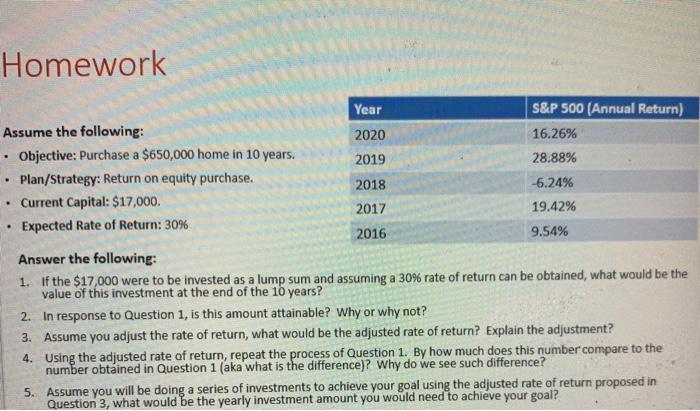

Question: Homework . . Year S&P 500 (Annual Return) Assume the following: 2020 16.26% Objective: Purchase a $650,000 home in 10 years. 2019 28.88% Plan/Strategy: Return

Homework . . Year S&P 500 (Annual Return) Assume the following: 2020 16.26% Objective: Purchase a $650,000 home in 10 years. 2019 28.88% Plan/Strategy: Return on equity purchase. 2018 -6.24% . Current Capital: $17,000. 2017 19.42% Expected Rate of Return: 30% 2016 9.54% Answer the following: 1. If the $17,000 were to be invested as a lump sum and assuming a 30% rate of return can be obtained, what would be the value of this investment at the end of the 16 years? 2. In response to Question 1, is this amount attainable? Why or why not? 3. Assume you adjust the rate of return, what would be the adjusted rate of return? Explain the adjustment? 4. Using the adjusted rate of return, repeat the process of Question 1. By how much does this number compare to the number obtained in Question 1 (aka what is the difference)? Why do we see such difference? 5. Assume you will be doing a series of investments to achieve your goal using the adjusted rate of return proposed in Question 3, what would be the yearly investment amount you would need to achieve your goal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts