Question: how did he make this table from scratch? did the stock price 32 come from (current market price 37) - (5$ per option) or did

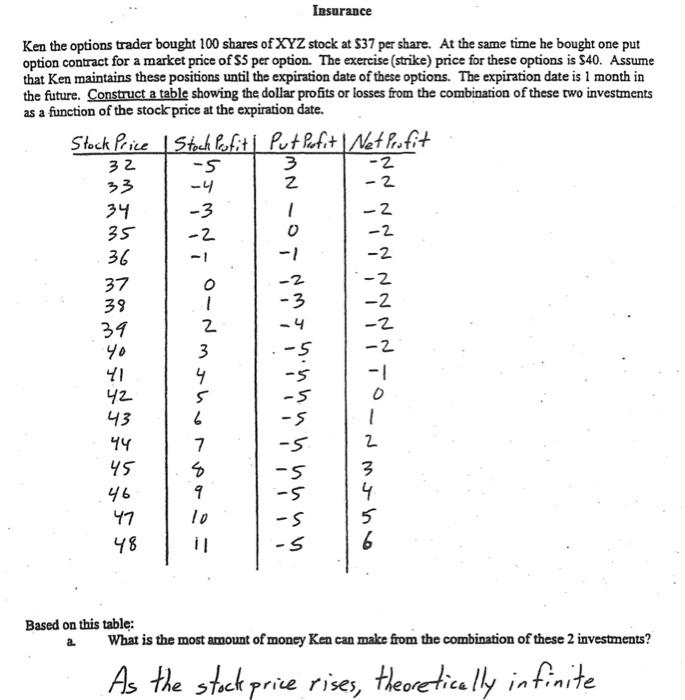

I w s -2 NN Insurance Ken the options trader bought 100 shares of XYZ stock at $37 per share. At the same time he bought one put option contract for a market price of $5 per option. The exercise (strike) price for these options is 540. Assume that Ken maintains these positions until the expiration date of these options. The expiration date is 1 month in the future. Construct a table showing the dollar profits or losses from the combination of these two investments as a function of the stock price at the expiration date. Stock Price Stock Profiti Put Profit | Net Profit 32 -2 33 -2 34 -3 -2 35 -2 36 -2 37 O -2 39 -2 34 2 -2 40 3 5 -2 41 4 -1 42 5 43 6 1 44 7 2 45 S 3 46 9 4 47 10 5 48 il 6 n n nin's w to - nw -5 Based on this table: a What is the most amount of money Ken can make from the combination of these 2 investments? As the stock price rises theoretically infinite

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts