Question: hope you can write the detailed steps to solve this problem How did you get this answer 9) A risk-averse individual with current savingss>0 considers

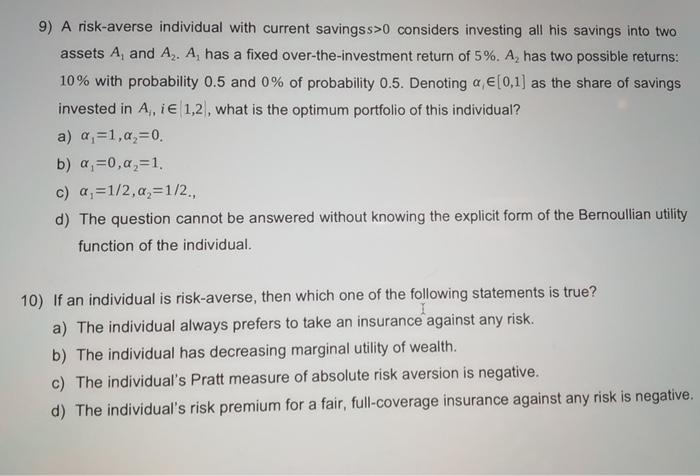

9) A risk-averse individual with current savingss>0 considers investing all his savings into two assets A, and A. A, has a fixed over-the-investment return of 5%. A, has two possible returns: 10% with probability 0.5 and 0% of probability 0.5. Denoting a E[0,1] as the share of savings invested in A, i 1,2, what is the optimum portfolio of this individual? a) a,=1,2,=0. b) a,=0,0,=1 c) a=1/2,a,=1/2. d) The question cannot be answered without knowing the explicit form of the Bernoullian utility function of the individual. 10) If an individual is risk-averse, then which one of the following statements is true? a) The individual always prefers to take an insurance against any risk. b) The individual has decreasing marginal utility of wealth. c) The individual's Pratt measure of absolute risk aversion is negative. d) The individual's risk premium for a fair, full-coverage insurance against any risk is negative. 9) A risk-averse individual with current savingss>0 considers investing all his savings into two assets A, and A. A, has a fixed over-the-investment return of 5%. A, has two possible returns: 10% with probability 0.5 and 0% of probability 0.5. Denoting a E[0,1] as the share of savings invested in A, i 1,2, what is the optimum portfolio of this individual? a) a,=1,2,=0. b) a,=0,0,=1 c) a=1/2,a,=1/2. d) The question cannot be answered without knowing the explicit form of the Bernoullian utility function of the individual. 10) If an individual is risk-averse, then which one of the following statements is true? a) The individual always prefers to take an insurance against any risk. b) The individual has decreasing marginal utility of wealth. c) The individual's Pratt measure of absolute risk aversion is negative. d) The individual's risk premium for a fair, full-coverage insurance against any risk is negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts