Question: How do I calculate Jonathan's tax liability? Can someone explain step by step? please I will appreciate it, thankyou. Problem 1-8 The Tax Formula for

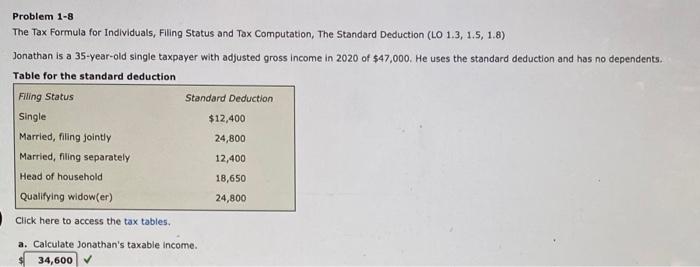

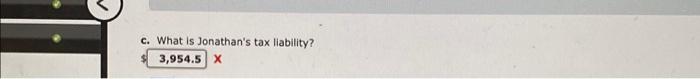

Problem 1-8 The Tax Formula for Individuals, Filling Status and Tax Computation, The Standard Deduction (LO 1.3, 1.5, 1.8) Jonathan is a 35-year-old single taxpayer with adjusted gross income in 2020 of $47.000. He uses the standard deduction and has no dependents. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, hiling separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 Click here to access the tax tables. a. Calculate Jonathan's taxable income. 34,600, c. What is Jonathan's tax liability? 3,954.5 X Problem 1-8 The Tax Formula for Individuals, Filling Status and Tax Computation, The Standard Deduction (LO 1.3, 1.5, 1.8) Jonathan is a 35-year-old single taxpayer with adjusted gross income in 2020 of $47.000. He uses the standard deduction and has no dependents. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, hiling separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 Click here to access the tax tables. a. Calculate Jonathan's taxable income. 34,600, c. What is Jonathan's tax liability? 3,954.5 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts