Question: Homework: Week One Question 10, E8-14 (boo.. HW Score: 26.52%, 2.92 of 11 points Part 1 of 10 Score: 0 of 1 Save Gary Construction

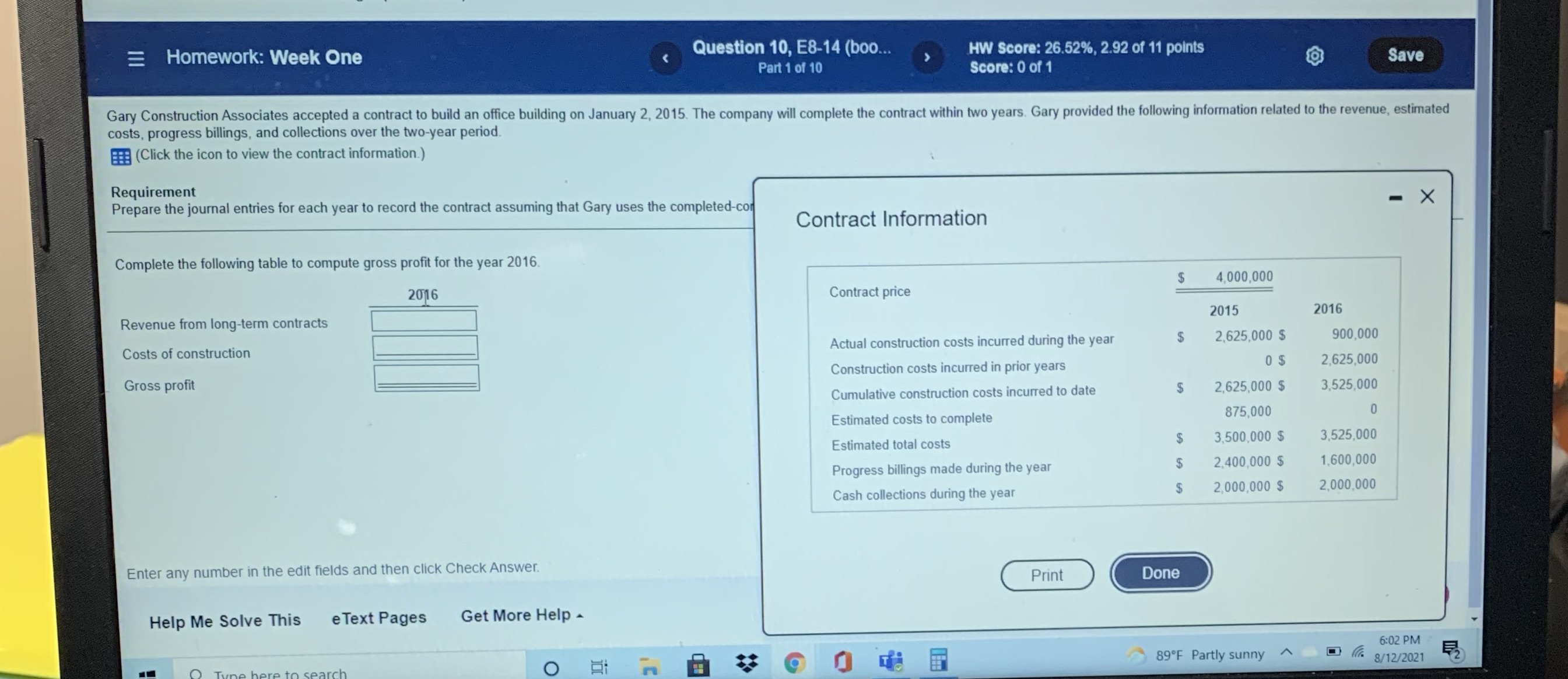

Homework: Week One Question 10, E8-14 (boo.. HW Score: 26.52%, 2.92 of 11 points Part 1 of 10 Score: 0 of 1 Save Gary Construction Associates accepted a contract to build an office building on January 2, 2015. The company will complete the contract within two years. Gary provided the following information related to the revenue, estimated costs, progress billings, and collections over the two-year period. (Click the icon to view the contract information.) Requirement Prepare the journal entries for each year to record the contract assuming that Gary uses the completed-con - X Contract Information Complete the following table to compute gross profit for the year 2016. $ 4.000,000 2016 Contract price Revenue from long-term contracts 2015 2016 Costs of construction Actual construction costs incurred during the year $ 2,625,000 $ 900,000 2,625,000 Gross profit Construction costs incurred in prior years 0 $ Cumulative construction costs incurred to date 2,625,000 $ 3,525,000 Estimated costs to complete 875,000 Estimated total costs 3,500,000 $ 3,525,000 Progress billings made during the year $ 2,400,000 $ 1,600,000 Cash collections during the year 2,000,000 $ 2,000,000 Enter any number in the edit fields and then click Check Answer. Print Done Help Me Solve This e Text Pages Get More Help - 6:02 PM O 89 F Partly sunny 8/12/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts