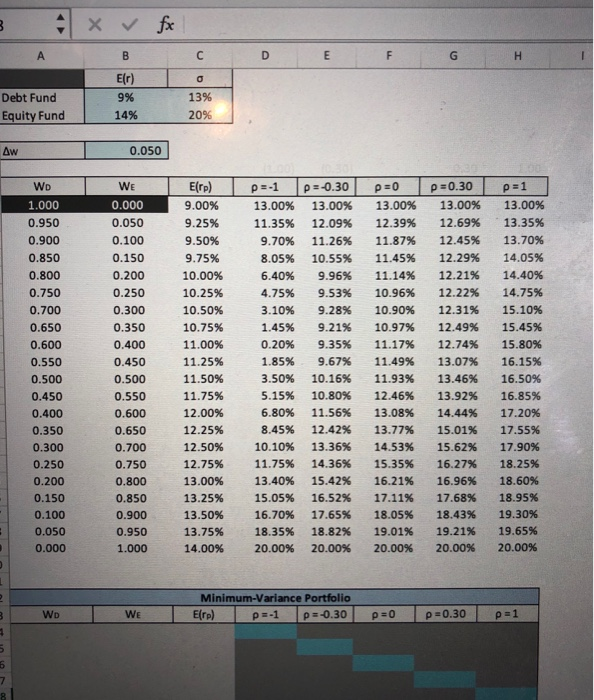

Question: How can you calculate a minimum-variance p ortfolio in excel? B x fx D E F G H I B E(r) 9% 14% C 0

B x fx D E F G H I B E(r) 9% 14% C 0 13% 20% Debt Fund Equity Fund AW 0.050 WD 1.000 0.950 0.900 0.850 0.800 0.750 0.700 0.650 0.600 0.550 0.500 0.450 0.400 0.350 0.300 0.250 0.200 0.150 0.100 0.050 0.000 WE 0.000 0.050 0.100 0.150 0.200 0.250 0.300 0.350 0.400 0.450 0.500 0.550 0.600 0.650 0.700 0.750 0.800 0.850 0.900 0.950 1.000 E(rp) 9.00% 9.25% 9.50% 9.75% 10.00% 10.25% 10.50% 10.75% 11.00% 11.25% 11.50% 11.75% 12.00% 12.25% 12.50% 12.75% 13.00% 13.25% 13.50% 13.75% 14.00% p=-1 13.00% 11.35% 9.70% 8.05% 6.40% 4.75% 3.10% 1.45% 0.20% 1.85% 3.50% 5.15% 6.80% 8.45% 10.10% 11.75% 13.40% 15.05% 16.70% 18.35% 20.00% p =-0.30 13.00% 12.09% 11.26% 10.55% 9.96% 9.53% 9.28% 9.21% 9.35% 9.67% 10.16% 10.80% 11.56% 12.42% 13.36% 14.36% 15.42% 16.52% 17.65% 18.82% 20.00% p=0 13.00% 12.39% 11.87% 11.45% 11.14% 10.96% 10.90% 10.97% 11.17% 11.49% 11.93% 12.46% 13.08% 13.77% 14.53% 15.35% 16.21% 17.11% 18.05% 19.01% 20.00% p=0.30 13.00% 12.69% 12.45% 12.29% 12.21% 12.22% 12.31% 12.49% 12.74% 13.07% 13.46% 13.92% 14.44% 15.01% 15.62% 16.27% 16.96% 17.68% 18.43% 19.21% 20.00% p=1 13.00% 13.35% 13.70% 14.05% 14.40% 14.75% 15.10% 15.45% 15.80% 16.15% 16.50% 16.85% 17.20% 17.55% 17.90% 18.25% 18.60% 18.95% 19.30% 19.65% 20.00% WD WE E Minimum-Variance Portfolio (TP) p=-1 P=-0.30 p=0 p=0.30 = 1 1000 B x fx D E F G H I B E(r) 9% 14% C 0 13% 20% Debt Fund Equity Fund AW 0.050 WD 1.000 0.950 0.900 0.850 0.800 0.750 0.700 0.650 0.600 0.550 0.500 0.450 0.400 0.350 0.300 0.250 0.200 0.150 0.100 0.050 0.000 WE 0.000 0.050 0.100 0.150 0.200 0.250 0.300 0.350 0.400 0.450 0.500 0.550 0.600 0.650 0.700 0.750 0.800 0.850 0.900 0.950 1.000 E(rp) 9.00% 9.25% 9.50% 9.75% 10.00% 10.25% 10.50% 10.75% 11.00% 11.25% 11.50% 11.75% 12.00% 12.25% 12.50% 12.75% 13.00% 13.25% 13.50% 13.75% 14.00% p=-1 13.00% 11.35% 9.70% 8.05% 6.40% 4.75% 3.10% 1.45% 0.20% 1.85% 3.50% 5.15% 6.80% 8.45% 10.10% 11.75% 13.40% 15.05% 16.70% 18.35% 20.00% p =-0.30 13.00% 12.09% 11.26% 10.55% 9.96% 9.53% 9.28% 9.21% 9.35% 9.67% 10.16% 10.80% 11.56% 12.42% 13.36% 14.36% 15.42% 16.52% 17.65% 18.82% 20.00% p=0 13.00% 12.39% 11.87% 11.45% 11.14% 10.96% 10.90% 10.97% 11.17% 11.49% 11.93% 12.46% 13.08% 13.77% 14.53% 15.35% 16.21% 17.11% 18.05% 19.01% 20.00% p=0.30 13.00% 12.69% 12.45% 12.29% 12.21% 12.22% 12.31% 12.49% 12.74% 13.07% 13.46% 13.92% 14.44% 15.01% 15.62% 16.27% 16.96% 17.68% 18.43% 19.21% 20.00% p=1 13.00% 13.35% 13.70% 14.05% 14.40% 14.75% 15.10% 15.45% 15.80% 16.15% 16.50% 16.85% 17.20% 17.55% 17.90% 18.25% 18.60% 18.95% 19.30% 19.65% 20.00% WD WE E Minimum-Variance Portfolio (TP) p=-1 P=-0.30 p=0 p=0.30 = 1 1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts