Question: how can we calculate goodwill in this question? Question 4 The statement of financial position as at 31 December 2016 and income statements for the

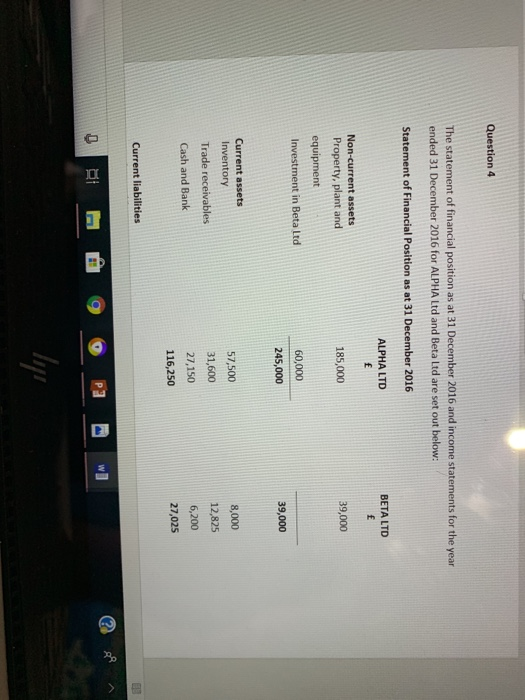

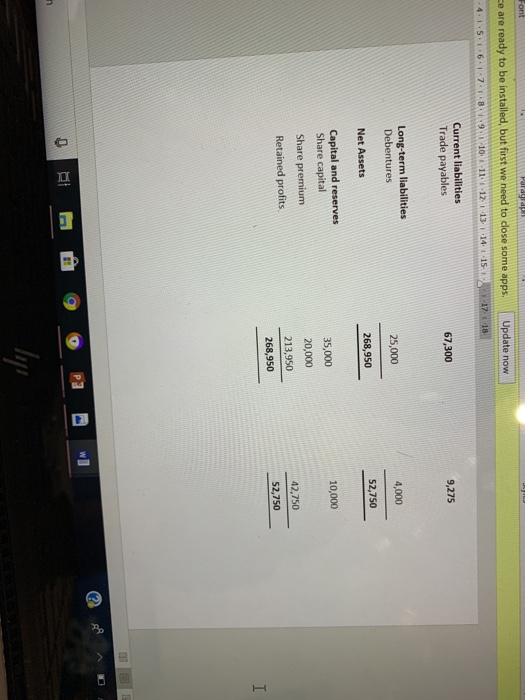

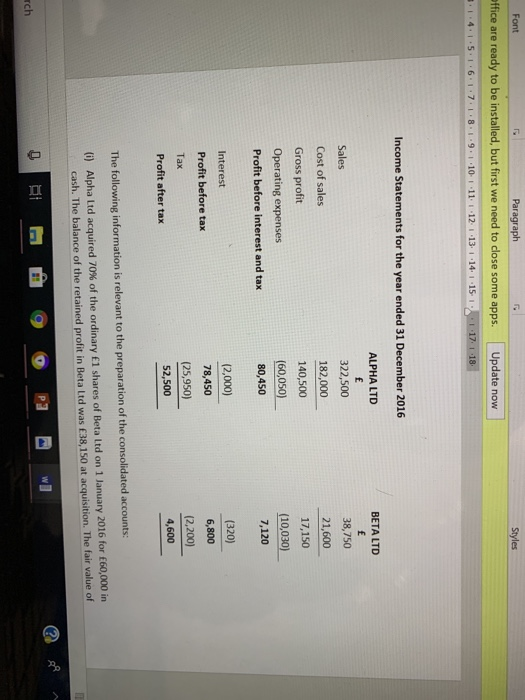

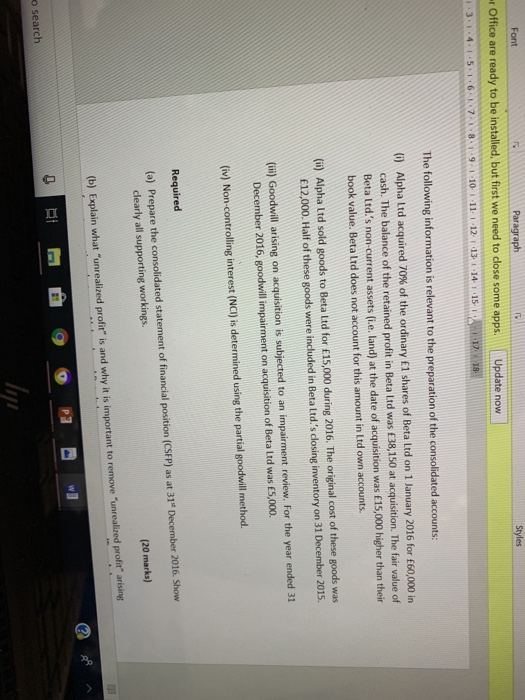

Question 4 The statement of financial position as at 31 December 2016 and income statements for the year ended 31 December 2016 for ALPHA Ltd and Beta Ltd are set out below: Statement of Financial Position as at 31 December 2016 ALPHA LTD BETA LTD Non-current assets Property, plant and equipment Investment in Beta Ltd 185,000 39,000 60,000 245,000 39,000 Current assets Inventory Trade receivables Cash and Bank 57,500 31,600 27,150 116,250 12,825 6,200 27,025 Current liabilities e are ready to be installed, but first we need to close some apps. Update now 151.61-78 910 11 -12 1 1314 15 Current liabilities Trade payables 67,300 9,275 Debentures Net Assets Capital and reserves 4,000 25,000 268,950 52,750 Share capital Share premium Retained profits 35,000 20,000 213,950 268,950 10,000 42,750 S2,750 Paragraph Styles ffice are ready to be installed, but first we need to close some apps.Update now , 6-1 7. -, .8 : . 9 ,, -10-1-1112. -13' -14' ,1-15-1 : . 4. ; .5- . Income Statements for the year ended 31 December 2016 ALPHA LTD BETA LTD 38,750 21,600 17,150 (10,030) 7,120 Sales Cost of sales Gross proft Operating expenses Profit before interest and tax 322,500 182,000 140,500 (60,050) 80,450 (2,000) 78,450 (25,950) 52,500 (320) 6,800 (2,200) 4,600 Interest Profit before tax Tax Profit after tax The following information is relevant to the preparation of the consolidated accounts (i) Alpha Ltd acquired 70% of the ordinary 1 shares of Beta ltd on 1 January 2016 for f60.000 in cash. The balance of the retained profit in Beta Ltd was 38,150 at acquisition. The fair value of rch Font Paragraph Styles r Office are ready to be installed, but first we need to close some apps. Update now The following information is relevant to the preparation of the consolidated accounts (i) Alpha Ltd acquired 70% of the ordinary 1 shares of Beta Ltd on 1 January 2016 for 60,000 in cash. The balance of the retained profit in Beta Ltd was 38,150 at acquisition. The fair value of Beta Ltd s non-current assets (i.e. land) at the date of acquisition was 15,000 higher than their book value. Beta Ltd does not account for this amount in Ltd own accounts. (i) Alpha Ltd sold goods to Beta Ltd for 15,000 during 2016. The original cost of these goods was 12,000. Half of these goods were included in Beta Ltd.'s closing inventory on 31 December 201s (ii) Goodwill arising on acquisition is subjected to an impairment review. For the year ended 31 December 2016, goodwill impairment on acquisition of Beta Ltd was 5,000. (iv) Non-controlling interest (NCI) is determined using the partial goodwill method. Required (a) Prepare the consolidated statement of financial position (CSFP) as at 31* December 2016 Show clearly all supporting workings. (20 marks) (b) Explain what "unrealized profit" is and why it is important to remove "unrealized profit arising o search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts