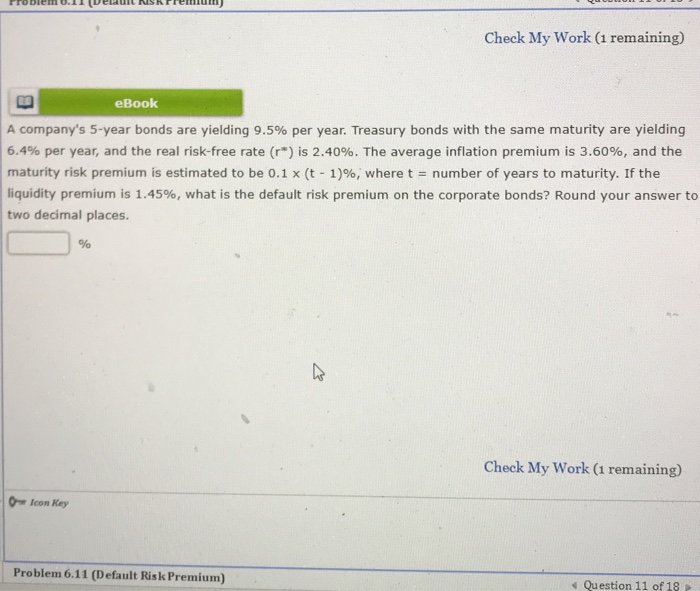

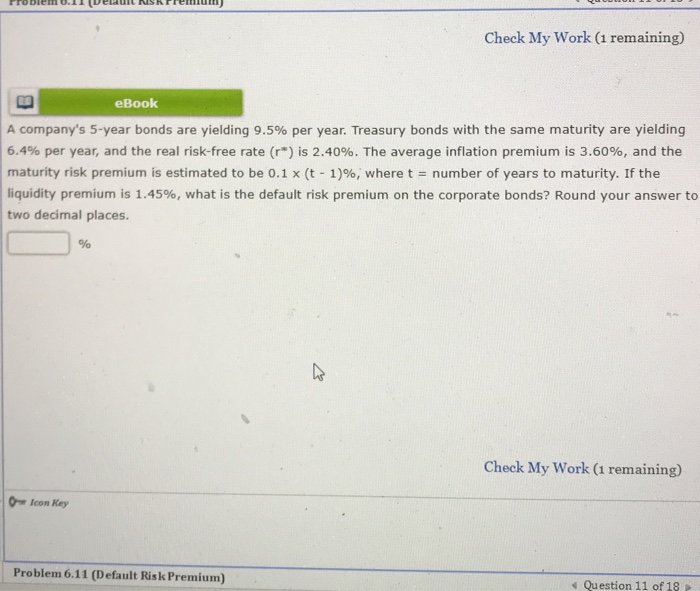

Question: Hoping to be able to solve this problem on excel Check My Work (1 remaining) eBook A company's 5-year bonds are yielding 9.5% per year

Hoping to be able to solve this problem on excel

Check My Work (1 remaining) eBook A company's 5-year bonds are yielding 9.5% per year Treasury bonds with the same maturity are yielding 6.4% per year, and the real risk-free rate (r*) is 2.40%. The average inflation premium is 3.60%, and the maturity risk premium is estimated to be 0.1 x (t-1)96, where t = number of years to maturity. If the liquidity premium is 1.45%, what is the default risk premium on the corporate bonds? Round your answer to two decimal places. Check My Work (i remaining) Om Icon Key Problem 6.11 (Default Risk Premium) s Question 11 of 18 P

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock