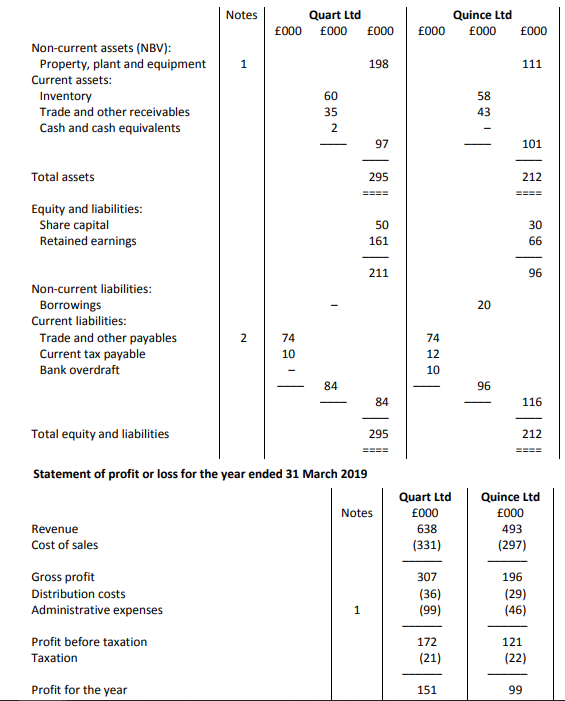

Question: How do I calculate return on capital employed using these statements given (SOPOL and SOFP)? The formula is: PBIT / (Equity+Non current liabilities) * 100

How do I calculate return on capital employed using these statements given (SOPOL and SOFP)?

The formula is: PBIT / (Equity+Non current liabilities) * 100

I'm struggling to get PBIT, I have the answers but I don't understand how they get profit before interest and tax from this picture attached.

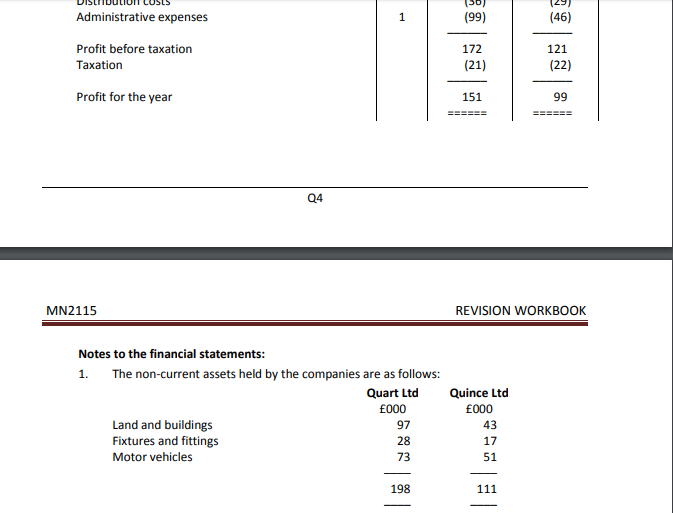

Notes Quart Ltd 000 000 000 000 Quince Ltd 000 000 1 198 111 Non-current assets (NBV): Property, plant and equipment Current assets: Inventory Trade and other receivables Cash and cash equivalents Nuo 97 Total assets 295 212 Equity and liabilities: Share capital Retained earnings 161 211 Non-current liabilities: Borrowings Current liabilities: Trade and other payables Current tax payable Bank overdraft 2 *** | 84 116 Total equity and liabilities 295 212 Statement of profit or loss for the year ended 31 March 2019 Notes Quart Ltd 000 638 (331) Quince Ltd 000 493 (297) Revenue Cost of sales Gross profit Distribution costs Administrative expenses 307 (36) (99) 196 (29) (46) 172 Profit before taxation Taxation (21) 121 (22) Profit for the year 151 (56) 1291 VISLIIDULIUI LUSLS Administrative expenses (99) (46) 172 Profit before taxation Taxation (21) 121 (22) Profit for the year 151 ====== MN2115 REVISION WORKBOOK Notes to the financial statements: 1. The non-current assets held by the companies are as follows: Quart Ltd 000 Land and buildings Fixtures and fittings 28 Motor vehicles 73 Quince Ltd 000 43 97 198

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts