Question: How can this problem be done in excel Wheat Inc. has just paid its annual dividend of $2.10. The company is expected to pay the

How can this problem be done in excel

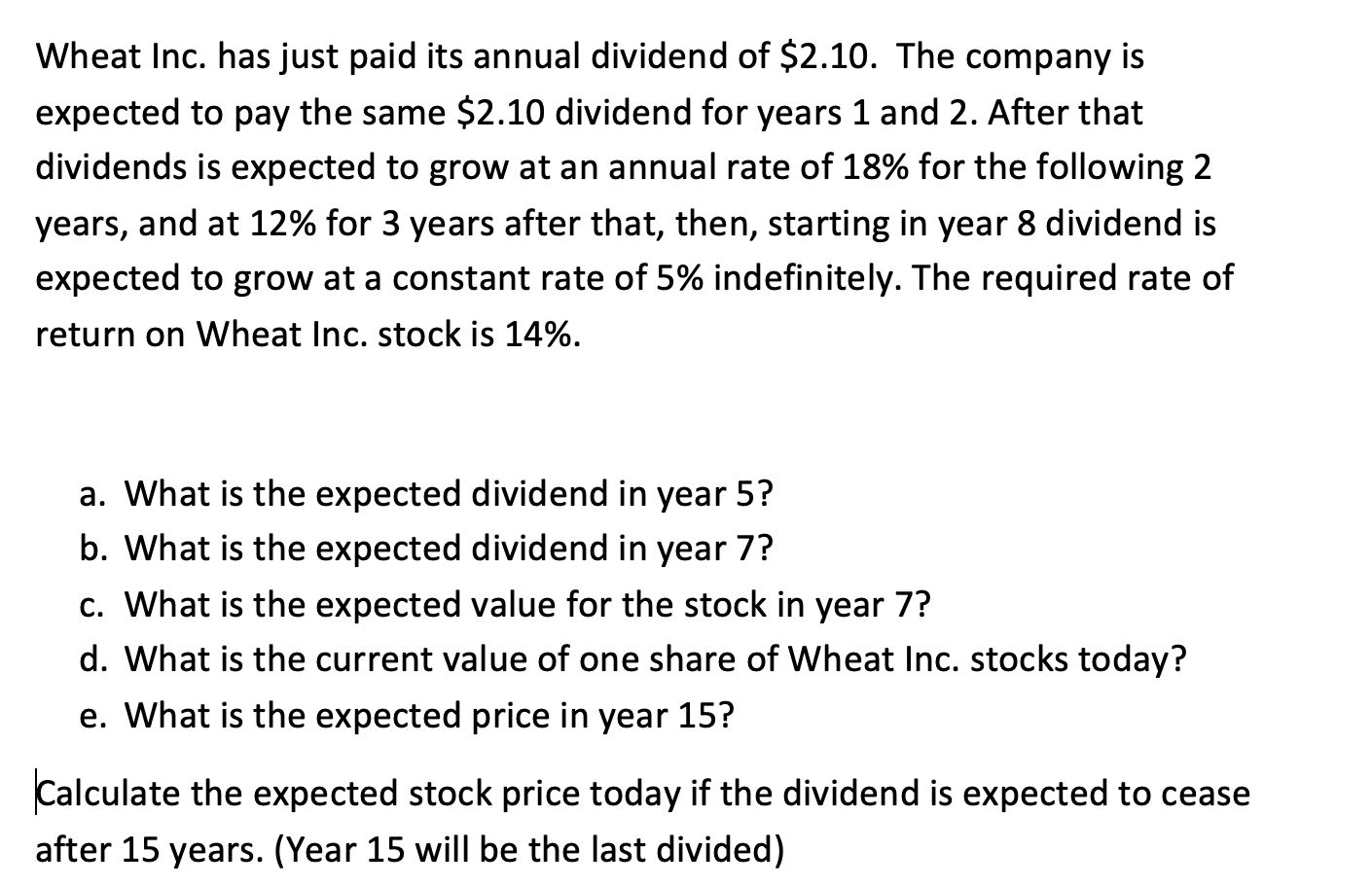

Wheat Inc. has just paid its annual dividend of $2.10. The company is expected to pay the same $2.10 dividend for years 1 and 2 . After that dividends is expected to grow at an annual rate of 18% for the following 2 years, and at 12% for 3 years after that, then, starting in year 8 dividend is expected to grow at a constant rate of 5% indefinitely. The required rate of return on Wheat Inc. stock is 14%. a. What is the expected dividend in year 5 ? b. What is the expected dividend in year 7 ? c. What is the expected value for the stock in year 7 ? d. What is the current value of one share of Wheat Inc. stocks today? e. What is the expected price in year 15 ? Calculate the expected stock price today if the dividend is expected to cease after 15 years. (Year 15 will be the last divided) Wheat Inc. has just paid its annual dividend of $2.10. The company is expected to pay the same $2.10 dividend for years 1 and 2 . After that dividends is expected to grow at an annual rate of 18% for the following 2 years, and at 12% for 3 years after that, then, starting in year 8 dividend is expected to grow at a constant rate of 5% indefinitely. The required rate of return on Wheat Inc. stock is 14%. a. What is the expected dividend in year 5 ? b. What is the expected dividend in year 7 ? c. What is the expected value for the stock in year 7 ? d. What is the current value of one share of Wheat Inc. stocks today? e. What is the expected price in year 15 ? Calculate the expected stock price today if the dividend is expected to cease after 15 years. (Year 15 will be the last divided)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts