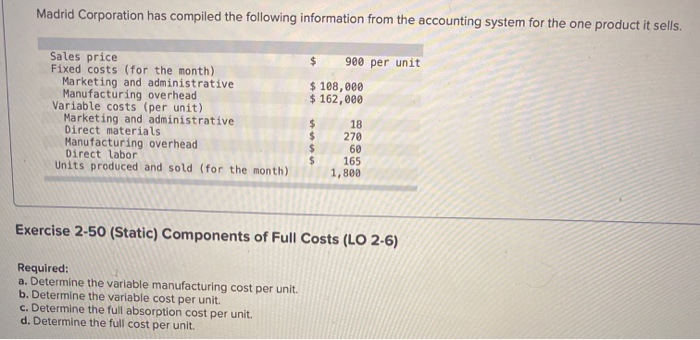

Question: how do i calculate these? i can't figure it out Madrid Corporation has compiled the following information from the accounting system for the one product

Madrid Corporation has compiled the following information from the accounting system for the one product it sells. $ 900 per unit $ 108,000 $ 162,000 Sales price Fixed costs (for the month) Marketing and administrative Manufacturing overhead Variable costs (per unit) Marketing and administrative Direct materials Manufacturing overhead Direct labor Units produced and sold (for the month) $ $ $ $ 18 270 60 165 1,800 Exercise 2-50 (Static) Components of Full Costs (LO 2-6) Required: a. Determine the variable manufacturing cost per unit. b. Determine the variable cost per unit. c. Determine the full absorption cost per unit. d. Determine the full cost per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts