Question: How did they get the interest expense for the. first problem and why did they divide 6/12 in the bottom problem? # 1 - Rainbow

How did they get the interest expense for the. first problem and why did they divide 6/12 in the bottom problem?

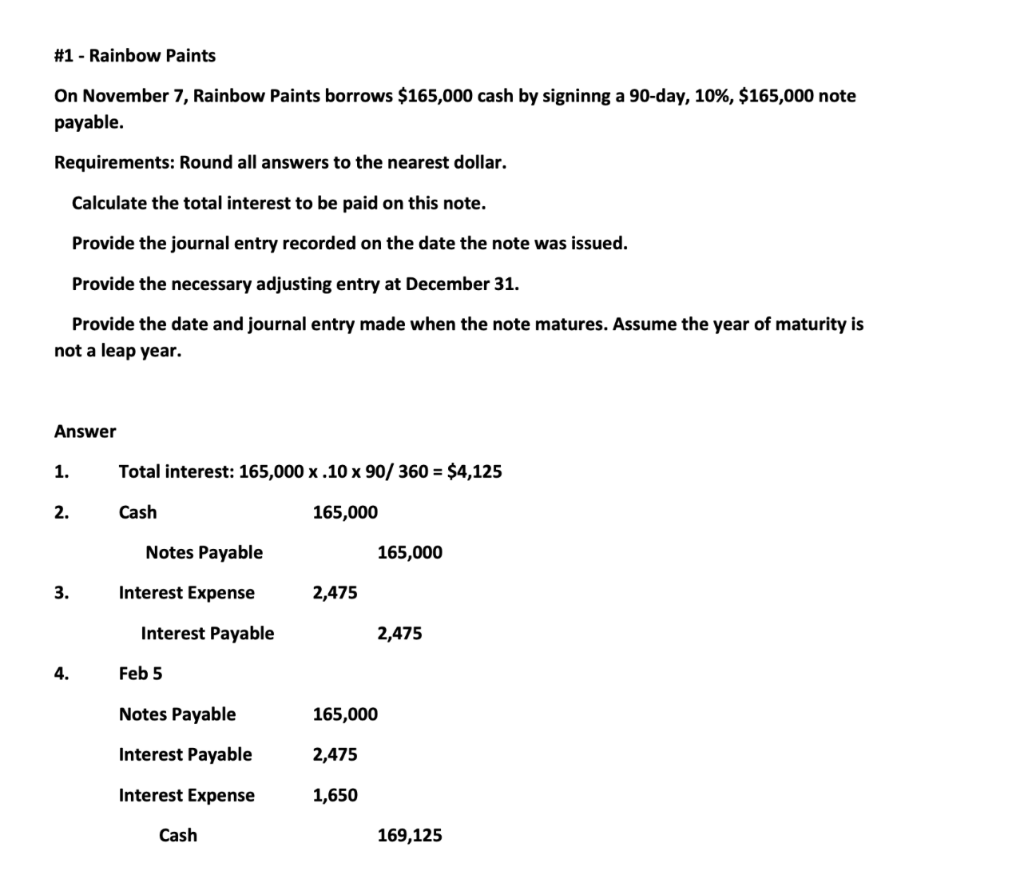

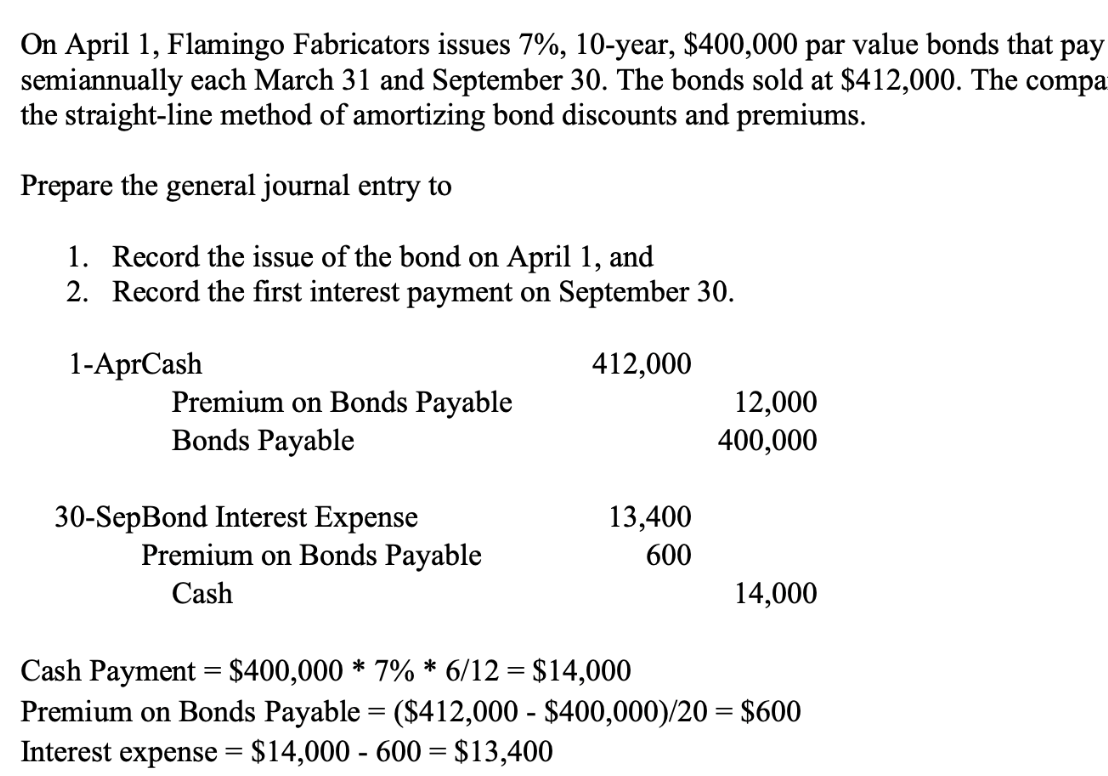

# 1 - Rainbow Paints On November 7, Rainbow Paints borrows $165,000 cash by signinng a 90-day, 10%, $165,000 note payable. Requirements: Round all answers to the nearest dollar. Calculate the total interest to be paid on this note. Provide the journal entry recorded on the date the note was issued. Provide the necessary adjusting entry at December 31. Provide the date and journal entry made when the note matures. Assume the year of maturity is not a leap year. Answer 1. 2. 3. 4. Total interest: 165,000 x .10 x 90/360 = $4,125 Cash 165,000 Notes Payable Interest Expense Interest Payable Feb 5 Notes Payable Interest Payable Interest Expense Cash 2,475 165,000 2,475 165,000 2,475 1,650 169,125 On April 1, Flamingo Fabricators issues 7%, 10-year, $400,000 par value bonds that pay semiannually each March 31 and September 30. The bonds sold at $412,000. The compa the straight-line method of amortizing bond discounts and premiums. Prepare the general journal entry to 1. Record the issue of the bond on April 1, and 2. Record the first interest payment on September 30. 1-AprCash Premium on Bonds Payable Bonds Payable 30-SepBond Interest Expense Premium on Bonds Payable Cash 412,000 13,400 600 12,000 400,000 14,000 Cash Payment = $400,000 * 7% * 6/12 = $14,000 Premium on Bonds Payable = ($412,000 - $400,000)/20 = $600 Interest expense = $14,000 - 600 = $13,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts