Question: Host Corp. will pay a $2.40 dividend (D1) in the next 12 months. The required rate of return (Ke) is 13 percent and the

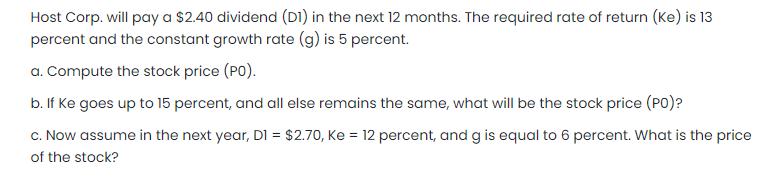

Host Corp. will pay a $2.40 dividend (D1) in the next 12 months. The required rate of return (Ke) is 13 percent and the constant growth rate (g) is 5 percent. a. Compute the stock price (PO). b. If Ke goes up to 15 percent, and all else remains the same, what will be the stock price (PO)? c. Now assume in the next year, D1 = $2.70, Ke = 12 percent, and g is equal to 6 percent. What is the price of the stock?

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

a The current stock price is given by discounting back the expected future divid... View full answer

Get step-by-step solutions from verified subject matter experts