Question: how do I do the statement of retained earning '? Overview: In your final project, you will assume the role of an accountant and complete

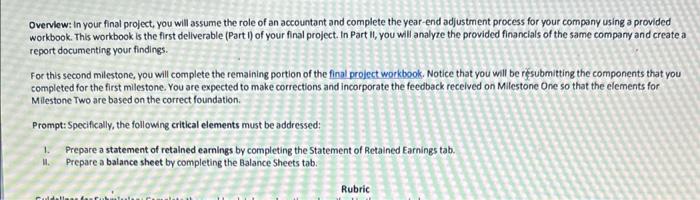

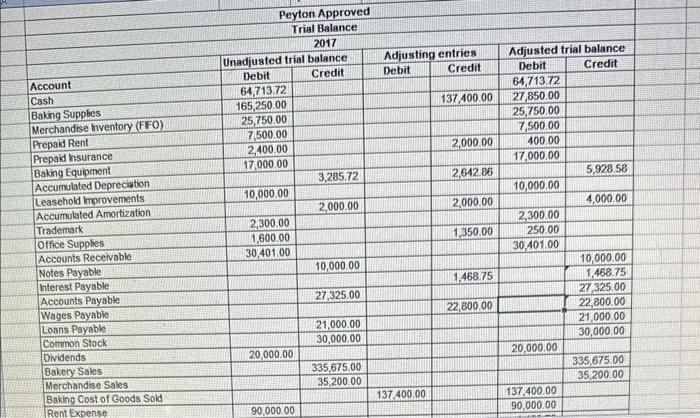

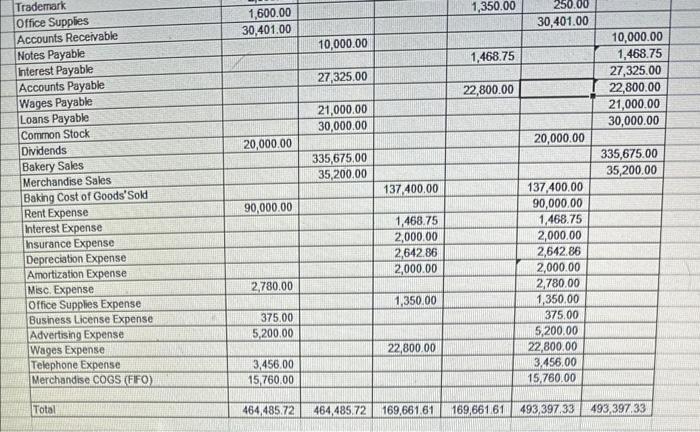

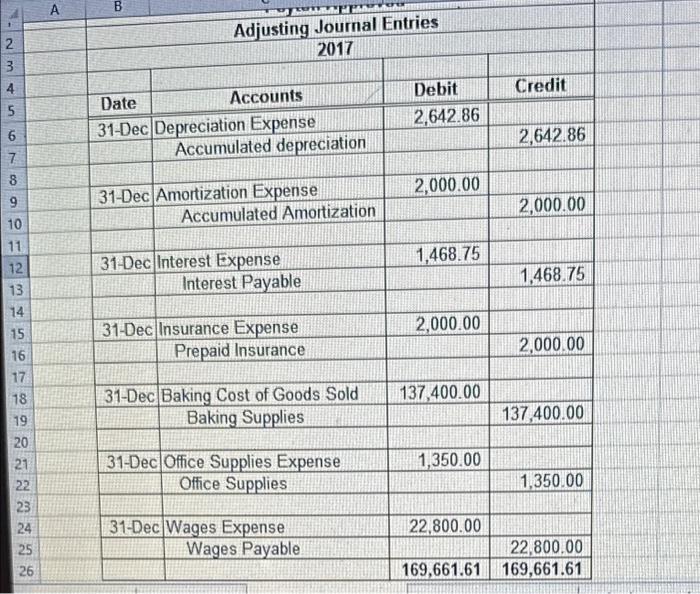

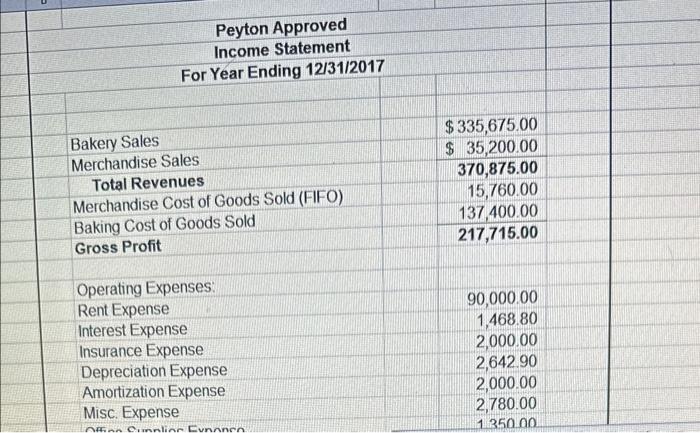

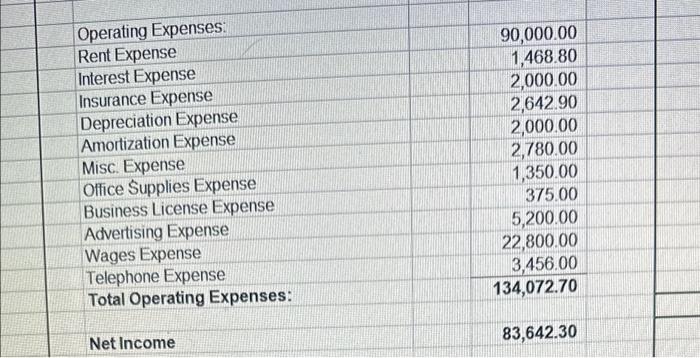

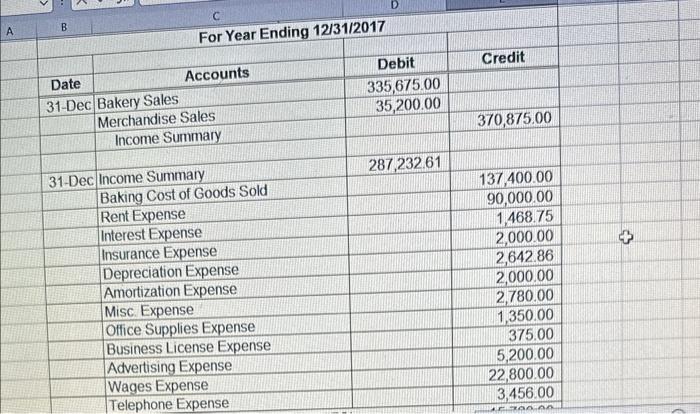

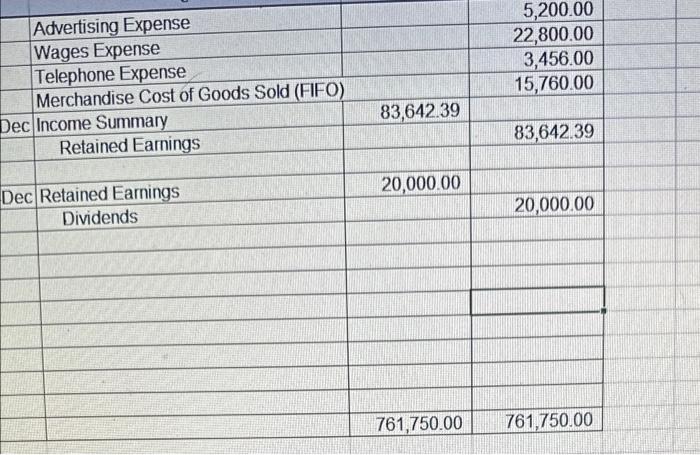

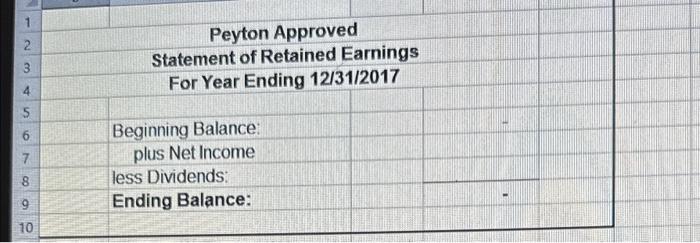

Overview: In your final project, you will assume the role of an accountant and complete the year-end adjustment process for your company using a provided workbook. This workbook is the first deliverable (Parti) of your final project. In Part II, you will analyze the provided financials of the same company and create a report documenting your findings. For this second milestone, you will complete the remaining portion of the final prolect workbook. Notice that you will be refsubmitting the components that you completed for the first milestone. You are expected to make corrections and incorporate the feedback recelved on Milestone One so that the elements for Milestone Two are based on the correct foundation. Prompt: Specifically, the following critical elements must be addressed: 1. Prepare a statement of retained earnings by completing the Statement of Retained Earnings tab. 11. Prepare a balance sheet by completing the Balance Sheets tab. Operating Expenses: Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Total Operating Expenses: \begin{tabular}{|r|} \hline 90,000.00 \\ \hline 1,468.80 \\ 2,000.00 \\ \hline 2,642.90 \\ \hline 2,000.00 \\ \hline 2,780.00 \\ \hline 1,350.00 \\ 375.00 \\ \hline 5,200.00 \\ \hline 22,800.00 \\ 3,456.00 \\ \hline 134,072.70 \\ \hline 83,642.30 \\ \hline \end{tabular} Peyton Approved Statement of Retained Earnings For Year Ending 12/31/2017 Beginning Balance: plus Net Income less Dividends: Ending Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts