Question: How did you got the goodwill 1,340,000? Question 2 P Co obtained control through acquiring ownership interest of 90% in X Co on 1 January

How did you got the goodwill "1,340,000"?

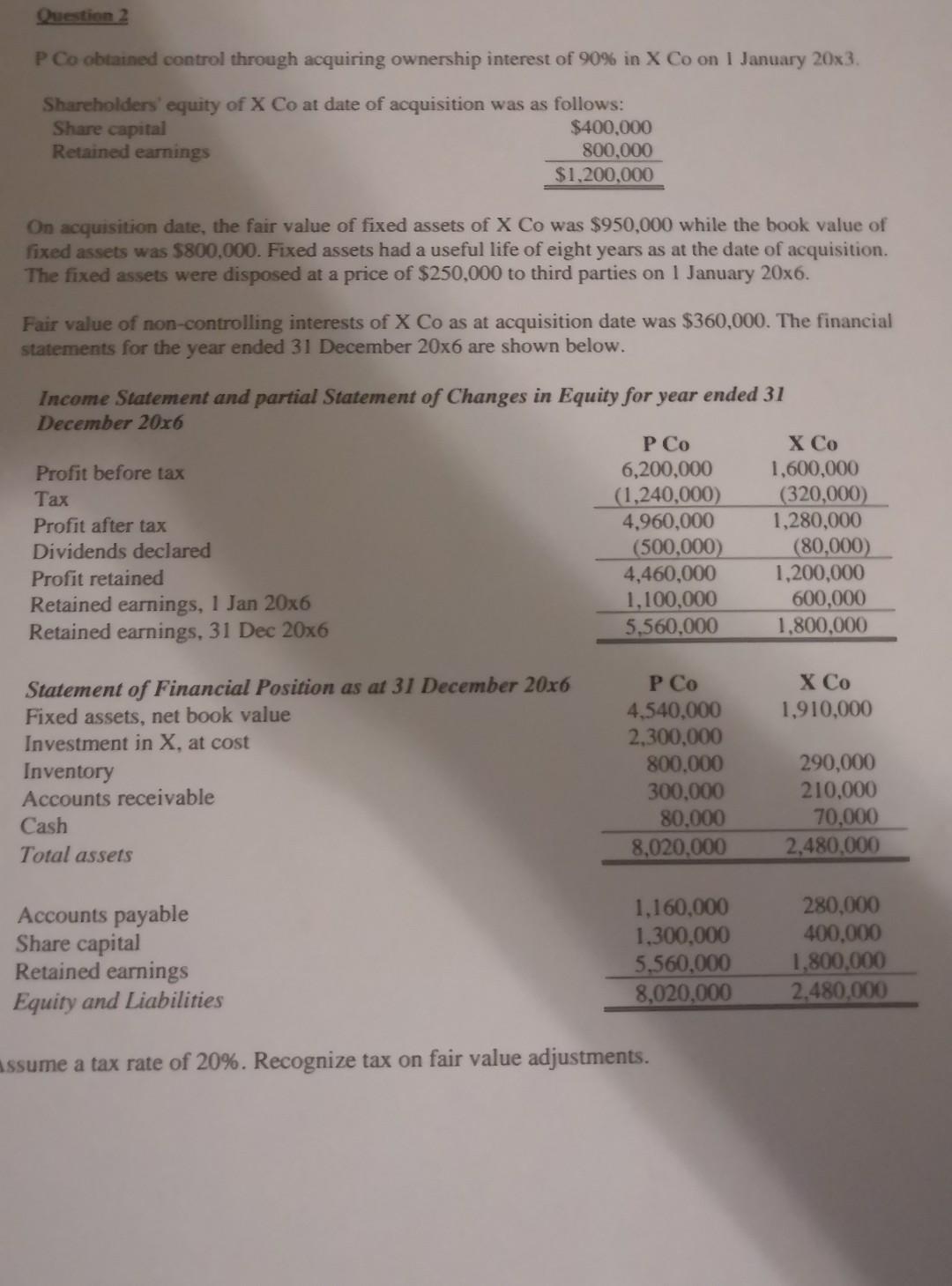

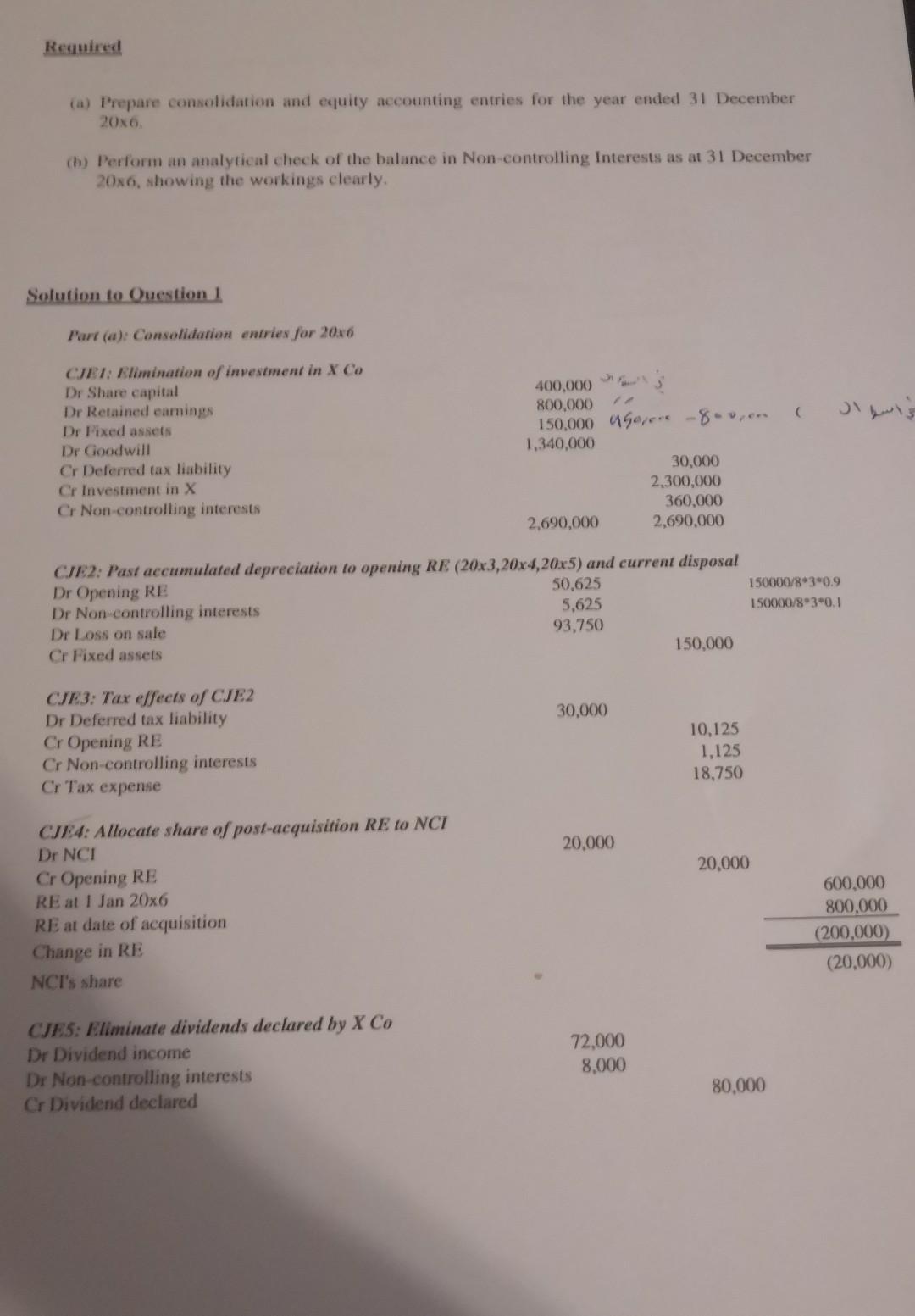

Question 2 P Co obtained control through acquiring ownership interest of 90% in X Co on 1 January 20x3. Shareholders' equity of X Co at date of acquisition was as follows: Share capital $400,000 Retained earnings 800,000 $1,200,000 On acquisition date, the fair value of fixed assets of X Co was $950,000 while the book value of fixed assets was $800,000. Fixed assets had a useful life of eight years as at the date of acquisition. The fixed assets were disposed at a price of $250,000 to third parties on 1 January 20x6. Fair value of non-controlling interests of X Co as at acquisition date was $360,000. The financial statements for the year ended 31 December 20x6 are shown below. Income Statement and partial Statement of Changes in Equity for year ended 31 December 20x6 P Co X Co Profit before tax 6,200,000 1,600,000 Tax (1,240,000) (320,000) Profit after tax 4,960,000 1,280,000 Dividends declared (500,000) (80,000) Profit retained 4,460,000 1,200,000 Retained earnings, 1 Jan 20x6 1,100,000 600,000 Retained earnings, 31 Dec 20x6 5,560,000 1,800,000 X Co 1,910,000 Statement of Financial Position as at 31 December 20x6 Fixed assets, net book value Investment in X, at cost Inventory Accounts receivable Cash Total assets P Co 4,540,000 2,300,000 800,000 300,000 80.000 8,020,000 290,000 210,000 70,000 2,480,000 Accounts payable Share capital Retained earnings Equity and Liabilities 1,160,000 1,300,000 5,560,000 8,020,000 280,000 400.000 1,800,000 2.480,000 assume a tax rate of 20%. Recognize tax on fair value adjustments. Required (a) Prepare consolidation and equity accounting entries for the year ended 31 December 2016 (h) Perform an analytical check of the balance in Non-controlling Interests as at 31 December 20x6, showing the workings clearly. Solution to Question 1 Part (a): Consolidation entries for 20x6 CJET: Elimination of investment in X Co Dr Share capital Dr Retained earnings Dr Pixed assets Dr Goodwill Cr Deferred tax liability Cr Investment in X Cr Non-controlling interests 400,000 800,000 150,000 490 -8. 1,340,000 30,000 2.300,000 360,000 2,690,000 2,690,000 150000/83*0.9 150000/83.0.1 CJE2: Past accumulated depreciation to opening RE (20x3,20x4,20x5) and current disposal Dr Opening RE 50,625 Dr Non-controlling interests 5,625 Dr Loss on sale 93,750 Cr Fixed assets 150,000 30,000 CJE3: Tax effects of CJE2 Dr Deferred tax liability Cr Opening RE Cr Non-controlling interests Cr Tax expense 10,125 1,125 18,750 20,000 20,000 CJE4: Allocate share of post-acquisition RE to NCI Dr NCI Cr Opening RE RE at 1 Jan 20x6 RE at date of acquisition Change in RE NCI's share 600.000 800,000 (200,000) (20,000) CJES: Eliminate dividends declared by X Co Dr Dividend income Dr Non-controlling interests Cr Dividend declared 72,000 8,000 80,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts