Question: How can I figure out CPP 5 - 1 ( # 1 ) Calculate and Record Employer Payroll Taxes Calculate the employer's total FUTA and

How can I figure out

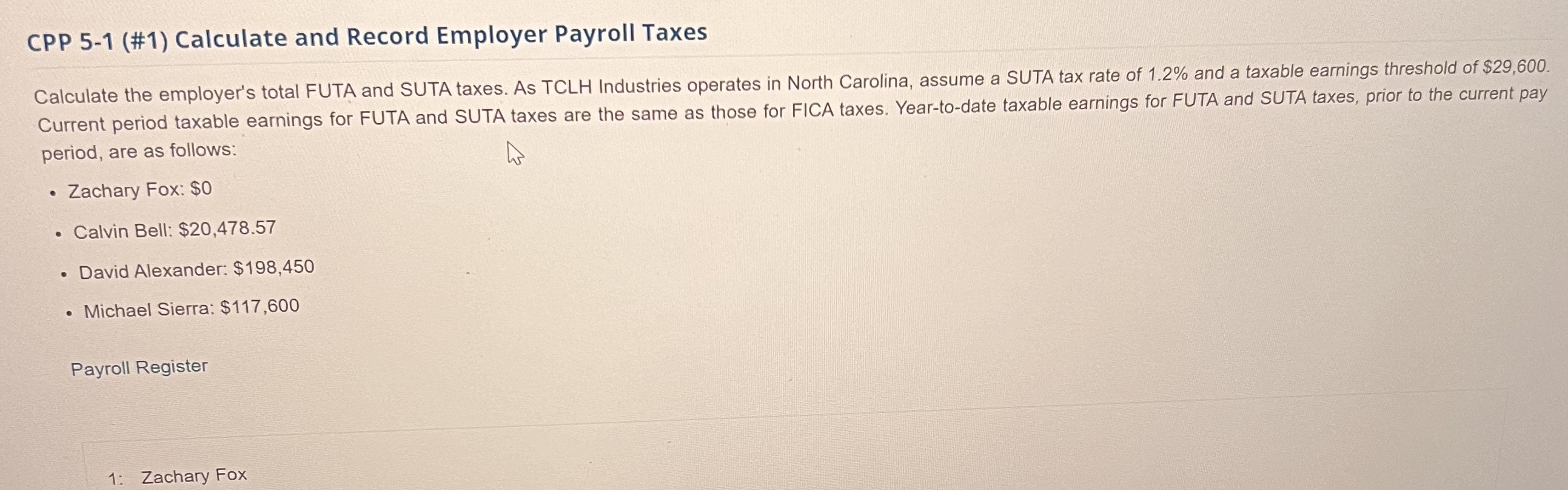

CPP # Calculate and Record Employer Payroll Taxes

Calculate the employer's total FUTA and SUTA taxes. As TCLH Industries operates in North Carolina, assume a SUTA tax rate of and a taxable earnings threshold of $ Current period taxable earnings for FUTA and SUTA taxes are the same as those for FICA taxes. Yeartodate taxable earnings for FUTA and SUTA taxes, prior to the current pay period, are as follows:

Zachary Fox: $

Calvin Bell: $

David Alexander: $

Michael Sierra: $

Payroll Register

: Zachary Fox

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock