Question: How do I complete these accounting problems? This is the beginning of my assignment, I do not have the April 30th trial balance. This is

How do I complete these accounting problems? This is the beginning of my assignment, I do not have the April 30th trial balance. This is all the information that was given to me.

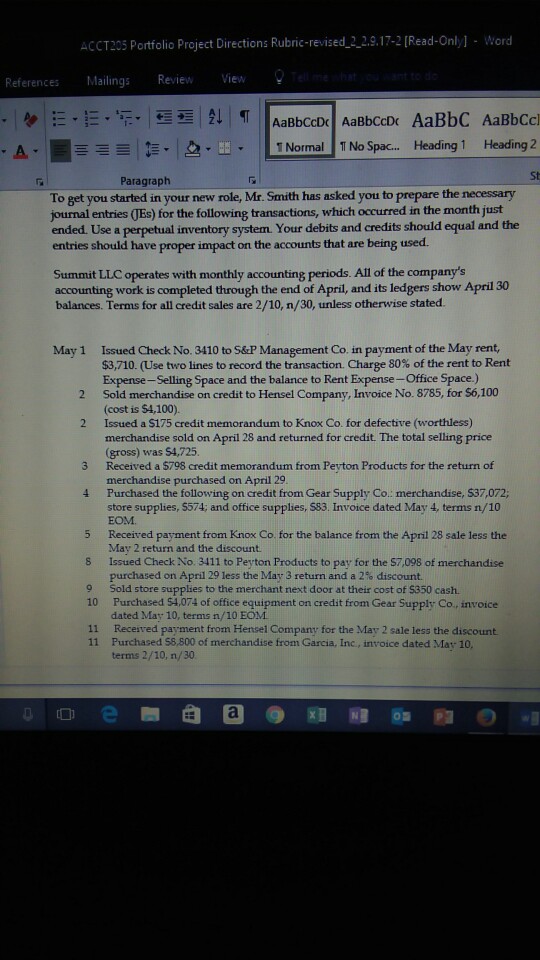

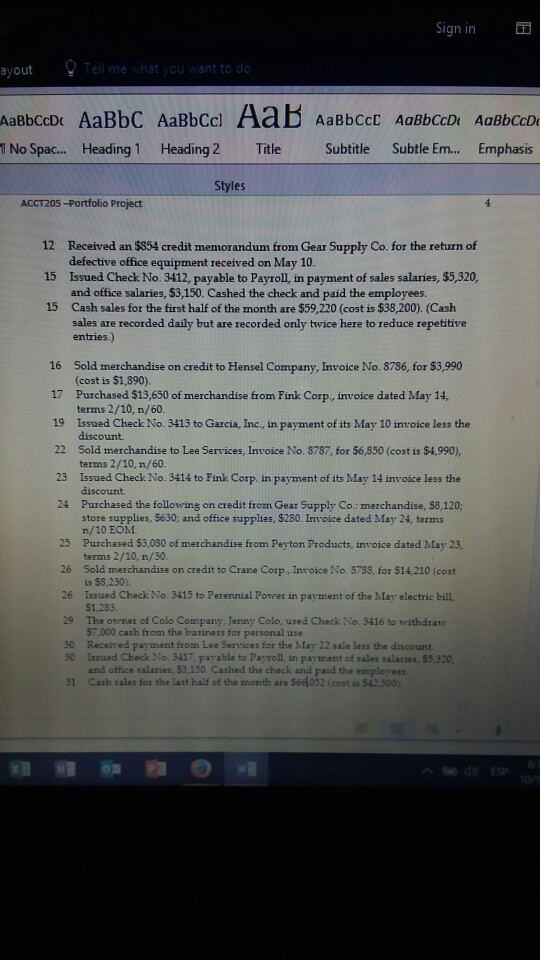

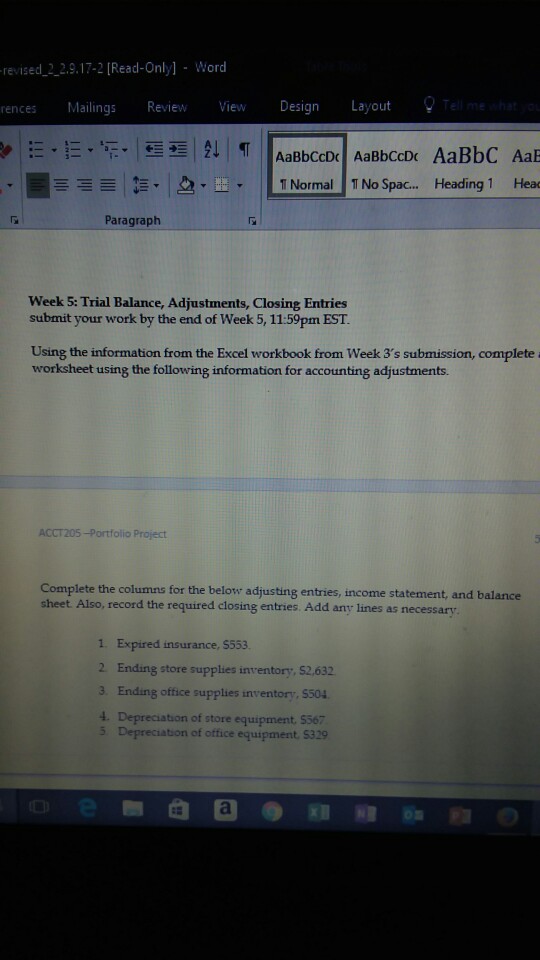

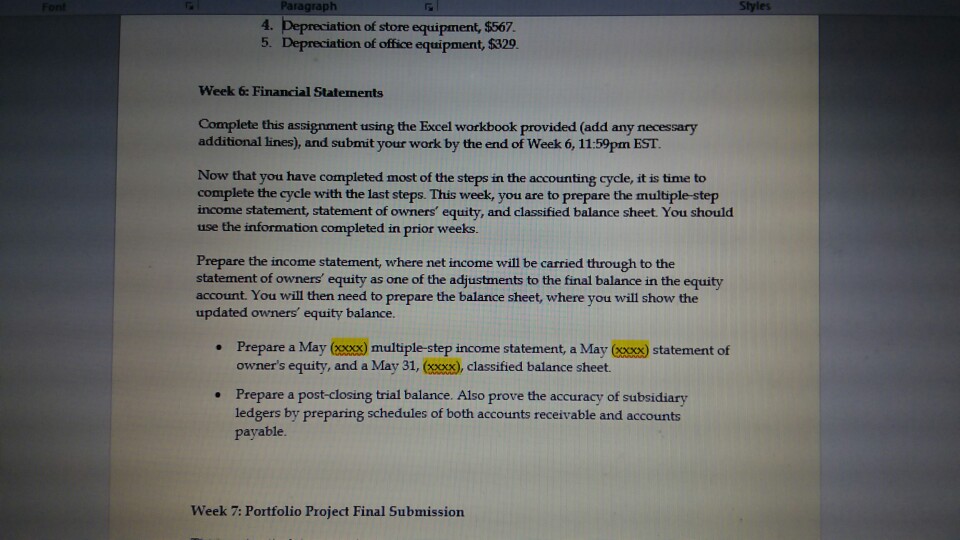

ACCT205 Portfolio Project Directions Rubric-revised,-2.9, 17-2 [Read-Onl/-word References Mailings Review View aBbCcD AaBbCcDc AaBbC AaBbCcl Normal 1 No Spac... Heading1 Heading 2 St Paragraph To get you started in your new role, Mr. Smith has asked you to prepare the necessary journal entries (JEs) for the following transactions, which occurred in the month just ended. Use a perpetual inventory system Your debits and credits should equal and the entries should have proper impact on the accounts that are being used. Summit LLC operates with monthly accounting periods. All of the company's accounting work is completed through the end of April, and its ledgers show April 30 balances. Terms for all credit sales are 2/10, n/30, unless otherwise stated Issued Check No. 3410 to S&P Management Co. in payment of the May rent, $3,710. (Use two lines to record the transaction. Charge 80% of the rent to Rent Expense-Selling Space and the balance to Rent Expense-Office Space.) Sold merchandise on credit to Hensel Company, Invoice No. 8785, for $6,100 (cost is $4,100). Issued a $175 credit memorandum to Knox Co. for defective (worthless) merchandise sold on April 28 and returned for credit. The total selling price (gross) was S4,725 Received a 5798 credit memorandum from Peyton Products for the return of merchandise purchased on April 29 May 1 2 2 3 4 Purchased the following on credit from Gear Supply Co.: merchandise, 537,072; store supplies, 5574; and office supplies, 583. Invoice dated May 4, terms n/10 EOM 5 Received payment from Knox Co for the balance from the April 28 sale less the May 2 return and the discount Issued Check No. 3411 to Peyton Products to pay for the S7,098 of merchandise purchased on April 29 less the May 3 return and a 2% discount. 8 Purchased $4,074 of office equipment on credit from Gear Supply Co, invoice dated May 10, terms n/10 EOM 10 11 Received payment from Hensel Company for the May 2 sale less the discount 11 Purchased S5,500 of merchandise from Garcia, Inc, invoice dated May 10, terms 2/10, n/30 ACCT205 Portfolio Project Directions Rubric-revised,-2.9, 17-2 [Read-Onl/-word References Mailings Review View aBbCcD AaBbCcDc AaBbC AaBbCcl Normal 1 No Spac... Heading1 Heading 2 St Paragraph To get you started in your new role, Mr. Smith has asked you to prepare the necessary journal entries (JEs) for the following transactions, which occurred in the month just ended. Use a perpetual inventory system Your debits and credits should equal and the entries should have proper impact on the accounts that are being used. Summit LLC operates with monthly accounting periods. All of the company's accounting work is completed through the end of April, and its ledgers show April 30 balances. Terms for all credit sales are 2/10, n/30, unless otherwise stated Issued Check No. 3410 to S&P Management Co. in payment of the May rent, $3,710. (Use two lines to record the transaction. Charge 80% of the rent to Rent Expense-Selling Space and the balance to Rent Expense-Office Space.) Sold merchandise on credit to Hensel Company, Invoice No. 8785, for $6,100 (cost is $4,100). Issued a $175 credit memorandum to Knox Co. for defective (worthless) merchandise sold on April 28 and returned for credit. The total selling price (gross) was S4,725 Received a 5798 credit memorandum from Peyton Products for the return of merchandise purchased on April 29 May 1 2 2 3 4 Purchased the following on credit from Gear Supply Co.: merchandise, 537,072; store supplies, 5574; and office supplies, 583. Invoice dated May 4, terms n/10 EOM 5 Received payment from Knox Co for the balance from the April 28 sale less the May 2 return and the discount Issued Check No. 3411 to Peyton Products to pay for the S7,098 of merchandise purchased on April 29 less the May 3 return and a 2% discount. 8 Purchased $4,074 of office equipment on credit from Gear Supply Co, invoice dated May 10, terms n/10 EOM 10 11 Received payment from Hensel Company for the May 2 sale less the discount 11 Purchased S5,500 of merchandise from Garcia, Inc, invoice dated May 10, terms 2/10, n/30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts