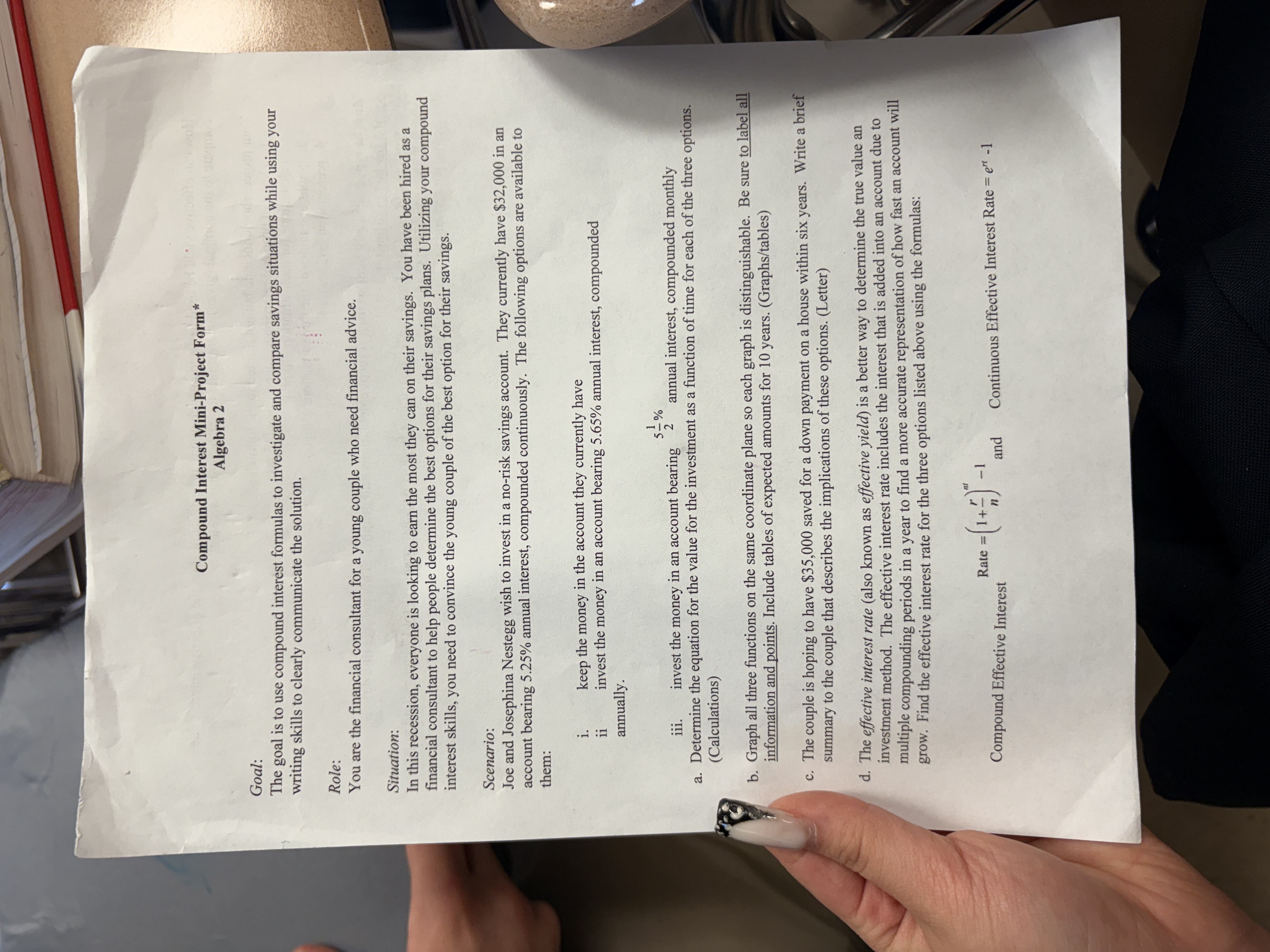

Question: How can effective yield be used to decide which option is best? How does the effective interest rate compare to the nominal (given) interest rate

How can effective yield be used to decide which option is best? How does the effective interest rate compare to the nominal (given) interest rate for each savings account?e. Your project should include but not limited to the following:1. a letter of proposal referring to each option (15 pts)2. calculations for each situation (30 pts)3. graphs and tables of the three situations (30 pts)4. presentation is (25%)Must be typed or neatly handwritten (except calculations and graphs). This project due date is April 3 the last to submit it.Your work can be presented on a poster board or a booklet with paper size 11 by 17 inches. and must collorfull. Box your correct answers.If it is late, your grade as a consultant will be 25% less:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts