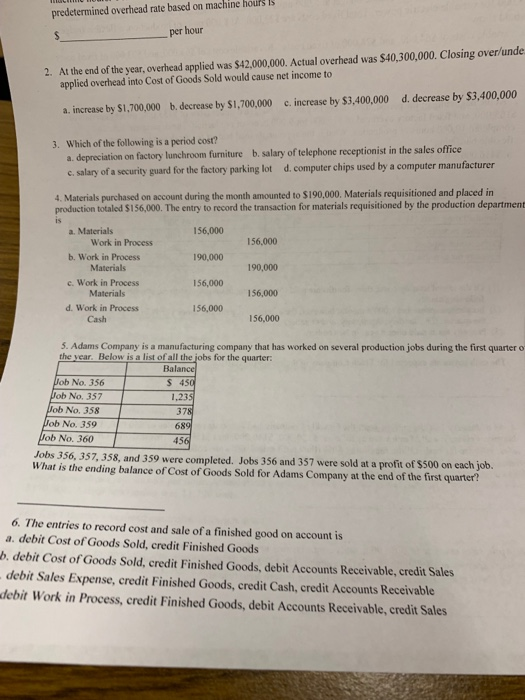

Question: hours 1 predetermined overhead rate based on machine per hour 2. At the end of the year, overhead applied was $42,000,000. Actual overhead was $40,300,000.

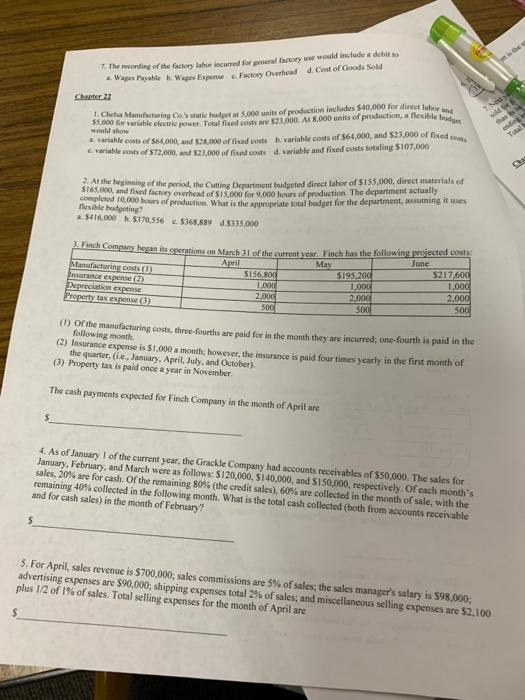

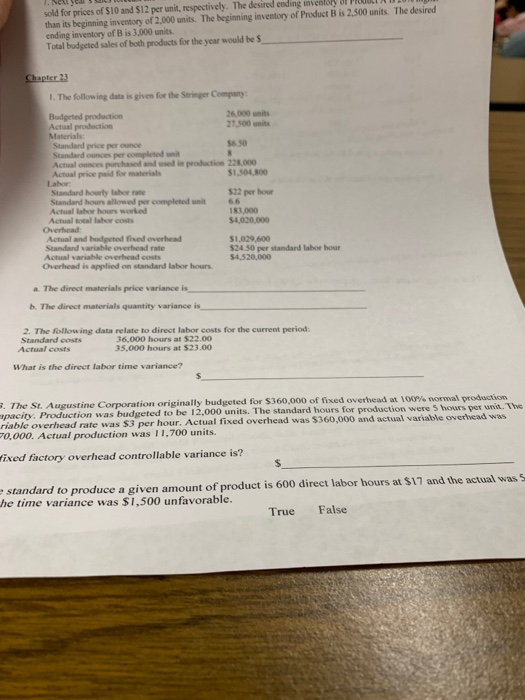

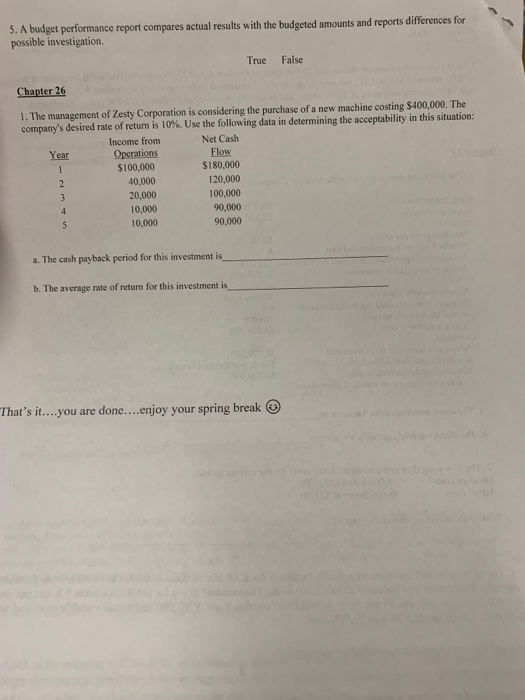

hours 1 predetermined overhead rate based on machine per hour 2. At the end of the year, overhead applied was $42,000,000. Actual overhead was $40,300,000. Closing over/unde applied overhead into Cost of Goods Sold would cause net income to c. increase by $3,400,000 d. decrease by $3,400,000 a. increase by $1,700,000 b. decrease by $1,700,000 Which of the following is a period cost? a. depreciation on factory lunchroom furniture b. salary of telephone receptionist in the sales office c salary of a security guard for the factory parking lot d.computer chips used by a computer manufacturer 3. 4. Materials purchased on account during the month amounted to $190,000. Materials requisitioned and placed in production totaled $156,000. The entry to record the transaction for materials requisitioned by the production department a. Materials 156.000 156,000 Work in Process b. Work in Process 190,000 Materials 190,000 c. Work in Process 156,000 156,000 Materials d. Work in Process Cash 156,000 5. Adams Company is a manufacturing company that has worked on several production jobs during the first quarter o the year. Below is a list of all the jobs for the quarter ob No. 356 ob No. 357 b No. 358 Balance S 450 1,23 b No. 359 68 b No. 360 Jobs 356, 357,358, and 359 were completed. Jobs 356 and 357 were sold at a profit of $500 on each job. What is the ending balance of Cost of Goods Sold for Adams Company at the end of the first quarter? 6. The entries to record cost and sale of a finished good on account is a. debit Cost of Goods Sold, credit Finished Goods h. debit Cost of Goods Sold, credit Finished Goods, debit Accounts Receivable, credit Sales debit Sales Expense, credit Finished Goods, credit Cash, credit Accounts Receivable debit Work in Process, credit Finished Goods, debit Accounts Receivable, credit Sales d.Cost of Goods Sold 7. The wconding of the factory labor incurred for pemeral factory use would include a debit to e. Factory Overhead Wages Expense Manufactrng 's static budpet at 5,000 units of production inclades $40,000 for direct labor bleelecrie power. Total fixed costs are $23,000. At 8,000 units of production, a flexible bud 1. Chelsa N 55,000 f would shovw a variable eosts c. variable costs fixed cot costs of S6,000,and $28,000 of fised costs b. variable costs of $64,000, and $23,000 of f d. variable and fixed costs totaling $107,000 of $72,000, and $23,000 of fixed costs the Cutting Department budgeted direct labor of $155,000, direct materials of of production. What is the appropriate total budget for the department, assuming it uses 2 At the beginning of the period, 165,000, and fixed The department actually y tos0 and fixed factory overhead of s1,000 for 9,000 hours of production. T completed 10,000 hours flexible budgeting? a. S4 16,000 b.S3 70.556 c.$368,889 d.$335,000 ions on March 31 of the current year. Finch has the following projected costs $217,60 1,00 2,00 .Fiach Cemeany bogn is ogerat April 5156 (1) Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month. (2) Insurance expense is $1,000 a month, however, the insurance is paid four times yearly in the first month of (3) Property tax is paid once a year in November the quarter, (i.e., January, April, July, and October). cash payments expected for Finch Company in the month of April are 4. As of January 1 of the current year, the Grackle Company had accounts receivables of $50,000. The sales for January, February, and March were as follows: $120,000, $140,000, and $150,000, respectively, Of each month's sales, 20% are for cash. Of the remaining 80% (the credit sales), 60% are collected in the month of sale, with the remaining 40% collected in the following month. What is the total cash collected (both from accounts receivable and for cash sales) in the month of February? 5. For April, sales revenue is S700.000, sales commissions are 5% of sales; the sales manager's salary is S98,00, advertising expenses are $90 000; shipping expenses total 2% of sales; and miscellaneous selling expenses are S2 100 plus 12 of 1% of sales. Total selling expenses for the month of April are sold for prices of $10 and $12 per unit, respectively. The desired ending invenlory Prtduct than its beginning inventory of 2,000 units. The beginning inventory of Product B is 2.500 units. The desired ending inventory of B is 3,000 units. Total budgeted sales of both products for the year would be S 8r 1. The following data is given for the Stringer Company 26,000 units Budgeted production Actual prodaction 7,500 units $6.50 Standard price per ounce Standard ouncoes per completed unit Actual ounces parchased and used in production 228.000 rish $1,504,800 Actual price paid for Labor Standard hourly labor rate $22 per hou Standard hours allowed per completed unit66 183,000 $4,020,000 Actual lalbor hours worked Actual total labor cots Actual and budgeted fixed overhead Standard variable overhead rate Actual variahle overhead costs $1,029,600 $24.50 per standard labor hour Overhead is applied on standard labor hours a. The direct materials price variance is b. The direct materials quantity variance is 2. The following data relate to direct labor costs for the current period 36,000 hours at $22.00 Standard costs Actual costs 35,000 hours at $23.00 What is the direet labor time variance? 7 The St Augustine Corporation originally budgeted for S360,000 of fixed overhead at 100% normal production pacity. Production was budgeted to be 12,000 units. riable overhead rate was 0,000. Actual production was 11,700 units. The standard hours for production were 5 hours per unit. The $3 per hour. Actual fixed overhead was $360,000 and actual variable overhead was fixed factory overhead controllable variance is? standard to produce a given amount of product is 600 direct labor hours at $17 and the actual was S he time variance was $1,500 unfavorable True False 5. A bud possible investigation. get performance report compares actual results with the budgeted amounts and reports differences for True False Chapter 26 1. The management of Zesty Corporation is considering the purchase of a new machine costing $400,000. The company's desired rate of return is 10% Use the following data in determining the acceptability in this situation: Net Cash Flow $180,000 120,000 100,000 90,000 90,000 Income from Operations 100,000 40,000 20,000 10,000 10,000 Year a. The cash payback period for this investment is b. The average rate of return for this investment is That's it... you are done...enjoy your spring break

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts