Question: How do I do a, b and c? Please go step by step and in detail. Thank you in advance! 5. Assume that it is

How do I do a, b and c? Please go step by step and in detail. Thank you in advance!

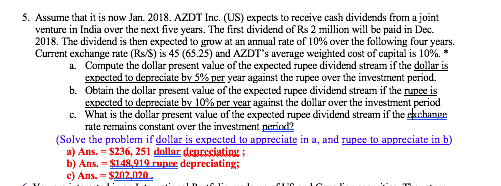

5. Assume that it is now Jan. 2018. AZDT Inc. (US) expects to receive cash dividends from a joint venture in India over the next five years. The first dividend of Rs 2 million will be paid in Dec. 2018. The dividend is then expected to grow at an annual rate of 10% over the following four years. Current exchange rate (Rs/S) is 45 (65.25) and AZDT's average weighted cost of capital is 10%. * 1. Compute the dollar present value of the expected rupee dividend stream if the dollar is expected to depreciate by 5% per year against the rupee over the investment period. b. Obtain the dollar present value of the expected rupee dividend stream if the rupee is expected to depreciate by 10% per year against the dollar over the investment period c. What is the dollar present value of the expected rupee dividend stream if the exchange rate remains constant over the investment period? (Solve the problem if dollar is expected to appreciate in a, and rupee to appreciate in b) a) Ans. = $236, 251 dollar depreciating b) Ans. = $148,919 rupee depreciating c) Ans. - $202,020 CIT 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts