Question: How can this be done on EXCEL? Please show all formulas! 5. The following information is for a proposed project that will provide the capability

How can this be done on EXCEL? Please show all formulas!

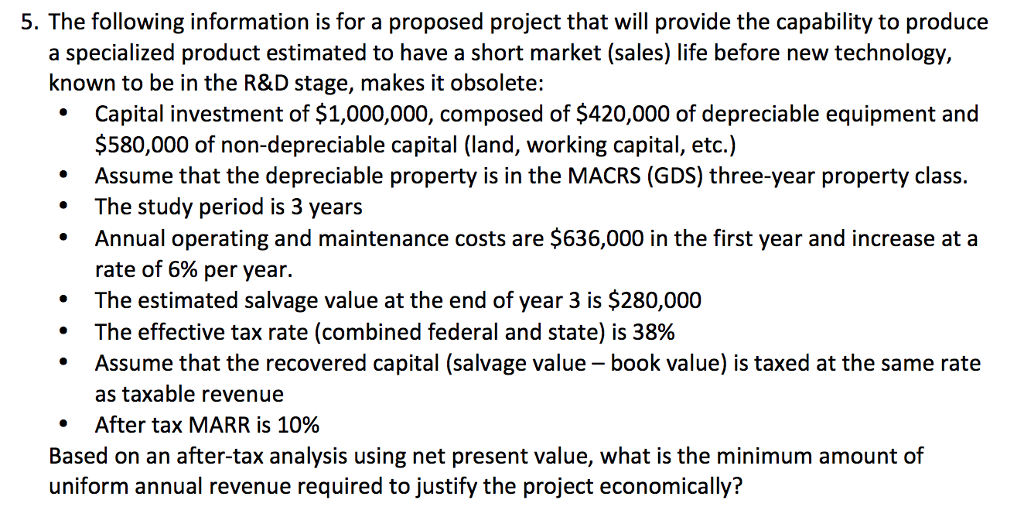

5. The following information is for a proposed project that will provide the capability to produce a specialized product estimated to have a short market (sales) life before new technology, known to be in the R&D stage, makes it obsolete: Capital investment of $1,000,000, composed of $420,000 of depreciable equipment and $580,000 of non-depreciable capital (land, working capital, etc.) *Assume that the depreciable property is in the MACRS (GDS) three-year property class. .The study period is 3 years Annual operating and maintenance costs are $636,000 in the first year and increase at a rate of 6% per year. .The estimated salvage value at the end of year 3 is $280,000 . The effective tax rate (combined federal and state) is 38% Assume that the recovered capital (salvage value - book value) is taxed at the same rate as taxable revenue After tax MARR is 10% . Based on an after-tax analysis using net present value, what is the minimum amount of uniform annual revenue required to justify the project economically

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts