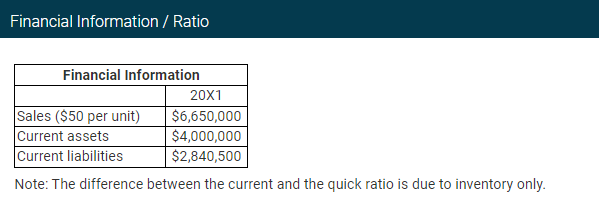

Question: How can the quick ratio be determined with the given information? Financial Information / Ratio Note: The difference between the current and the quick ratio

How can the quick ratio be determined with the given information?

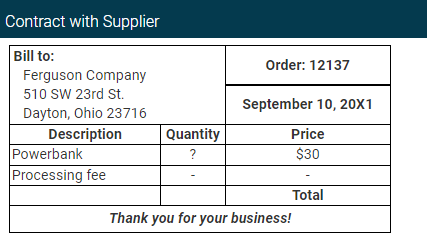

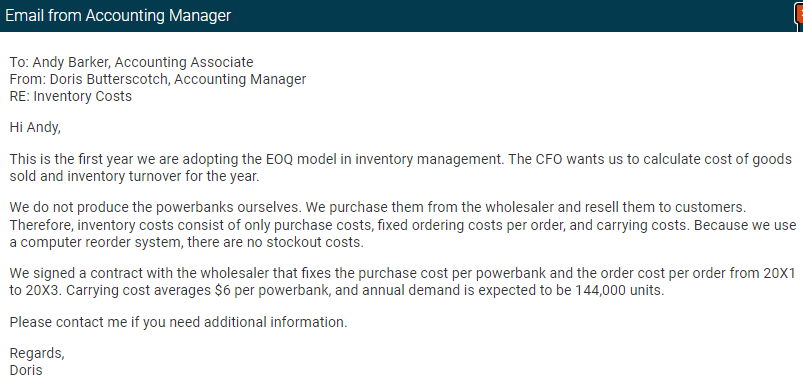

Financial Information / Ratio Note: The difference between the current and the quick ratio is due to inventory only. Contract with Supplier \begin{tabular}{|l|c|c|} \hline \multicolumn{1}{|l|}{ Bill to: Ferguson Company 510 SW 23rd St. Dayton, Ohio 23716 } & Order: 12137 \\ \cline { 2 - 3 } & & September 10,201 \\ \hline Description & Quantity & Price \\ \hline Powerbank & ? & $30 \\ \hline Processing fee & & \\ \hline \multicolumn{3}{|c|}{ Thank you for your business! } \\ \hline \multicolumn{3}{|c|}{ Total } \\ \hline \end{tabular} To: Andy Barker, Accounting Associate From: Doris Butterscotch, Accounting Manager RE: Inventory Costs Hi Andy, This is the first year we are adopting the EOQ model in inventory management. The CFO wants us to calculate cost of goods sold and inventory turnover for the year. We do not produce the powerbanks ourselves. We purchase them from the wholesaler and resell them to customers. Therefore, inventory costs consist of only purchase costs, fixed ordering costs per order, and carrying costs. Because we use a computer reorder system, there are no stockout costs. We signed a contract with the wholesaler that fixes the purchase cost per powerbank and the order cost per order from 20X1 to 203. Carrying cost averages $6 per powerbank, and annual demand is expected to be 144,000 units. Please contact me if you need additional information. Regards

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts