Question: How do economists define expected return and risk? A . Risk is the price of an asset a year from now, while expected return is

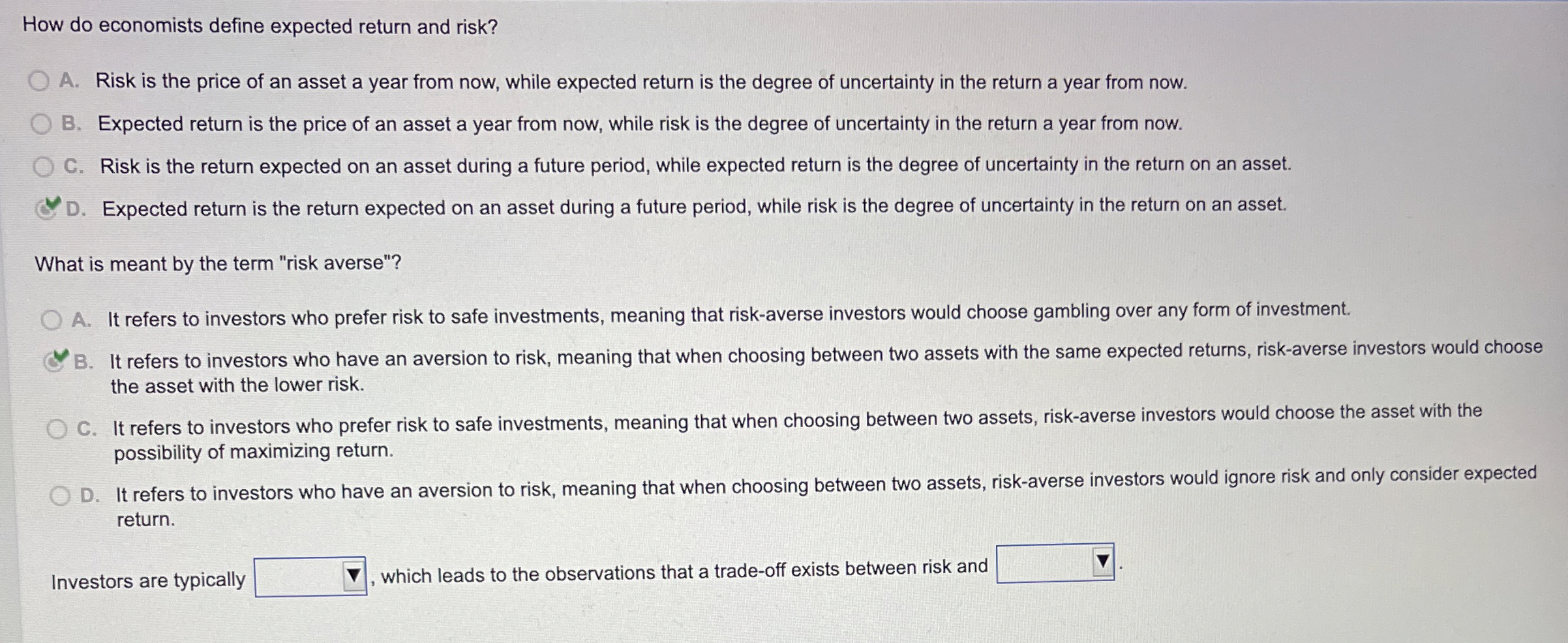

How do economists define expected return and risk?

A Risk is the price of an asset a year from now, while expected return is the degree of uncertainty in the return a year from now.

B Expected return is the price of an asset a year from now, while risk is the degree of uncertainty in the return a year from now.

C Risk is the return expected on an asset during a future period, while expected return is the degree of uncertainty in the return on an asset.

D Expected return is the return expected on an asset during a future period, while risk is the degree of uncertainty in the return on an asset.

What is meant by the term "risk averse"?

A It refers to investors who prefer risk to safe investments, meaning that riskaverse investors would choose gambling over any form of investment.

B It refers to investors who have an aversion to risk, meaning that when choosing between two assets with the same expected returns, riskaverse investors would choose

the asset with the lower risk.

C It refers to investors who prefer risk to safe investments, meaning that when choosing between two assets, riskaverse investors would choose the asset with the

possibility of maximizing return.

D It refers to investors who have an aversion to risk, meaning that when choosing between two assets, riskaverse investors would ignore risk and only consider expected

return.

Investors are typically

which leads to the observations that a tradeoff exists between risk and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock