Question: how do i asnwer (b) ! A hedpe fund has crealed a portfolio using just two stocks. It has shorted $40,000,000 worth of Oracle stock

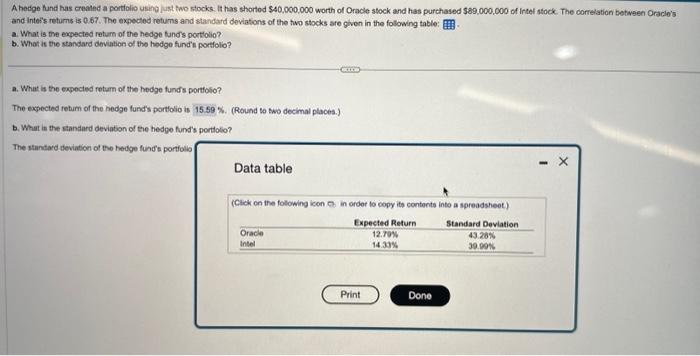

A hedpe fund has crealed a portfolio using just two stocks. It has shorted \$40,000,000 worth of Oracle stock and has purchased $89,000,000 of Irtel stock. The correlation between Oraclo's and intels returns is 0.67 . The expected retums and standard deviations of the two stocks ste given in the following table: a. What is the expected retum of the hedge funds portlolio? b. What is the standard deviation of the hedge fund's portilolio? a. What is the expocted return of the hedge funds portolio? The expected retum of the hedge fund's portolio is 6. (Round to two decimal places.) b. What is the standard deviation of the hedgo fund's portiolio? The stundard deviation of the hedge fund's portiolio Data table (Cick on the folowing icon 0. in order to copy its contents into a spreadsheot)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts