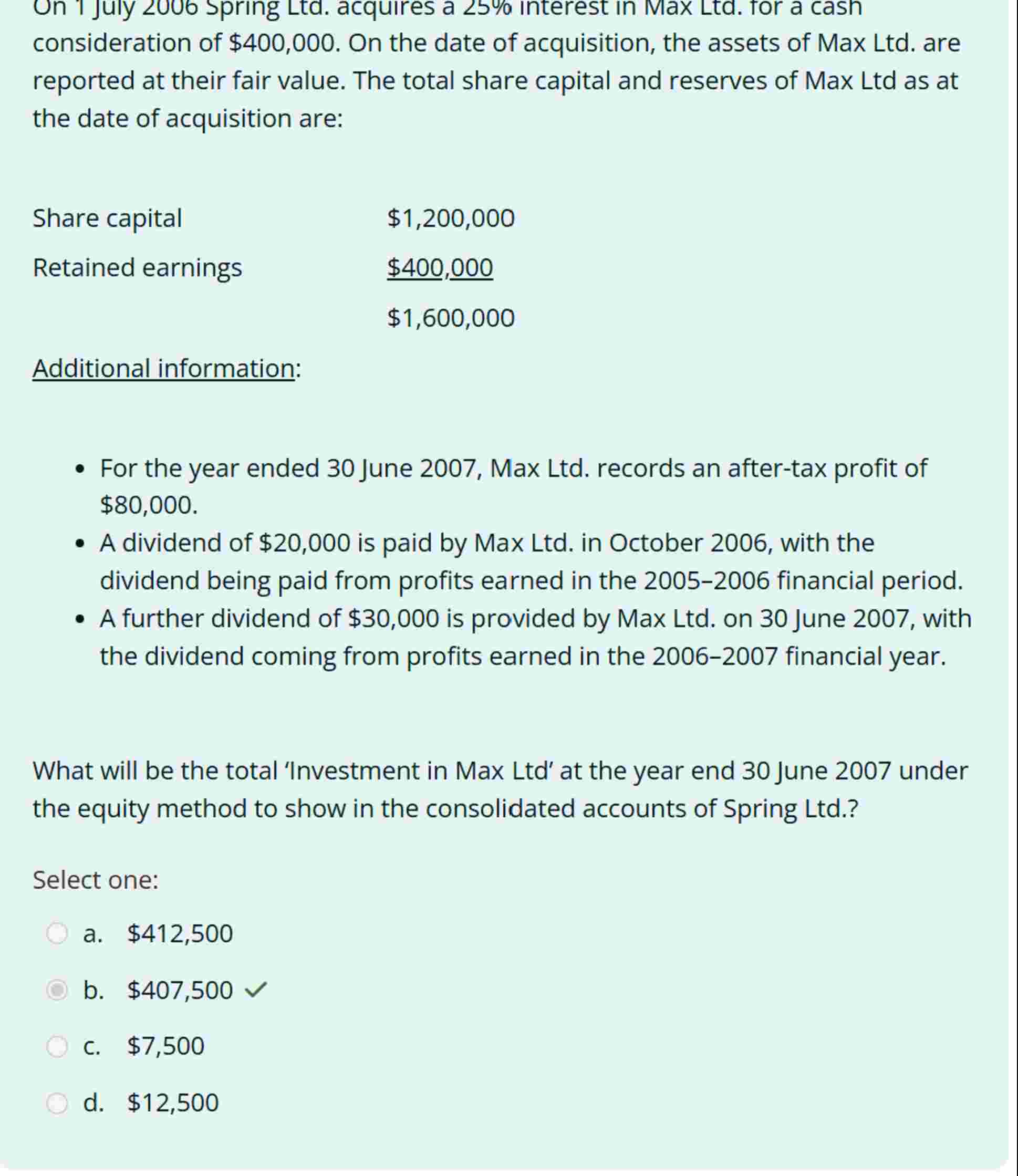

Question: How did they get this answer? On I July 2 0 0 6 Spring Ltd . acquires a ( 2 5 %

How did they get this answer? On I July Spring Ltd acquires a interest in IMax Ltd for a cash consideration of $ On the date of acquisition, the assets of Max Ltd are reported at their fair value. The total share capital and reserves of Max Ltd as at the date of acquisition are: Additional information: For the year ended June Max Ltd records an aftertax profit of $ A dividend of $ is paid by Max Ltd in October with the dividend being paid from profits earned in the financial period. A further dividend of $ is provided by Max Ltd on June with the dividend coming from profits earned in the financial year. What will be the total 'Investment in Max Ltd at the year end June under the equity method to show in the consolidated accounts of Spring Ltd Select one:a$ b$ c$ d$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock