Question: How can I create a production cost report using the information provided? I dont understand how to perform the calculations involved in the second image

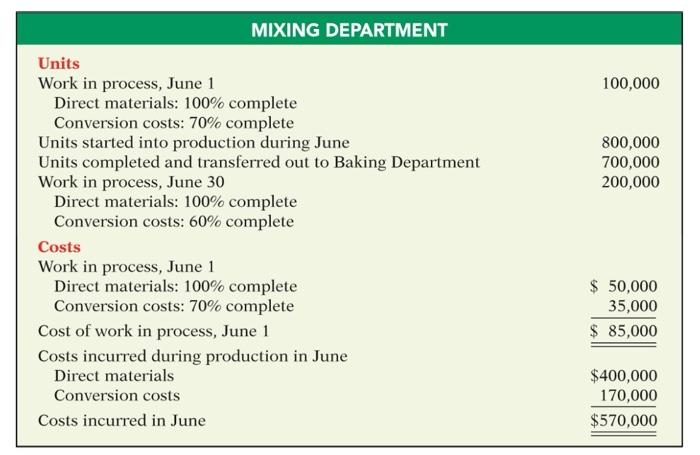

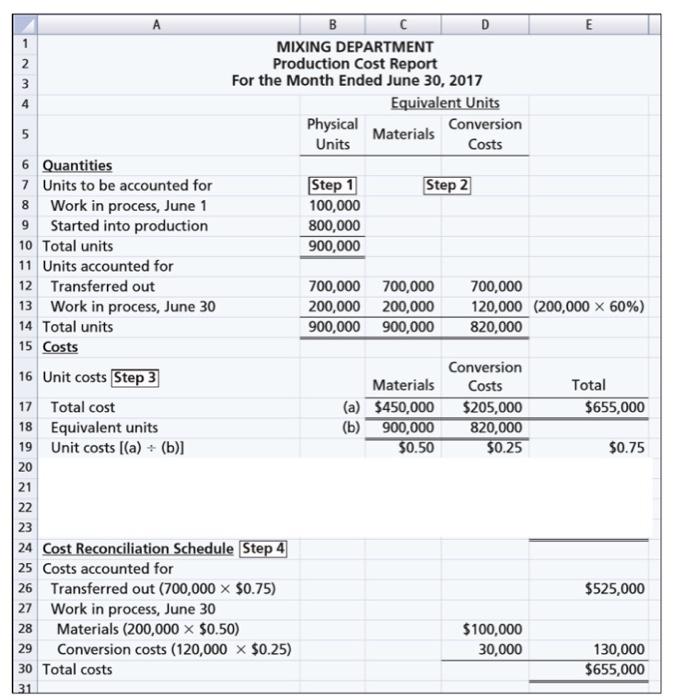

\begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{ MIXING DEPARTMENT } \\ \hline Units & \\ \hline Work in process, June 1 & 100,000 \\ \hline Direct materials: 100% complete & \\ \hline Conversion costs: 70% complete & \\ \hline Units started into production during June & 800,000 \\ \hline Units completed and transferred out to Baking Department & 700,000 \\ \hline Work in process, June 30 & 200,000 \\ \hline Direct materials: 100% complete & \\ \hline Conversion costs: 60% complete & \\ \hline Costs & \\ \hline Work in process, June 1 & \\ \hline Direct materials: 100% complete & $50,000 \\ \hline Conversion costs: 70% complete & 35,000 \\ \hline Cost of work in process, June 1 & $85,000 \\ \hline Costs incurred during production in June & \\ \hline Direct materials & $400,000 \\ \hline Conversion costs & 170,000 \\ \hline Costs incurred in June & $570,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline & A & B & C & D & E \\ \hline \begin{tabular}{l} 1 \\ 2 \\ 3 \end{tabular} & \multicolumn{5}{|c|}{\begin{tabular}{c} MIXING DEPARTMENT \\ Production Cost Report \\ For the Month Ended June 30, 2017 \end{tabular}} \\ \hline 4 & & \multicolumn{3}{|c|}{ Equivalent Units } & \\ \hline 5 & & \begin{tabular}{c} Physical \\ Units \end{tabular} & Materials & \begin{tabular}{c} Conversion \\ Costs \end{tabular} & \\ \hline 6 & Quantities & & & & \\ \hline 7 & Units to be accounted for & Step 1 & \multicolumn{2}{|c|}{ Step 2 } & \\ \hline 8 & Work in process, June 1 & 100,000 & & & \\ \hline 9 & Started into production & 800,000 & & & \\ \hline 10 & Total units & 900,000 & & & \\ \hline 11 & Units accounted for & & & & \\ \hline 12 & Transferred out & 700,000 & 700,000 & 700,000 & \\ \hline 13 & Work in process, June 30 & 200,000 & 200,000 & 120,000 & (200,00060%) \\ \hline 14 & Total units & 900,000 & 900,000 & 820,000 & \\ \hline 15 & Costs & & & & \\ \hline 16 & Unit costs Step 3 & & Materials & \begin{tabular}{c} Conversion \\ Costs \end{tabular} & Total \\ \hline 17 & Total cost & (a) & $450,000 & $205,000 & $655,000 \\ \hline 18 & Equivalent units & (b) & 900,000 & 820,000 & \\ \hline 19 & Unit costs [(a)(b)] & & 50.50 & $0.25 & $0.75 \\ \hline 20 & & & & & \\ \hline 21 & & & & & \\ \hline 22 & & & & & \\ \hline 23 & & & & & \\ \hline 24 & Cost Reconciliation Schedule Step 4 & & & & \\ \hline 25 & Costs accounted for & & & & \\ \hline 26 & Transferred out (700,000$0.75) & & & & $525,000 \\ \hline 27 & Work in process, June 30 & & & & \\ \hline 28 & Materials (200,000$0.50) & & & $100,000 & \\ \hline 29 & Conversion costs (120,000$0.25) & & & 30,000 & 130,000 \\ \hline 30 & Total costs & & & & $655,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts