rate Term Data Table (1) Oct 1 S 24,000 12% 1 year Jun. 30 20.000 6% 9 months (3) Sep. 10 18,000 894 90 days Note Date Principal Amount Interest Rate Term Oct. 1 $ 24.000 12% 1 year (2) Jun. 30 696 9 months 20.000 18.000 (3) Sep. 19 896 90 days Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts