Question: How do I calculate the (1) current yield, (2) yield to maturity, (3) equivalent taxable yield, and (4) yield to call to get these right

How do I calculate the (1) current yield, (2) yield to maturity, (3) equivalent taxable yield, and (4) yield to call to get these right answers?

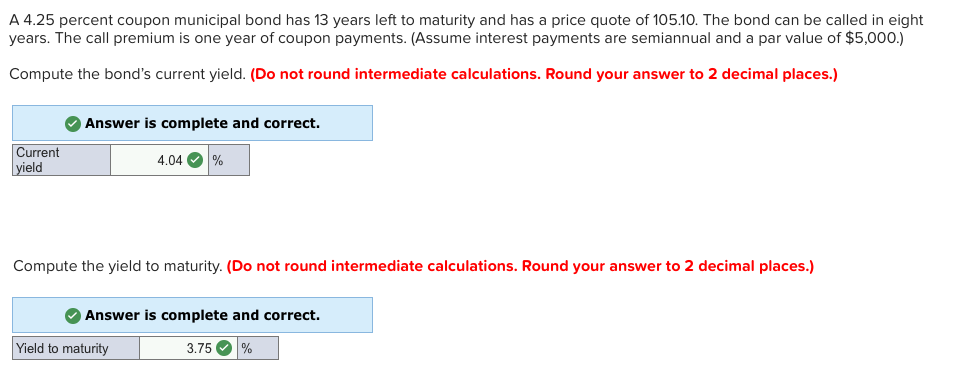

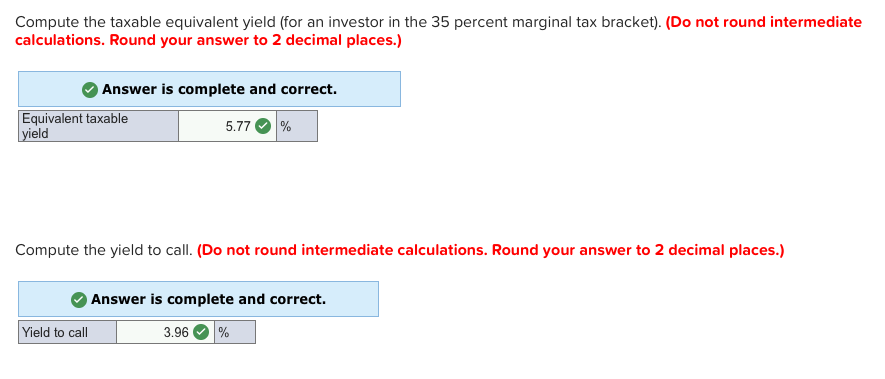

A 4.25 percent coupon municipal bond has 13 years left to maturity and has a price quote of 105.10. The bond can be called in eight years. The call premium is one year of coupon payments. (Assume interest payments are semiannual and a par value of $5,000.) Compute the bond's current yield. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current Answer is complete and correct. 4.040 % Compute the yield to maturity. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct. Yield to maturity 3.75 % Compute the taxable equivalent yield (for an investor in the 35 percent marginal tax bracket). (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct. Equivalent taxable yield 5.77 % Compute the yield to call. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct. Yield to call 3.96 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts