Question: How commission amount has been calculated on this attachment? How commission amount is $15,600 in this attachment? Would you please clarify how the commission amount

How commission amount has been calculated on this attachment? How commission amount is $15,600 in this attachment? Would you please clarify how the commission amount is $15,600?

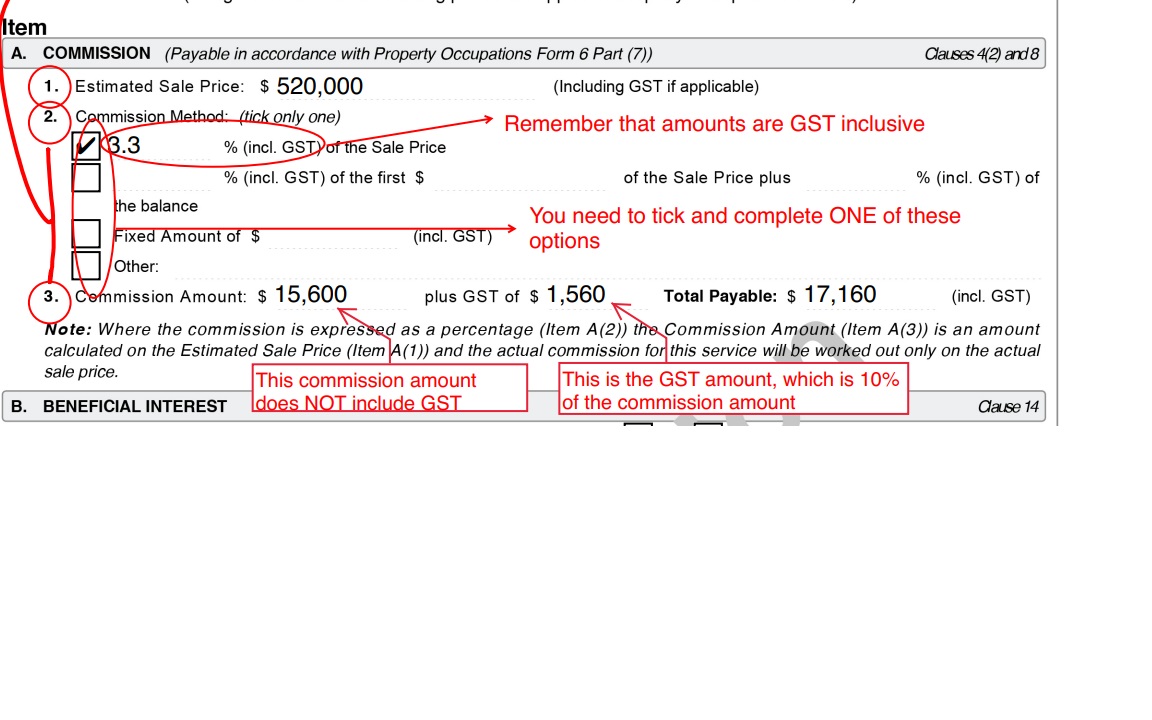

COMMISSION (Payable in accordance with Property Occupations Form 6 Part (7)) Clauses 4(2) and 8 1. Estimated Sale Price: $520,000 (Including GST if applicable) 2. Commission Method:-(tick only one) Remember that amounts are GST inclusive 3.3% (incl. GST) of the Sale Price % (incl. GST) of the first \$ of the Sale Price plus $ (incl. GST) of he balance Fixed Amount of $ Y You need to tick and complete ONE of these Other: 3. Commission Amount: $15,600 plus GST of $1,560_Total Payable: $17,160 (incl. GST) Note: Where the commission is expressed as a percentage (Item A(2)) the Commission Amount (Item A(3)) is an amount calculated on the Estimated Sale Price (Item A(1)) and the actual commission for this service will be worked out only on the actual sale price. BENEFICIAL INTEREST This is the GST amount, which is 10% \begin{tabular}{ll} of the commission amount & Cause 14 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts