Question: Hope for a fast reply. Thumbs up guaranteed! Current Attempt in Progress Sandhill Ltd. purchased an electric wax melter on April 30, 2020, by trading

Hope for a fast reply. Thumbs up guaranteed!

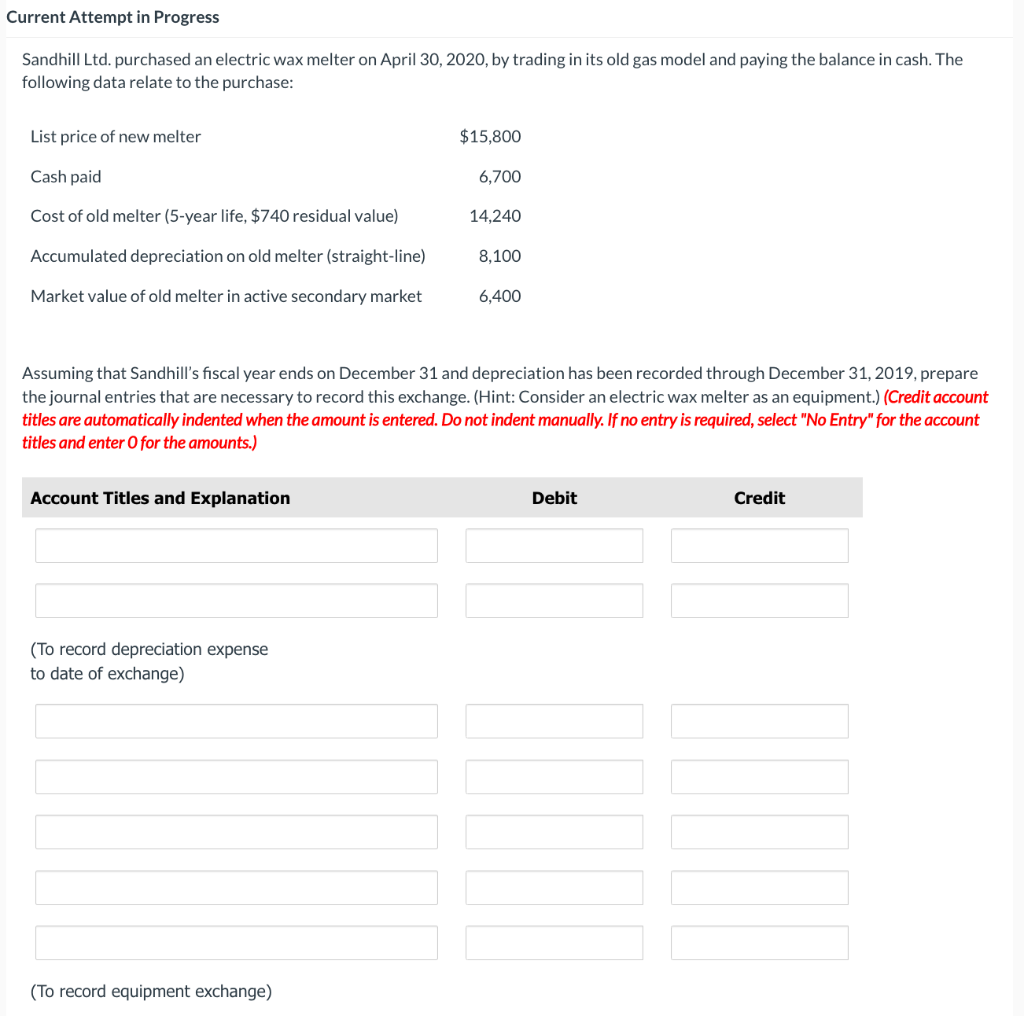

Current Attempt in Progress Sandhill Ltd. purchased an electric wax melter on April 30, 2020, by trading in its old gas model and paying the balance in cash. The following data relate to the purchase: List price of new melter $15,800 Cash paid 6,700 Cost of old melter (5-year life, $740 residual value) 14,240 Accumulated depreciation on old melter (straight-line) 8,100 Market value of old melter in active secondary market 6,400 Assuming that Sandhill's fiscal year ends on December 31 and depreciation has been recorded through December 31, 2019, prepare the journal entries that are necessary to record this exchange. (Hint: Consider an electric wax melter as an equipment.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record depreciation expense to date of exchange) (To record equipment exchange)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts