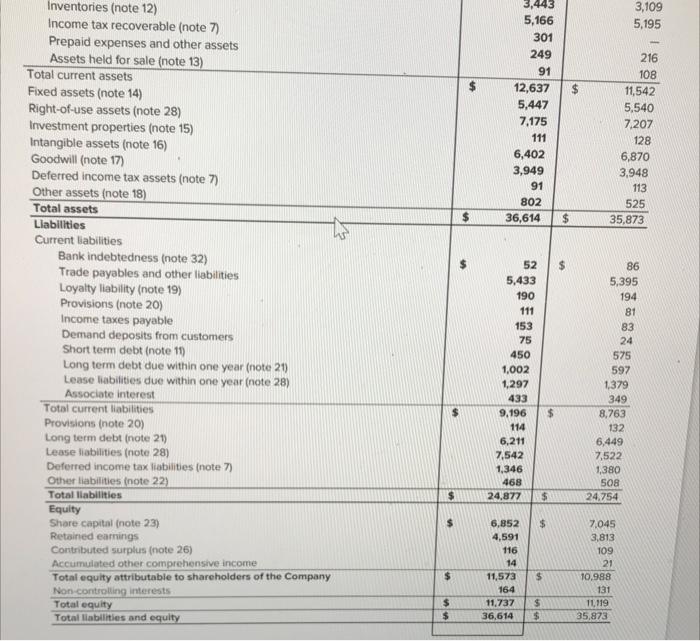

Question: how can i answer 9.2? you want the notes for which ones exactly? 3,109 5,195 $ 3,443 5,166 301 249 91 12,637 5,447 7,175 111

3,109 5,195 $ 3,443 5,166 301 249 91 12,637 5,447 7,175 111 6,402 3,949 91 802 36,614 216 108 11,542 5,540 7.207 128 6,870 3,948 113 525 35.873 $ $ $ Inventories (note 12) Income tax recoverable (note 7) Prepaid expenses and other assets Assets held for sale (note 13) Total current assets Fixed assets (note 14) Right-of-use assets (note 28) Investment properties (note 15) Intangible assets (note 16) Goodwill (note 17) Deferred income tax assets (note 7) Other assets (note 18) Total assets Llabilities Current liabilities Bank indebtedness (note 32) Trade payables and other liabilities Loyalty liability (note 19) Provisions (note 20) Income taxes payable Demand deposits from customers Short term debt (note 11) Long term debt due within one year (note 21) Lease labilities due within one year (note 28) Associate interest Total current liabilities Provisions (note 20) Long term debt (note 21) Lease liabilities (note 28) Deferred income tax liabilities (note 7) Other liabilities (note 22) Total liabilities Equity Share capital (note 23) Retained earnings Contributed surplus (note 26) Accumulated other comprehensive income Total equity attributable to shareholders of the Company Non controlling interests Total equity Total liabilities and equity 52 5,433 190 111 153 86 5,395 194 81 83 24 575 597 1379 349 8,763 132 6,449 7.522 1,380 508 24.754 75 450 1,002 1,297 433 9,196 114 6,211 7,542 1,346 468 24.877 $ $ $ $ $ 6,852 4,591 116 14 11,573 164 11,737 36,614 7.045 3,813 109 21 10.988 131 11,119 35,873 $ $ $ $ $ $ 9.2 - Does the company disclose any information on contingent liabilities (i.e., contingencies), in the notes to its financial statements? If so, briefly describe these contingencies. I 3,109 5,195 $ 3,443 5,166 301 249 91 12,637 5,447 7,175 111 6,402 3,949 91 802 36,614 216 108 11,542 5,540 7.207 128 6,870 3,948 113 525 35.873 $ $ $ Inventories (note 12) Income tax recoverable (note 7) Prepaid expenses and other assets Assets held for sale (note 13) Total current assets Fixed assets (note 14) Right-of-use assets (note 28) Investment properties (note 15) Intangible assets (note 16) Goodwill (note 17) Deferred income tax assets (note 7) Other assets (note 18) Total assets Llabilities Current liabilities Bank indebtedness (note 32) Trade payables and other liabilities Loyalty liability (note 19) Provisions (note 20) Income taxes payable Demand deposits from customers Short term debt (note 11) Long term debt due within one year (note 21) Lease labilities due within one year (note 28) Associate interest Total current liabilities Provisions (note 20) Long term debt (note 21) Lease liabilities (note 28) Deferred income tax liabilities (note 7) Other liabilities (note 22) Total liabilities Equity Share capital (note 23) Retained earnings Contributed surplus (note 26) Accumulated other comprehensive income Total equity attributable to shareholders of the Company Non controlling interests Total equity Total liabilities and equity 52 5,433 190 111 153 86 5,395 194 81 83 24 575 597 1379 349 8,763 132 6,449 7.522 1,380 508 24.754 75 450 1,002 1,297 433 9,196 114 6,211 7,542 1,346 468 24.877 $ $ $ $ $ 6,852 4,591 116 14 11,573 164 11,737 36,614 7.045 3,813 109 21 10.988 131 11,119 35,873 $ $ $ $ $ $ 9.2 - Does the company disclose any information on contingent liabilities (i.e., contingencies), in the notes to its financial statements? If so, briefly describe these contingencies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts