Question: how did he get the answer 0.9 ? please answer step by step thank youu Exercise 13 Consider a single period binomial setting where the

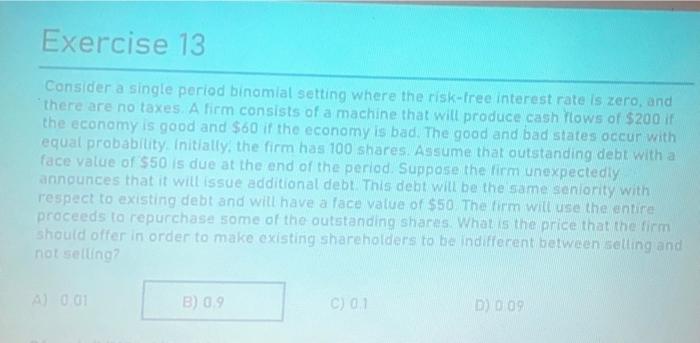

Exercise 13 Consider a single period binomial setting where the risk-free interest rate is zero, and there are no taxes. A firm consists of a machine that will produce cash flows of $200 the economy is good and $60 if the economy is bad. The good and bad states occur with equal probability Initially, the firm has 100 shares Assume that outstanding debt with a face value of $50 is due at the end of the period. Suppose the firm unexpectedly announces that it will issue additional debt This debt will be the same seniority with respect to existing debt and will have a face value of $50 The firm will use the entire proceeds to repurchase some of the outstanding shares. What is the price that the firm should offer in order to make existing shareholders to be indifferent between setting and not selling? 00 B) 09 C) 01 D) 009

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts