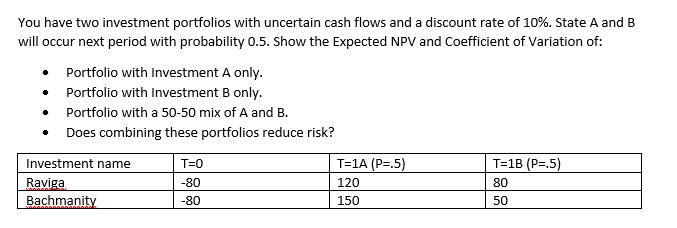

Question: You have two investment portfolios with uncertain cash flows and a discount rate of 10%. State A and B will occur next period with

You have two investment portfolios with uncertain cash flows and a discount rate of 10%. State A and B will occur next period with probability 0.5. Show the Expected NPV and Coefficient of Variation of: Portfolio with Investment A only. Portfolio with Investment B only. Portfolio with a 50-50 mix of A and B. Does combining these portfolios reduce risk? Investment name Raviga Bachmanity T=0 -80 -80 T-1A (P=.5) 120 150 T=1B (P=.5) 80 50

Step by Step Solution

There are 3 Steps involved in it

The expected NPV for Investment A is calculated as follows Expected NPV Probability of State A occur... View full answer

Get step-by-step solutions from verified subject matter experts