Question: how can i sove these problems using a financial calculator O 3.3 Johnson Motors' bonds have 10 years remaining to maturity. Interest is paid annually,

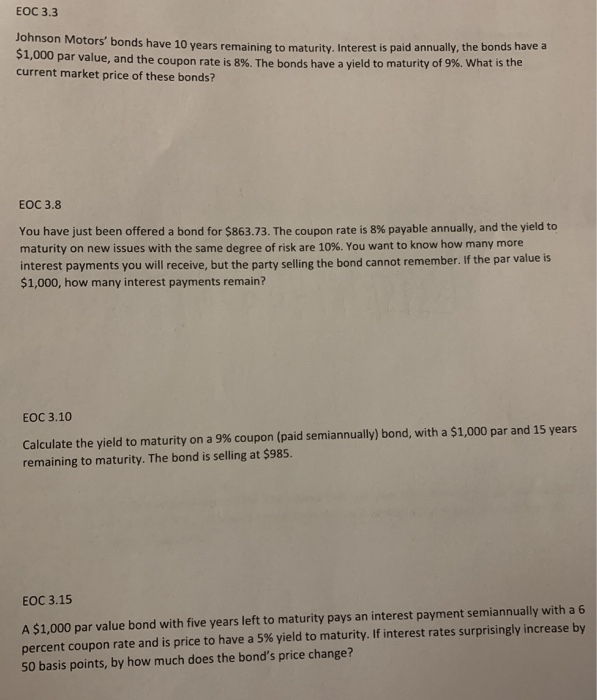

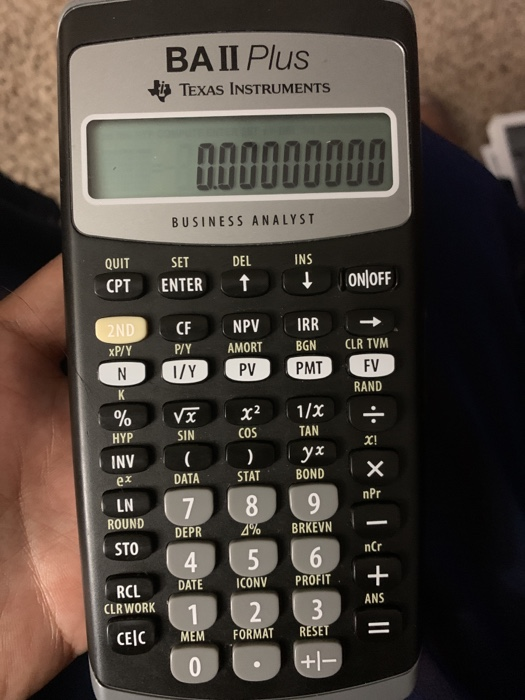

O 3.3 Johnson Motors' bonds have 10 years remaining to maturity. Interest is paid annually, the bonds have $1,000 par value, and the coupon rate is 8%. The bonds have a yield to maturity of 9%. What is the current market price of these bonds? O 3.8 You have just been offered a bond for $863.73. The coupon rate is 8% payable annually, and the yield to maturity on new issues with the same degree of risk are 10 % . You want to know how many more interest payments you will receive, but the party selling the bond cannot remember. If the par value is $1,000, how many interest payments remain? O 3.10 Calculate the yield to maturity on a 9% coupon (paid semiannually) bond, with a $1,000 par and 15 remaining to maturity. The bond is selling at $985. years O 3.15 A $1,000 par value bond with five years left to maturity pays an interest payment semiannually with a 6 percent coupon rate and is price to have a 5% yield to maturity. If interest rates surprisingly increase by S0 basis points, by how much does the bond's price change? BA II Plus iTEXAS INSTRUMENTS BUSINESS ANALYST QUIT SET DEL INS ONJOFF t CPT ENTER NPV CF IRR 2ND xP/Y CLR TVM AMORT BGN P/Y FV PV PMT VY RAND K 1/x x2 % COS TAN SIN HYP X! yx ) INV X STAT BOND DATA ex nPr LN 9 8 BRKEVN 7 4% ROUND DEPR STO nCr 6 PROFIT 4 DATE ICONV RCL ANS CLRWORK 3 2 1 RESET FORMAT CEIC MEM +1 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts