Question: how can I calculate the incremental cash flow for replacement asset? Fundamentals of Financial Management, 13e Chapter 12: Capital Budgeting and Estimating Cash Flows Example

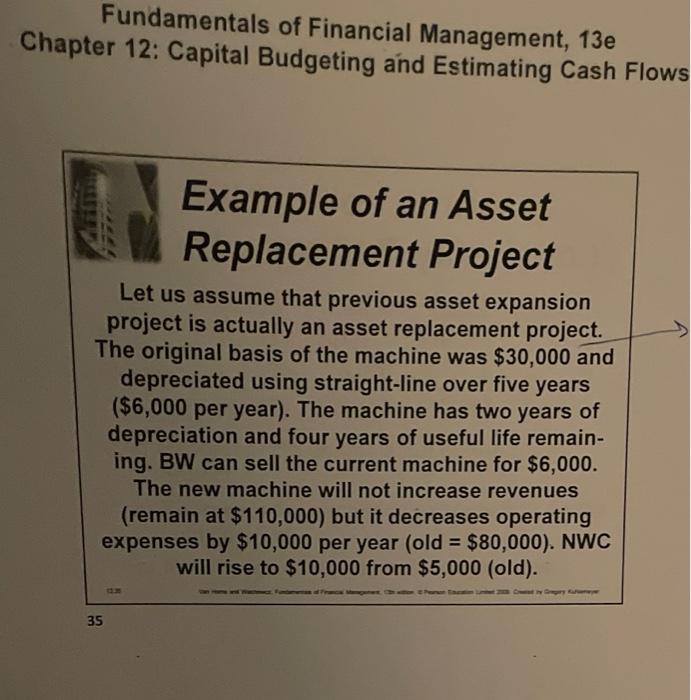

Fundamentals of Financial Management, 13e Chapter 12: Capital Budgeting and Estimating Cash Flows Example of an Asset Replacement Project Let us assume that previous asset expansion project is actually an asset replacement project. The original basis of the machine was $30,000 and depreciated using straight-line over five years ($6,000 per year). The machine has two years of depreciation and four years of useful life remaining. BW can sell the current machine for $6,000. The new machine will not increase revenues (remain at $110,000 ) but it decreases operating expenses by $10,000 per year (old =$80,000 ). NWC will rise to $10,000 from $5,000 (old). Fundamentals of Financial Management, 13e Chapter 12: Capital Budgeting and Estimating Cash Flows Example of an Asset Replacement Project Let us assume that previous asset expansion project is actually an asset replacement project. The original basis of the machine was $30,000 and depreciated using straight-line over five years ($6,000 per year). The machine has two years of depreciation and four years of useful life remaining. BW can sell the current machine for $6,000. The new machine will not increase revenues (remain at $110,000 ) but it decreases operating expenses by $10,000 per year (old =$80,000 ). NWC will rise to $10,000 from $5,000 (old)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts