Question: How do I calculate the Free Cash Flow & Current Cash Debt Coverage Ratio with the information provide. Prenare the statement of financial nncition as

How do I calculate the Free Cash Flow & Current Cash Debt Coverage Ratio with the information provide.

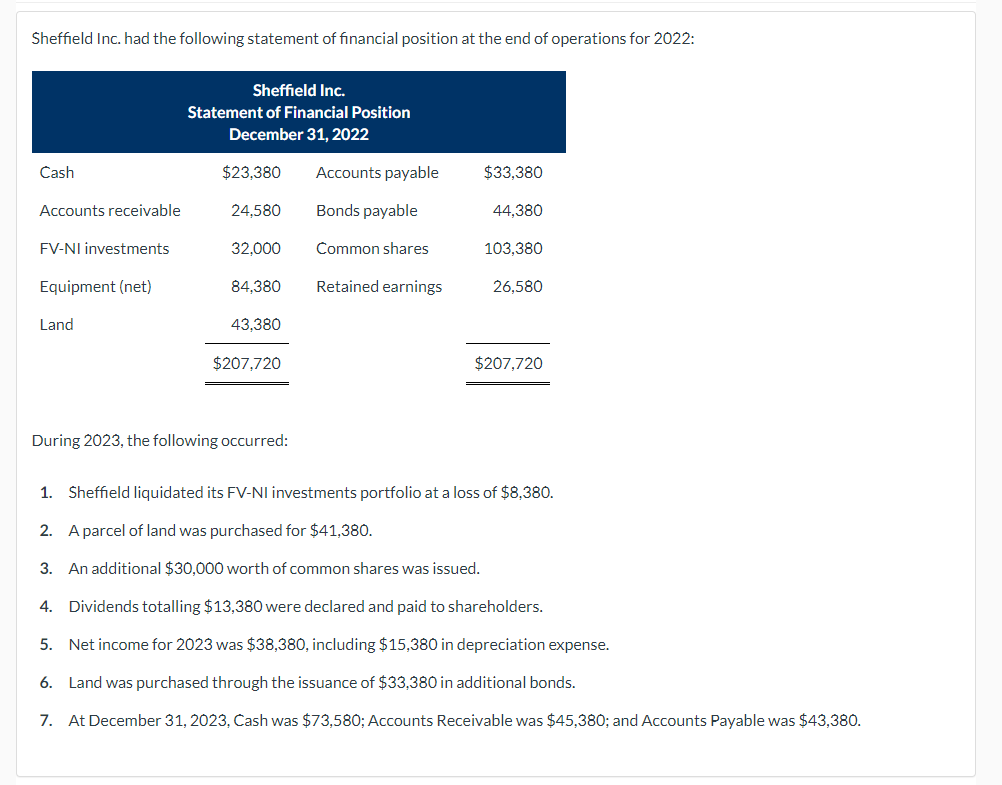

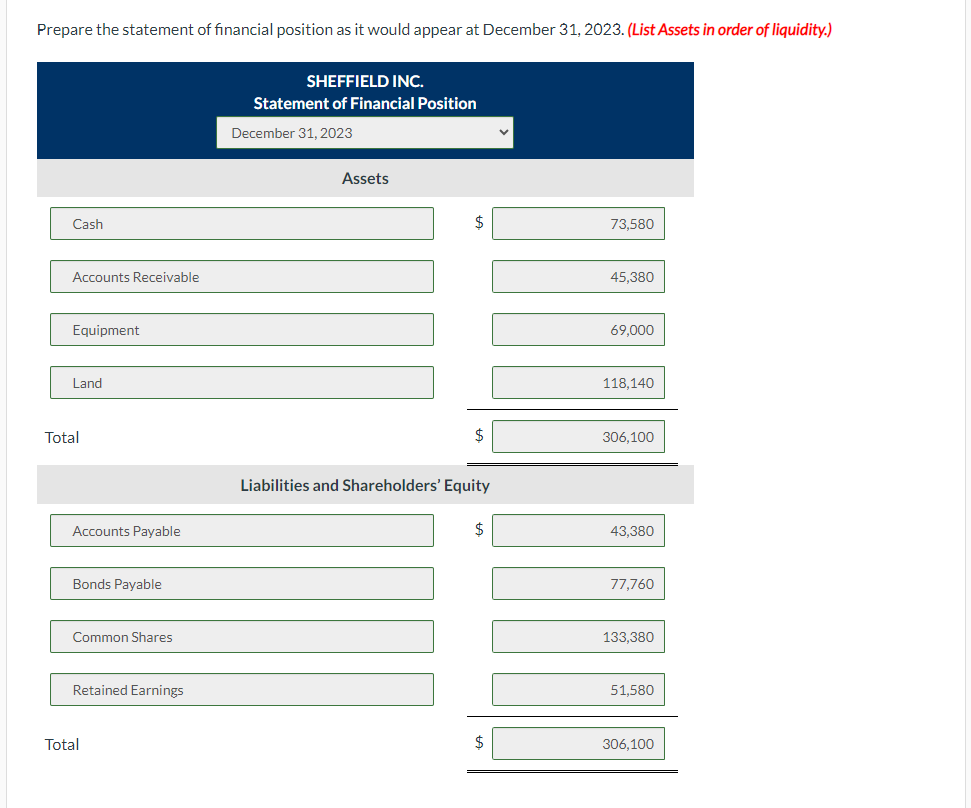

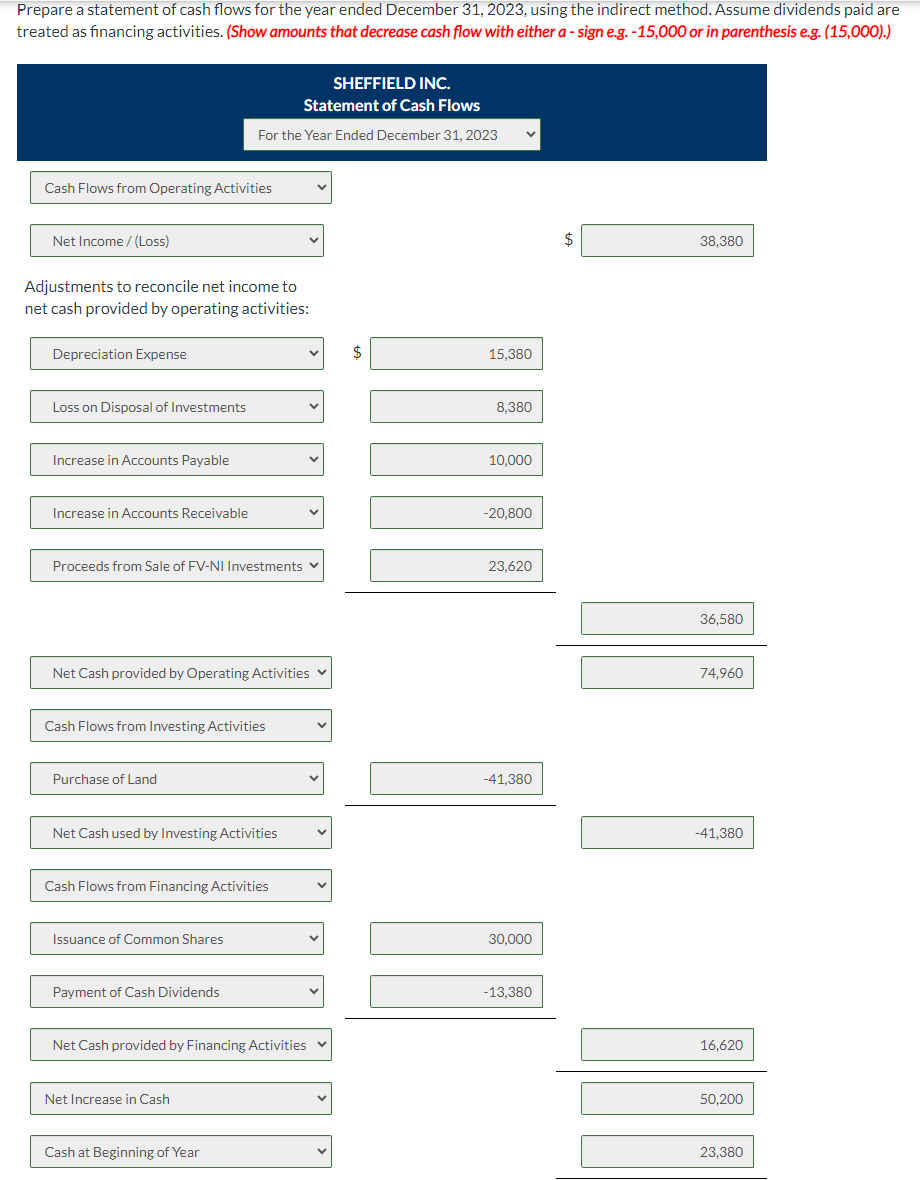

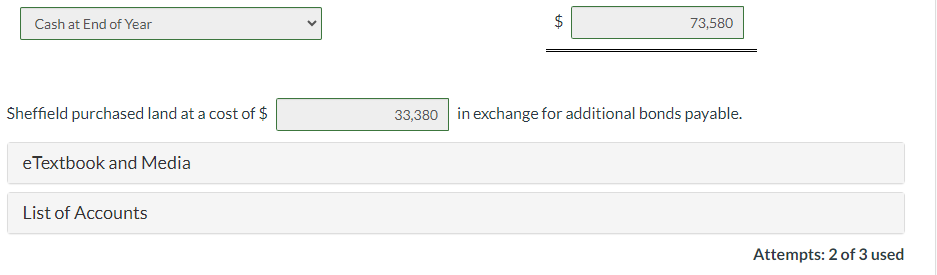

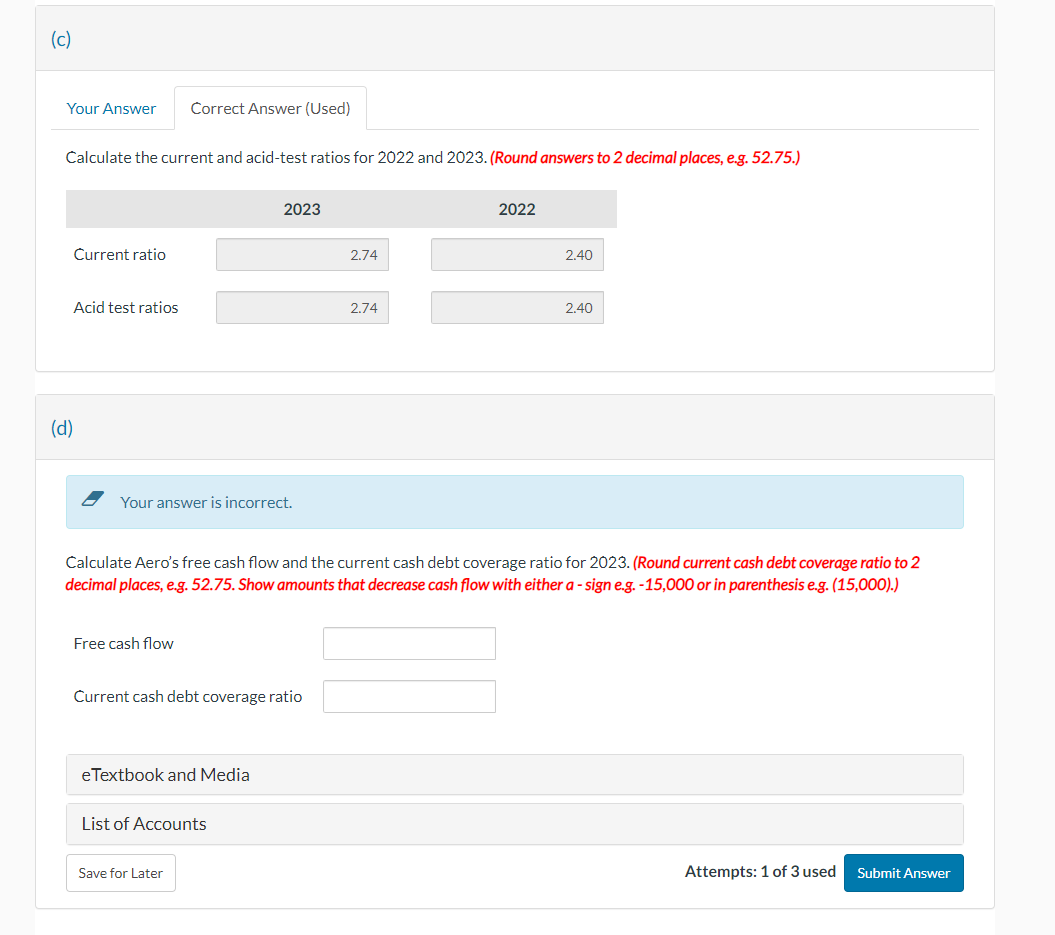

Prenare the statement of financial nncition as it wnld annear at Deremher 31203.3 (I ist Ascets in order of liquidity.) Sheffield purchased land at a cost of \$ in exchange for additional bonds payable. eTextbook and Media List of Accounts Attempts: 2 of 3 used Calculate the current and acid-test ratios for 2022 and 2023. (Round answers to 2 decimal places, e.g. 52.75.) d) Your answer is incorrect. Calculate Aero's free cash flow and the current cash debt coverage ratio for 2023. (Round current cash debt coverage ratio to 2 decimal places, e.g. 52.75. Show amounts that decrease cash flow with either a - sign e.g. 15,000 or in parenthesis e.g. (15,000).) paidare5,000).) Sheffield Inc. had the following statement of financial position at the end of operations for 2022 : During 2023, the following occurred: 1. Sheffield liquidated its FV-NI investments portfolio at a loss of $8,380. 2. A parcel of land was purchased for $41,380. 3. An additional $30,000 worth of common shares was issued. 4. Dividends totalling $13,380 were declared and paid to shareholders. 5. Net income for 2023 was $38,380, including $15,380 in depreciation expense. 6. Land was purchased through the issuance of $33,380 in additional bonds. 7. At December 31,2023 , Cash was $73,580; Accounts Receivable was $45,380; and Accounts Payable was $43,380

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts