Question: How can I resolve this problem?? ed Replace See all Eating perly REGISTRERE Fjercicio 1. Corte de los actores Cost of GoodMonfected Nog endringer Marth

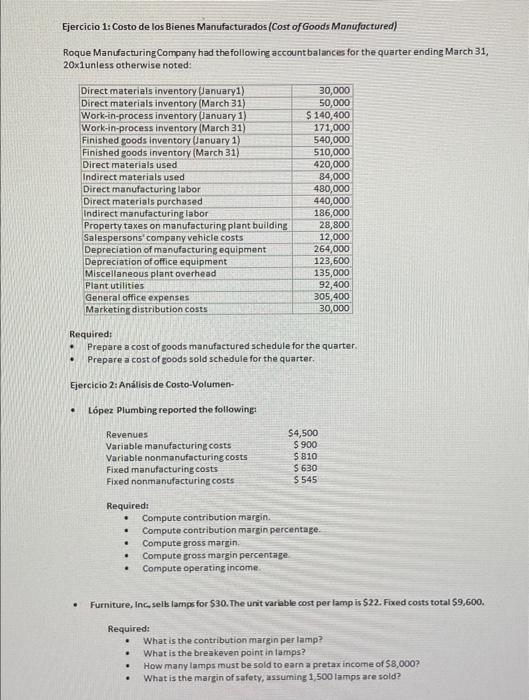

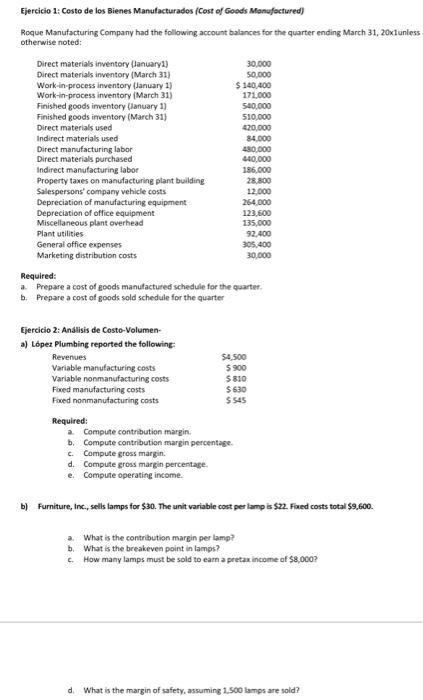

ed Replace See all Eating perly REGISTRERE Fjercicio 1. Corte de los actores Cost of GoodMonfected Nog endringer Marth 20erwise Directory and Direct material invatal 50 000 war incearca 5140,400 Work in procesory 175.000 The Day 1) Ferry March 510,000 Ow Sedirect 8.000 Demandangabe 40000 Draphed 000 156.000 party in plan Kasper 1330 Deprecat 200 Depan 1336 More 135.000 13.400 dan 1400 Marting Sco . Proin .COM th Gecko Anton Pedig na mandarin Fedorn $400 500 Sao 560 Cagi * Decor Donna Der congue Thessal Howy Ejercicio 1: Costo de los bienes Manufacturados (Cost of Goods Manufactured) Roque Manufacturing Company had the following account balances for the quarter ending March 31, 20xlunless otherwise noted: Direct materials inventory (January1) Direct materials inventory (March 31) Work-in-process inventory January 1) Work-in-process inventory (March 31) Finished goods inventory January 1) Finished goods inventory (March 31) Direct materials used Indirect materials used Direct manufacturing labor Direct materials purchased Indirect manufacturing labor Property taxes on manufacturing plant building Salespersons company vehicle costs Depreciation of manufacturing equipment Depreciation of office equipment Miscellaneous plant overhead Plant utilities General office expenses Marketing distribution costs 30,000 50,000 $ 140,400 171,000 540,000 510,000 420,000 84,000 480,000 440,000 186,000 28,800 12,000 264,000 123,600 135,000 92,400 305,400 30,000 Required: Prepare a cost of goods manufactured schedule for the quarter. Prepare a cost of goods sold schedule for the quarter. Ejercicio 2: Anlisis de Costo-Volumen- Lpez Plumbing reported the following Revenues Variable manufacturing costs Variable nonmanufacturing costs Fixed manufacturing costs Fixed nonmanufacturing costs $4,500 S 900 S 810 $ 630 5 545 . Required: Compute contribution margin Compute contribution margin percentage Compute gross margin: Compute gross margin percentage Compute operating income . . Furniture, Incsells lamps for $30. The unit variable cost per lamp is $22. Fixed costs total $9,600. Required: What is the contribution margin per lamp? What is the breakeven point in lamps? How many lamps must be sold to earn a pretax income of $8,000? What is the margin of safety, assuming 1,500 lamps are sold? . Ejercicio 1: Costo de los Bienes Manufacturados (Cost of Goods Manufactured) Roque Manufacturing Company had the following account balances for the quarter ending March 31, 20xl unless otherwise noted: Direct materials inventory (January 1) 30,000 Direct materials inventory (March 31) 50.000 Work-in-process inventory (January 1) $140.400 Work-in-process inventory (March 31) 171.000 Finished goods inventory (January 1) 540,000 Finished goods inventory (March 31) 510,000 Direct materials used 420,000 Indirect materials used 84.000 Direct manufacturing labor 480.000 Direct materials purchased 440,000 Indirect manufacturing labor 186,000 Property taxes on manufacturing plant building 28.800 Salespersons' company vehicle costs 12.000 Depreciation of manufacturing equipment 264.000 Depreciation of office equipment 123.500 Miscellaneous plant overhead 135.000 Plant utilities 92.400 General office expenses 305.400 Marketing distribution costs Required: a. Prepare a cost of goods manufactured schedule for the quarter b. Prepare a cost of goods sold schedule for the quarter 30.000 Ejercicio 2: Anlisis de Costo-Volumen a) Lpez Plumbing reported the following Revenues 54500 Variable manufacturing costs $ 900 Variable nonmanufacturing costs 5810 Fored manufacturing costs $630 Faxed nonmanufacturing costs $ 545 Required: a Compute contribution margin. b. Compute contribution margin percentage c Compute gross margin d. Compute gross margin percentage e compute operating income. b) Furniture, Inc., sells lamps for $30. The unit variable cost per lamp is $22. Fixed costs total $9,600. a. What is the contribution margin per lamp? b. What is the breakeven point in lamps? How many lamps must be sold to eam a pretax income of $8,000? d. What is the margin of safety, assuming 1.500 lamps are sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts