Question: how did they get the variable manufacturing cost amount 10,000 Starlight Inc. cans peaches for sale to food distributors. All costs are classified as either

how did they get the variable manufacturing cost amount 10,000

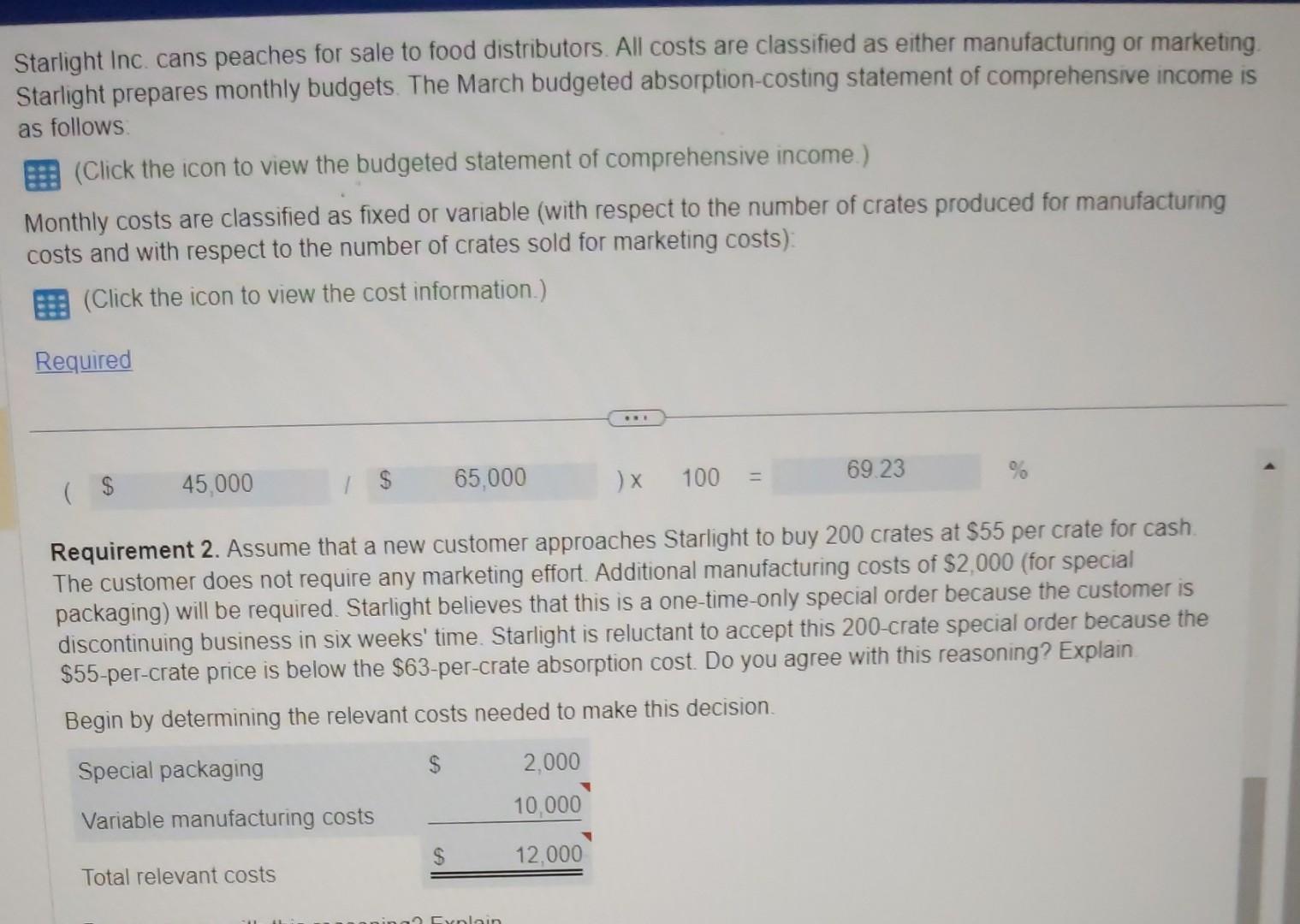

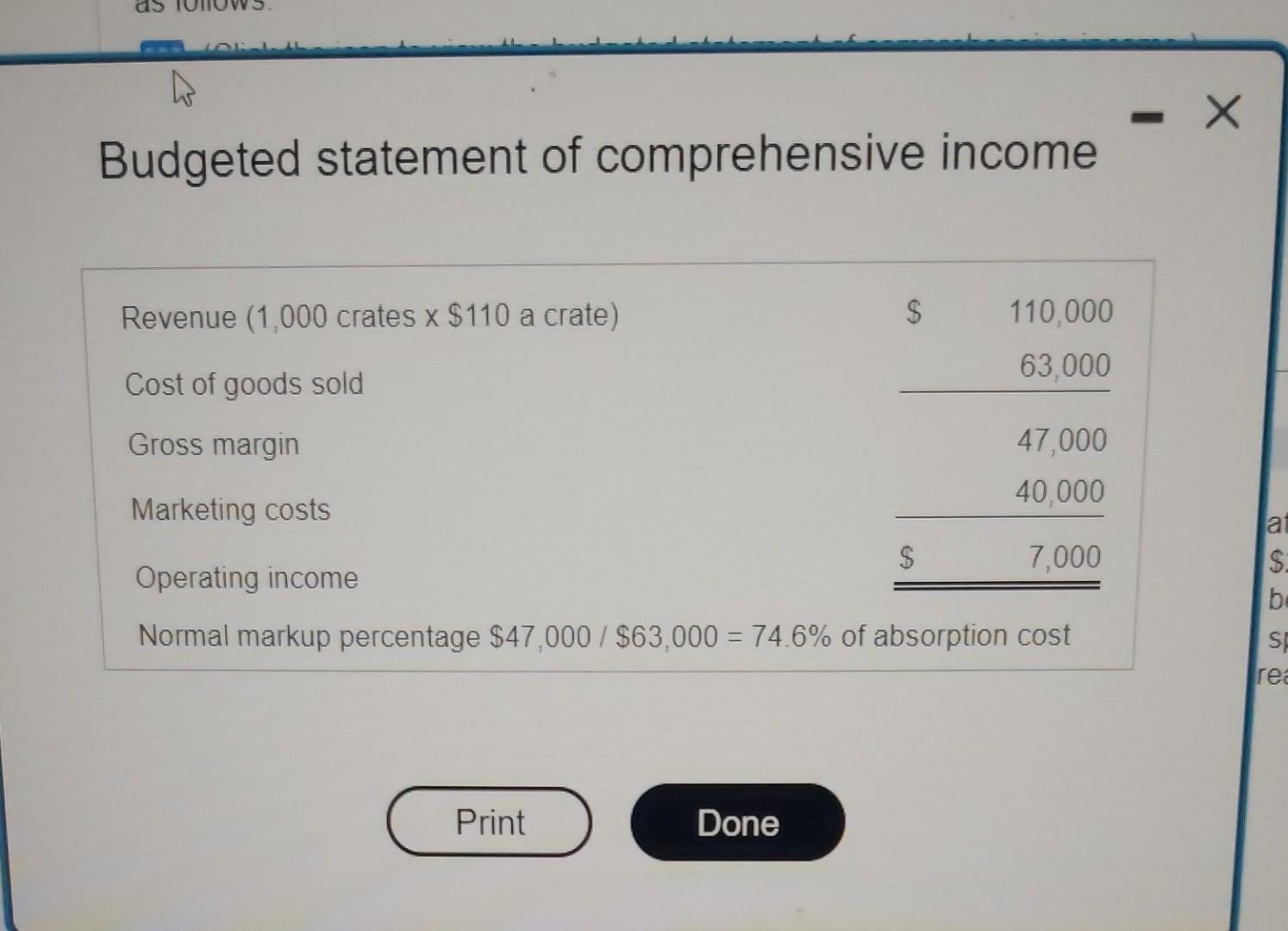

Starlight Inc. cans peaches for sale to food distributors. All costs are classified as either manufacturing or marketing. Starlight prepares monthly budgets. The March budgeted absorption-costing statement of comprehensive income is as follows. (Click the icon to view the budgeted statement of comprehensive income.) Monthly costs are classified as fixed or variable (with respect to the number of crates produced for manufacturing costs and with respect to the number of crates sold for marketing costs): (Click the icon to view the cost information.) Requirement 2. Assume that a new customer approaches Starlight to buy 200 crates at $55 per crate for cash The customer does not require any marketing effor. Additional manufacturing costs of $2,000 (for special packaging) will be required. Starlight believes that this is a one-time-only special order because the customer is discontinuing business in six weeks' time. Starlight is reluctant to accept this 200-crate special order because the $55-per-crate price is below the $63-per-crate absorption cost. Do you agree with this reasoning? Explain Beain by determining the relevant costs needed to make this decision. Budgeted statement of comprehensive income 1. Calculate the markup percentage based on total variable costs. 2. Assume that a new customer approaches Starlight to buy 200 crates at $55 per crate for cash. The customer does not require any marketing effort. Additional manufacturing costs of $2,000 (for special packaging) will be required. Starlight believes that this is a one-time-only special order because the customer is discontinuing business in six weeks' time. Starlight is reluctant to accept this 200-crate special order because the $55-per-crate price is below the $63-per-crate absorption cost. Do you agree with this reasoning? Explain. 3. Assume that the new customer decides to remain in business. How would this longevity affect your willingness to accept the \$55-per-crate offer? Explain. Starlight Inc. cans peaches for sale to food distributors. All costs are classified as either manufacturing or marketing. Starlight prepares monthly budgets. The March budgeted absorption-costing statement of comprehensive income is as follows. (Click the icon to view the budgeted statement of comprehensive income.) Monthly costs are classified as fixed or variable (with respect to the number of crates produced for manufacturing costs and with respect to the number of crates sold for marketing costs): (Click the icon to view the cost information.) Requirement 2. Assume that a new customer approaches Starlight to buy 200 crates at $55 per crate for cash The customer does not require any marketing effor. Additional manufacturing costs of $2,000 (for special packaging) will be required. Starlight believes that this is a one-time-only special order because the customer is discontinuing business in six weeks' time. Starlight is reluctant to accept this 200-crate special order because the $55-per-crate price is below the $63-per-crate absorption cost. Do you agree with this reasoning? Explain Beain by determining the relevant costs needed to make this decision. Budgeted statement of comprehensive income 1. Calculate the markup percentage based on total variable costs. 2. Assume that a new customer approaches Starlight to buy 200 crates at $55 per crate for cash. The customer does not require any marketing effort. Additional manufacturing costs of $2,000 (for special packaging) will be required. Starlight believes that this is a one-time-only special order because the customer is discontinuing business in six weeks' time. Starlight is reluctant to accept this 200-crate special order because the $55-per-crate price is below the $63-per-crate absorption cost. Do you agree with this reasoning? Explain. 3. Assume that the new customer decides to remain in business. How would this longevity affect your willingness to accept the \$55-per-crate offer? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts