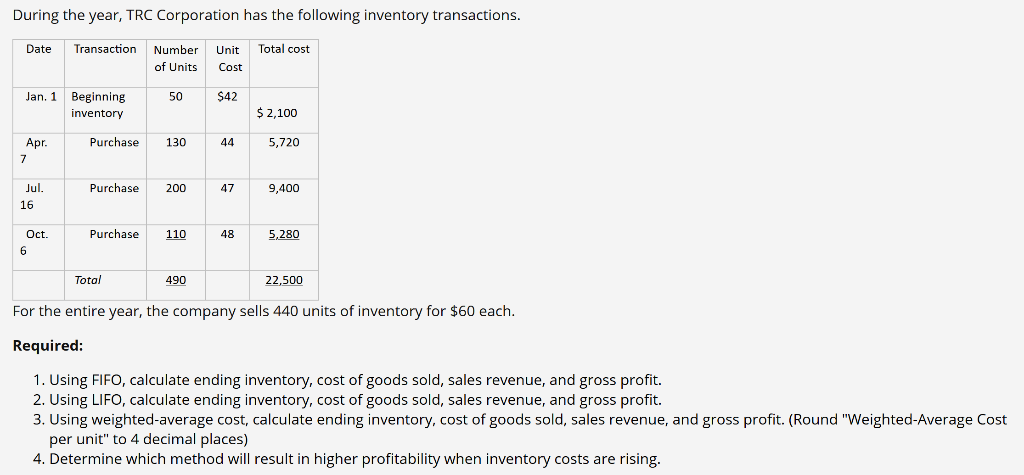

Question: How could this be done in EXCEL format? During the year, TRC Corporation has the following inventory transactions. Date Transaction Total cost Number of Units

How could this be done in EXCEL format?

During the year, TRC Corporation has the following inventory transactions. Date Transaction Total cost Number of Units Unit Cost Jan. 1 Beginning inventory 50 $42 $2,100 Apr. Purchase 130 5,720 Purchase 200 47 9,400 Jul. 16 Oct. Purchase 110 48 5,280 Total 490 22,500 For the entire year, the company sells 440 units of inventory for $60 each. Required: 1. Using FIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. 2. Using LIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. 3. Using weighted average cost, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. (Round "Weighted Average Cost per unit" to 4 decimal places) 4. Determine which method will result in higher profitability when inventory costs are rising

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts