Question: how did we get this answer. ? please give me a brief explaination. 4:21 chegg.com Alert when this question is answered GET APP Chegg 4,500.

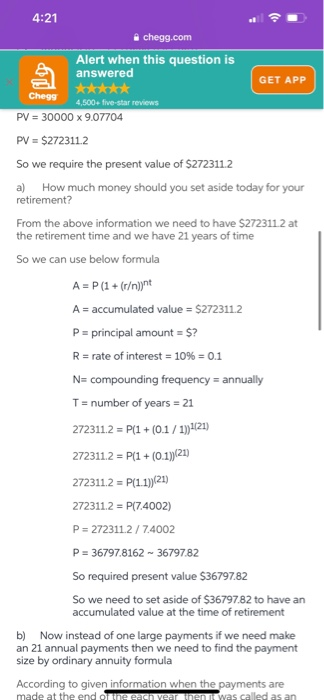

4:21 chegg.com Alert when this question is answered GET APP Chegg 4,500. five-star reviews PV = 30000 x 9.07704 PV = $272311.2 So we require the present value of $272311.2 a) How much money should you set aside today for your retirement? From the above information we need to have $2723112 at the retirement time and we have 21 years of time So we can use below formula A = P(1 + (rijnt A = accumulated value = $272311.2 P = principal amount = $? R = rate of interest = 10% = 0.1 N= compounding frequency = annually T= number of years = 21 272311.2 = P(1 + (0.1 / 1))(21) 272311.2 = P(1 + (0.1),(21) 272311.2 = P(1.1))(21) 272311.2 = P(7.4002) P = 272311.2 / 7.4002 P = 36797.8162 - 36797.82 So required present value $36797.82 So we need to set aside of $36797.82 to have an accumulated value at the time of retirement b) Now instead of one large payments if we need make an 21 annual payments then we need to find the payment size by ordinary annuity formula According to given information when the payments are made at the end of the each year then it was called as an 4:21 chegg.com Alert when this question is answered GET APP Chegg 4,500. five-star reviews PV = 30000 x 9.07704 PV = $272311.2 So we require the present value of $272311.2 a) How much money should you set aside today for your retirement? From the above information we need to have $2723112 at the retirement time and we have 21 years of time So we can use below formula A = P(1 + (rijnt A = accumulated value = $272311.2 P = principal amount = $? R = rate of interest = 10% = 0.1 N= compounding frequency = annually T= number of years = 21 272311.2 = P(1 + (0.1 / 1))(21) 272311.2 = P(1 + (0.1),(21) 272311.2 = P(1.1))(21) 272311.2 = P(7.4002) P = 272311.2 / 7.4002 P = 36797.8162 - 36797.82 So required present value $36797.82 So we need to set aside of $36797.82 to have an accumulated value at the time of retirement b) Now instead of one large payments if we need make an 21 annual payments then we need to find the payment size by ordinary annuity formula According to given information when the payments are made at the end of the each year then it was called as an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts