Question: Homework: Week Five Question 8, E22-9 (similar to) Part 1 of 2 HW Score: 57.89%, 5.79 of 10 points O Points: 0 of 1 Save

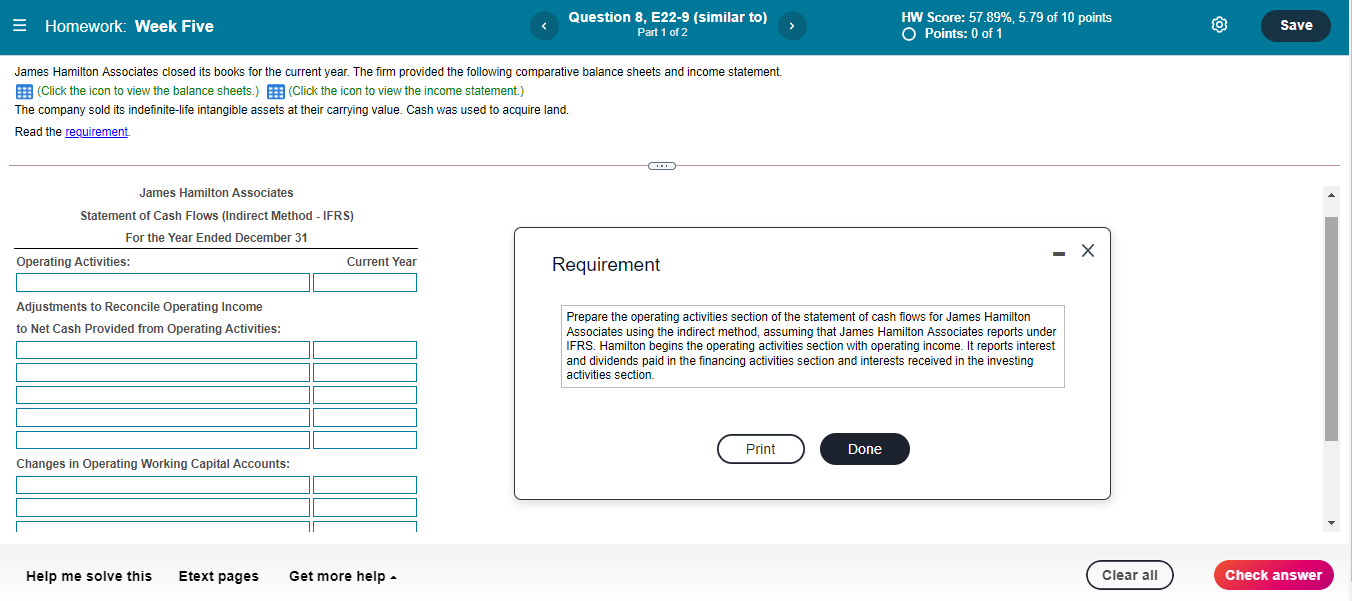

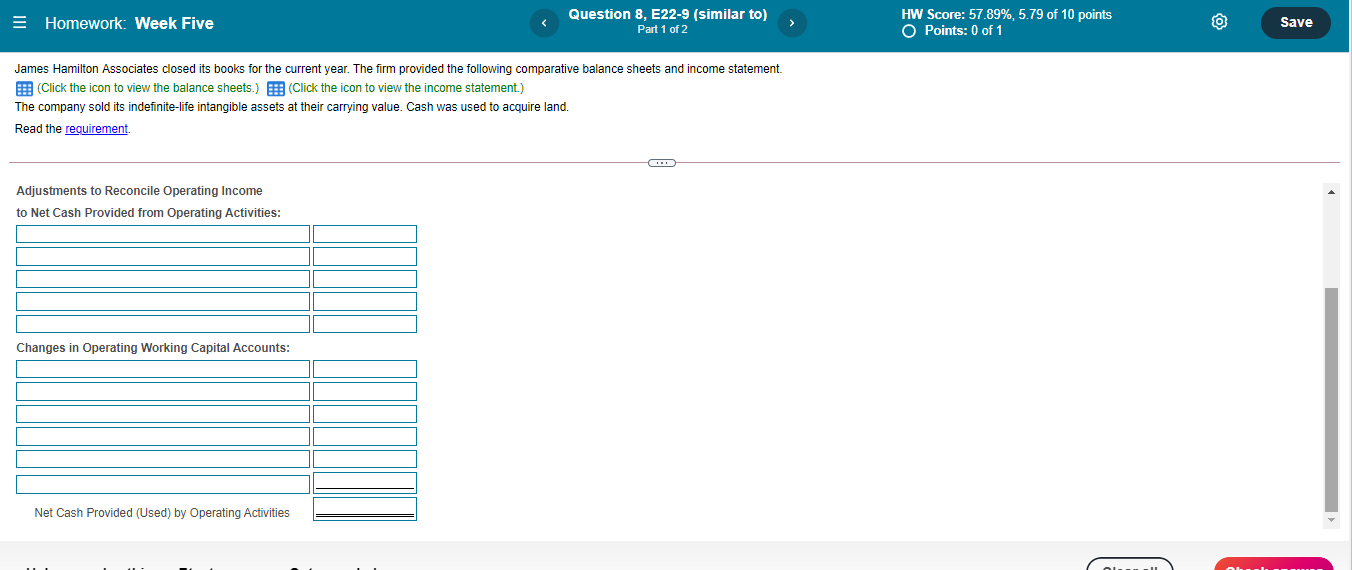

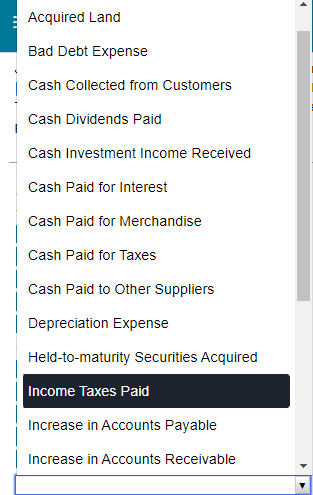

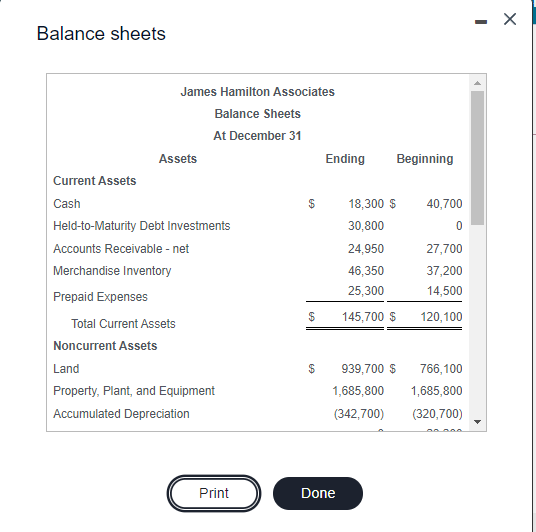

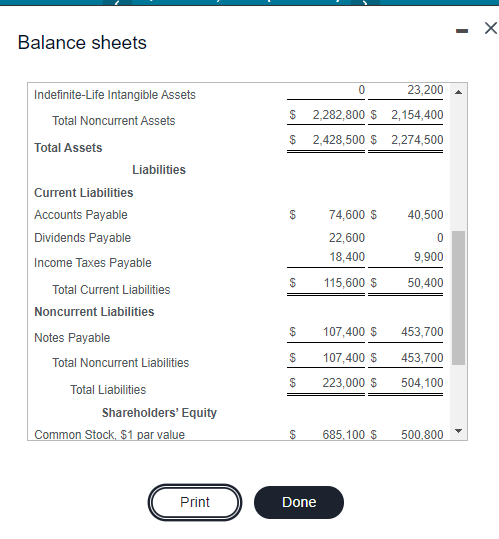

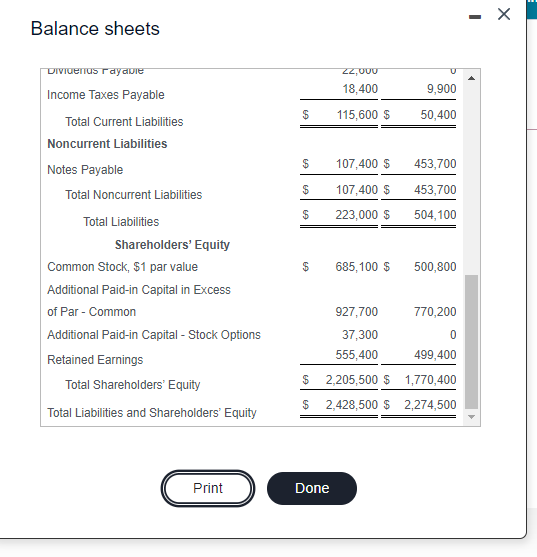

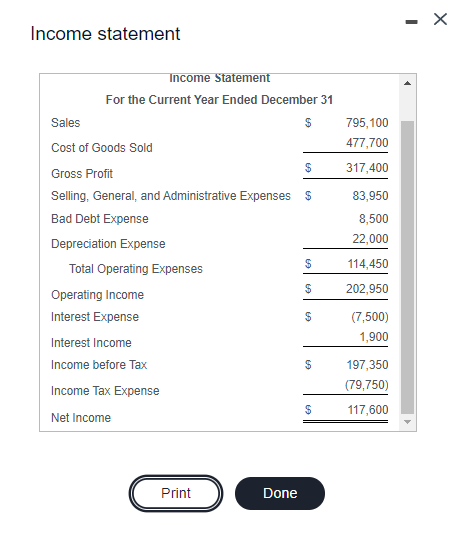

Homework: Week Five Question 8, E22-9 (similar to) Part 1 of 2 HW Score: 57.89%, 5.79 of 10 points O Points: 0 of 1 Save James Hamilton Associates closed its books for the current year. The firm provided the following comparative balance sheets and income statement. (Click the icon to view the balance sheets.) (Click the icon to view the income statement.) The company sold its indefinite-life intangible assets at their carrying value. Cash was used to acquire land. Read the requirement. O James Hamilton Associates Statement of Cash Flows (Indirect Method - IFRS) For the Year Ended December 31 - X Operating Activities: Current Year Requirement Adjustments to Reconcile Operating Income to Net Cash Provided from Operating Activities: Prepare the operating activities section of the statement of cash flows for James Hamilton Associates using the indirect method, assuming that James Hamilton Associates reports under IFRS. Hamilton begins the operating activities section with operating income. It reports interest and dividends paid in the financing activities section and interests received in the investing activities section Print Done Changes in Operating Working Capital Accounts: Help me solve this Etext pages Get more help Clear all Check answer Homework: Week Five Question 8, E22-9 (similar to) Part 1 of 2 HW Score: 57.89%, 5.79 of 10 points O Points: 0 of 1 Save James Hamilton Associates closed its books for the current year. The firm provided the following comparative balance sheets and income statement. (Click the icon to view the balance sheets.) (Click the icon to view the income statement.) The company sold its indefinite-life intangible assets at their carrying value. Cash was used to acquire land. Read the requirement. Adjustments to Reconcile Operating Income to Net Cash Provided from Operating Activities: Changes in Operating Working Capital Accounts: Net Cash Provided (Used) by Operating Activities . Acquired Land Bad Debt Expense Cash Collected from Customers Cash Dividends Paid Cash Investment Income Received Cash Paid for Interest Cash Paid for Merchandise Cash Paid for Taxes Cash Paid to Other Suppliers Depreciation Expense Held-to-maturity Securities Acquired Income Taxes Paid Increase in Accounts Payable Increase in Accounts Receivable - -X Balance sheets James Hamilton Associates Balance Sheets At December 31 Assets Ending Beginning Current Assets Cash $ 18,300 $ 40,700 Held-to-Maturity Debt Investments 30,800 0 Accounts Receivable - net 24,950 27,700 Merchandise Inventory 46,350 37,200 Prepaid Expenses 25,300 14,500 $ 145,700 $ 120, 100 Total Current Assets Noncurrent Assets Land $ 939,700 $ 766,100 Property, Plant, and Equipment 1,685,800 1,685,800 Accumulated Depreciation (342,700) (320,700) Print Done Balance sheets 0 23,200 $ 2,282,800 $ 2,154,400 $ 2,428,500 $ 2,274,500 $ 74,600 $ 22,600 18,400 Indefinite-Life Intangible Assets Total Noncurrent Assets Total Assets Liabilities Current Liabilities Accounts Payable Dividends Payable Income Taxes Payable Total Current Liabilities Noncurrent Liabilities Notes Payable Total Noncurrent Liabilities Total Liabilities Shareholders' Equity Common Stock, $1 par value 40,500 0 9,900 50,400 $ 115,600 $ $ $ 107,400 $ 453,700 107,400 $ 453,700 223,000 $504,100 $ $ 685,100 $ 500.800 Print Done X Balance sheets Dividerus ray dole 22,000 18,400 9,900 $ $ 115,600 $ 50,400 GA 107,400 $ 453,700 GA 107,400 $ 453,700 $ 223,000 $504,100 Income Taxes Payable Total Current Liabilities Noncurrent Liabilities Notes Payable Total Noncurrent Liabilities Total Liabilities Shareholders' Equity Common Stock, $1 par value Additional Paid-in Capital in Excess of Par - Common Additional Paid-in Capital - Stock Options Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity $ 685,100 $ 500,800 927,700 770,200 37,300 555,400 499,400 2,205,500 $ 1,770,400 2,428,500 $ 2,274,500 $ $ Print Done - Income statement 795,100 477,700 317,400 83,950 8,500 22,000 Income Statement For the Current Year Ended December 31 Sales $ Cost of Goods Sold Gross Profit $ Selling, General, and Administrative Expenses $ Bad Debt Expense Depreciation Expense Total Operating Expenses $ Operating Income $ Interest Expense Interest Income Income before Tax Income Tax Expense $ Net Income 114,450 202,950 A (7,500) 1,900 $ $ 197,350 (79,750) 117,600 Print Done Homework: Week Five Question 8, E22-9 (similar to) Part 1 of 2 HW Score: 57.89%, 5.79 of 10 points O Points: 0 of 1 Save James Hamilton Associates closed its books for the current year. The firm provided the following comparative balance sheets and income statement. (Click the icon to view the balance sheets.) (Click the icon to view the income statement.) The company sold its indefinite-life intangible assets at their carrying value. Cash was used to acquire land. Read the requirement. O James Hamilton Associates Statement of Cash Flows (Indirect Method - IFRS) For the Year Ended December 31 - X Operating Activities: Current Year Requirement Adjustments to Reconcile Operating Income to Net Cash Provided from Operating Activities: Prepare the operating activities section of the statement of cash flows for James Hamilton Associates using the indirect method, assuming that James Hamilton Associates reports under IFRS. Hamilton begins the operating activities section with operating income. It reports interest and dividends paid in the financing activities section and interests received in the investing activities section Print Done Changes in Operating Working Capital Accounts: Help me solve this Etext pages Get more help Clear all Check answer Homework: Week Five Question 8, E22-9 (similar to) Part 1 of 2 HW Score: 57.89%, 5.79 of 10 points O Points: 0 of 1 Save James Hamilton Associates closed its books for the current year. The firm provided the following comparative balance sheets and income statement. (Click the icon to view the balance sheets.) (Click the icon to view the income statement.) The company sold its indefinite-life intangible assets at their carrying value. Cash was used to acquire land. Read the requirement. Adjustments to Reconcile Operating Income to Net Cash Provided from Operating Activities: Changes in Operating Working Capital Accounts: Net Cash Provided (Used) by Operating Activities . Acquired Land Bad Debt Expense Cash Collected from Customers Cash Dividends Paid Cash Investment Income Received Cash Paid for Interest Cash Paid for Merchandise Cash Paid for Taxes Cash Paid to Other Suppliers Depreciation Expense Held-to-maturity Securities Acquired Income Taxes Paid Increase in Accounts Payable Increase in Accounts Receivable - -X Balance sheets James Hamilton Associates Balance Sheets At December 31 Assets Ending Beginning Current Assets Cash $ 18,300 $ 40,700 Held-to-Maturity Debt Investments 30,800 0 Accounts Receivable - net 24,950 27,700 Merchandise Inventory 46,350 37,200 Prepaid Expenses 25,300 14,500 $ 145,700 $ 120, 100 Total Current Assets Noncurrent Assets Land $ 939,700 $ 766,100 Property, Plant, and Equipment 1,685,800 1,685,800 Accumulated Depreciation (342,700) (320,700) Print Done Balance sheets 0 23,200 $ 2,282,800 $ 2,154,400 $ 2,428,500 $ 2,274,500 $ 74,600 $ 22,600 18,400 Indefinite-Life Intangible Assets Total Noncurrent Assets Total Assets Liabilities Current Liabilities Accounts Payable Dividends Payable Income Taxes Payable Total Current Liabilities Noncurrent Liabilities Notes Payable Total Noncurrent Liabilities Total Liabilities Shareholders' Equity Common Stock, $1 par value 40,500 0 9,900 50,400 $ 115,600 $ $ $ 107,400 $ 453,700 107,400 $ 453,700 223,000 $504,100 $ $ 685,100 $ 500.800 Print Done X Balance sheets Dividerus ray dole 22,000 18,400 9,900 $ $ 115,600 $ 50,400 GA 107,400 $ 453,700 GA 107,400 $ 453,700 $ 223,000 $504,100 Income Taxes Payable Total Current Liabilities Noncurrent Liabilities Notes Payable Total Noncurrent Liabilities Total Liabilities Shareholders' Equity Common Stock, $1 par value Additional Paid-in Capital in Excess of Par - Common Additional Paid-in Capital - Stock Options Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity $ 685,100 $ 500,800 927,700 770,200 37,300 555,400 499,400 2,205,500 $ 1,770,400 2,428,500 $ 2,274,500 $ $ Print Done - Income statement 795,100 477,700 317,400 83,950 8,500 22,000 Income Statement For the Current Year Ended December 31 Sales $ Cost of Goods Sold Gross Profit $ Selling, General, and Administrative Expenses $ Bad Debt Expense Depreciation Expense Total Operating Expenses $ Operating Income $ Interest Expense Interest Income Income before Tax Income Tax Expense $ Net Income 114,450 202,950 A (7,500) 1,900 $ $ 197,350 (79,750) 117,600 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts