Question: How do depository institutions create liquidity, pool risks, and lower the cost of borrowing? A depository institution creates liquidity by A . paying high interest

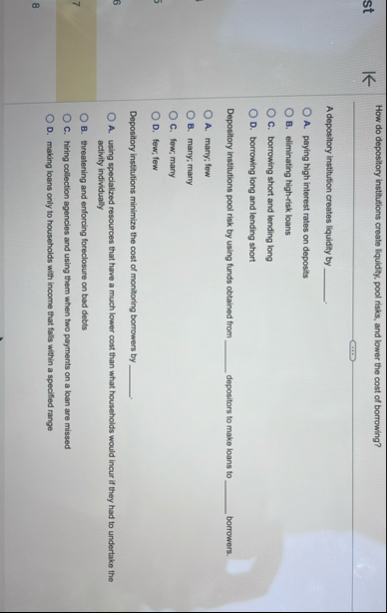

How do depository institutions create liquidity, pool risks, and lower the cost of borrowing?

A depository institution creates liquidity by

A paying high interest rates on deposits

B eliminating highrisk loans

C borrowing short and lending long

D borrowing long and lending short

Depository institutions pool risk by using funds obtained from depositors to make loans to borrowers.

A many; fow

B many; many

C few; many

D few; few

Depository institutions minimize the cost of monitoring borrowers by

B threatening and enforcing foreclosure on bad debts

C hiring collection agencies and using them when two payments on a loan are missed

D making loans only to households with income that falls within a specified range

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock