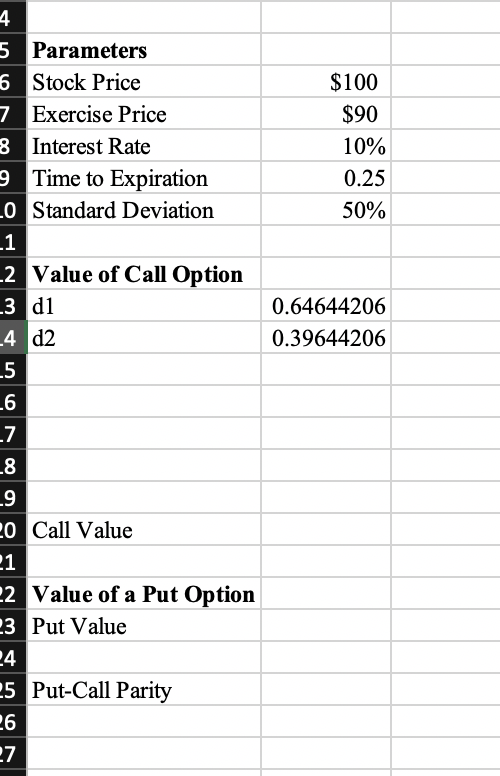

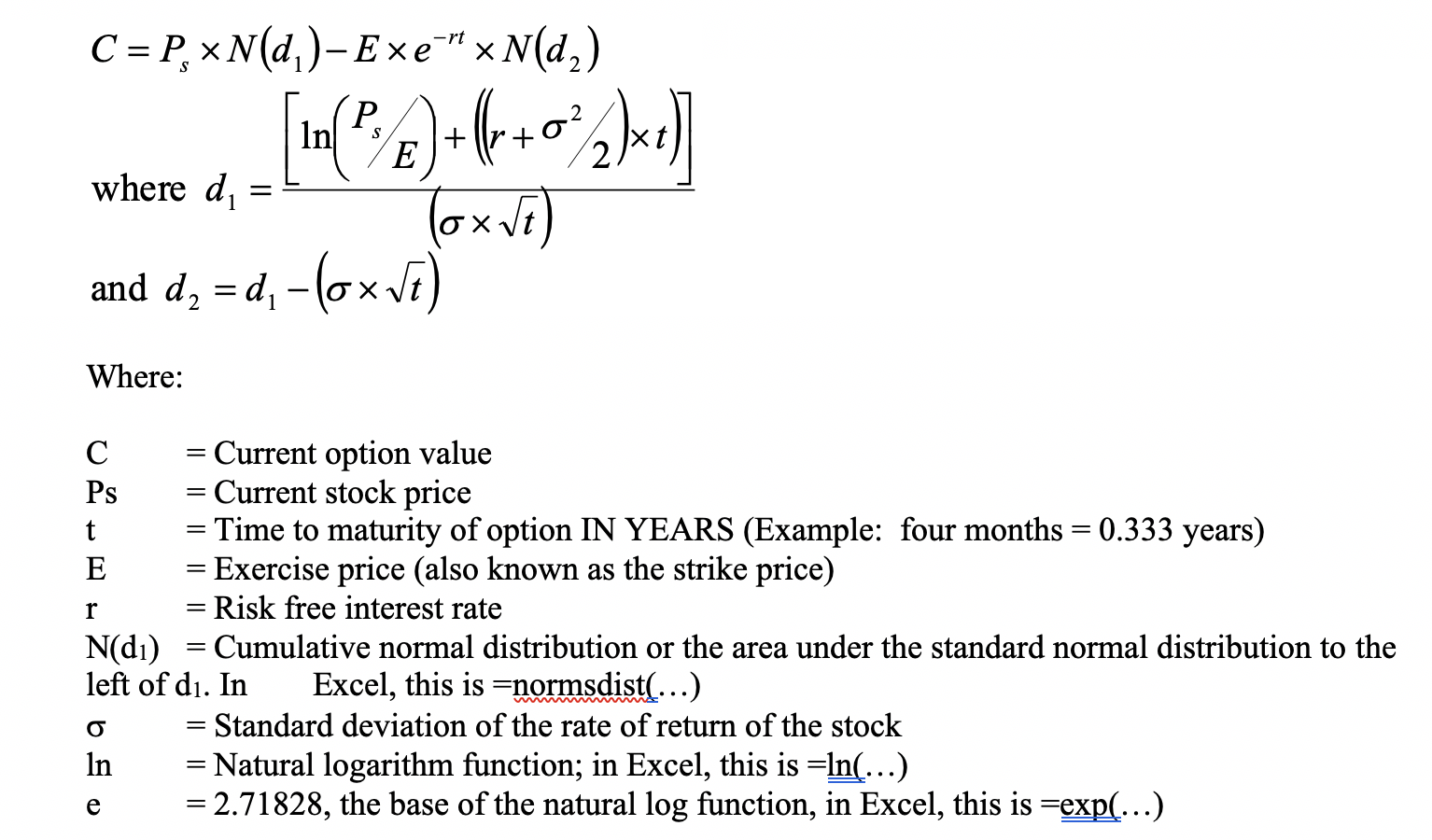

Question: how do i calculate call value from this data? i am struggling specifically with how to use the NORMDIST excel function to find the N(d1)

how do i calculate call value from this data? i am struggling specifically with how to use the NORMDIST excel function to find the N(d1) and N(d2) i need. i have included the formula i am using. i know the answer i should be getting for call value is $13.70.

5 Parameters 6 Stock Price 7 Exercise Price 8 Interest Rate 9 Time to Expiration 0 Standard Deviation $100 $90 10% 0.25 50% _1 _2 Value of Call Option _3 d1 0.64644206 _4 d2 0.39644206 _5 L7 _8 _9 20 Call Value 21 22 Value of a Put Option 23 Put Value 24 25 Put-Call Parity 26 27 -, N(,)-"xN(d,) -rt where d, "E)-b+o*k)] Tox vi) P. In and d, = d, - (ox Vi) Where: Current option value = Current stock price = Time to maturity of option IN YEARS (Example: four months = 0.333 years) = Exercise price (also known as the strike price) = Risk free interest rate Ps Cumulative normal distribution or the area under the standard normal distribution to the N(d1) left of di. In Excel, this is =normsdist(...) = Standard deviation of the rate of return of the stock = Natural logarithm function; in Excel, this is =In(..) = 2.71828, the base of the natural log function, in Excel, this is =exp(...) In

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts