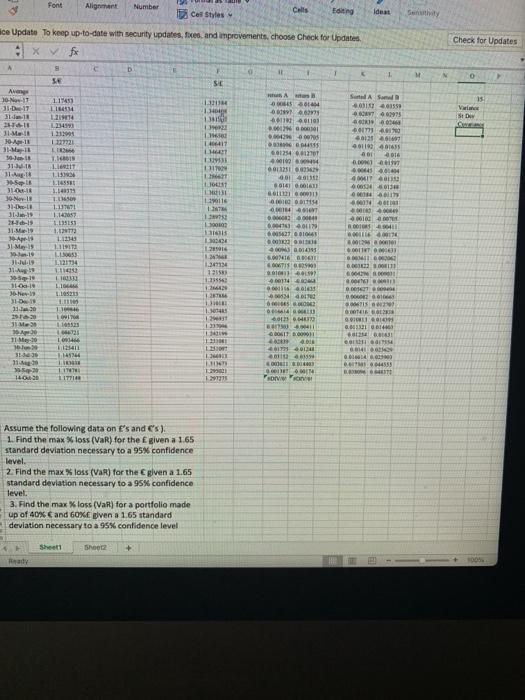

Question: How do i calculate Value at risk using the given data (questions 1-3)? Please dont answer the questions, but help me understand how to calculate

Member Check for Updates v M 0 15 Vs ESSED IN FROAD V SD Q 6134 BALL 100 BISEIDO INTE Font Alignment Number Cells Car Styles Ideas ice Update To keep up-to-date with security updates fixes and improvements. Choose Check for Updates XV fx 9 D 1 1 SE SE AVON SA 16-17 117451 1313 00015 31-De17 LI 0 0 0.0 1.2194 13 - 40103 H-1 12345 014 0.001 JIM 12391 0749 06007 6012 1013 122721 13 1911940143 SIMI LE 0.0127 - 30- T. 2016 DO 31-01-18 LIIT AL 11 1.15 0044 44 00012 LES IT 40141 61 004 31-03-18 001 Jo-New- 1.15 0.000114 00000 31-Dec- 1. 137671 14 31-19 04 1.147017 11 1.139151 0.000.000 10000400 0 401 31-19 1.12 000 441 1116 0104 107 Apa 2017 143 02 3) May 1.2016 9-10 LIS J. 1214 INI 134714 TIS 0.000 135 104.69 -60e. 200 1.00 1s 01 000 34 4.0172 11-01 13.20 6.006715 1.14 142 E B 29162 6.0 2010 31 Me 11 0. 04125 BONITORI 1. Me-20 LO GIG 10.1 12411 1145344 4.01.2014 32-33 6014 4011049 G0114 0.45 352 1177 1200 ON BRITI 14020 DIV . ON GB CS DO NE TWO www SO SVE! WER 100 1 LEI MIR WEB RITMO Assume the following data on E's and C's). 1. Find the max % loss (VaR) for the given a 1.65 standard deviation necessary to a 95% confidence level. 2. Find the max % loss (VaR) for the given a 1.65 standard deviation necessary to a 95% confidence level. 3. Find the max % loss (VaR) for a portfolio made up of 40% and GOXEven a 1.65 standard deviation necessary to a 95% confidence level her Apel 005

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts