Question: How come ROI would increase but ROE would not be affected? ROE is net income/average stockholders equity so if you are paying $15,000 from account

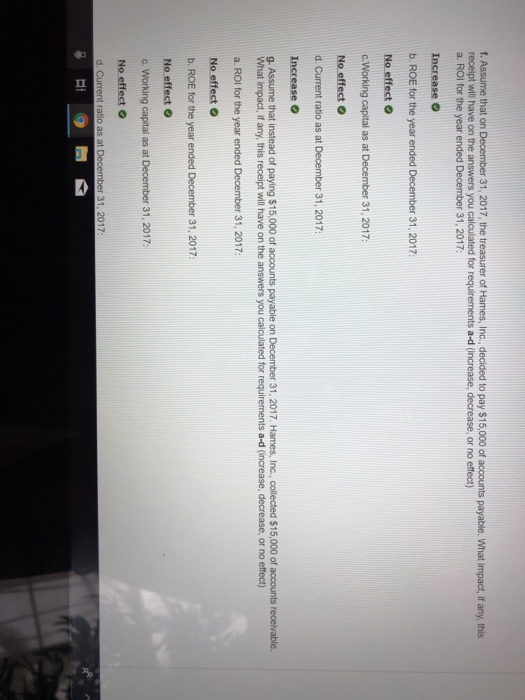

f. Assume that on receipt wll have on the answers you calculated for requirements a-d (increase, decrease, or no effect) a. ROI for the year ended December 31, 2017: Increase b. ROE for the year ended December 31, 2017: No effect CWorking capital as at December 31, 2017: No effect d. Current ratio as at December 31, 2017 Increase g. Assume that instead of paying $15,000 of accounts payable on December 31, 2017. Hames, Inc., collected $15,000 of accounts receivable. What impact, if any, this receipt will have on the answers you calculated for requirements a-d (increase, decrease, or no effect) a. ROI for the year ended December 31, 2017 No effect b. ROE for the year ended December 31, 2017: No effect C. Working capital as at No effect d. Current ratio as at December 31, 2017 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts