Question: how do i do these 3. Momo is a fast-growing company. The company will pay its first dividend of $2.45 a year from now. The

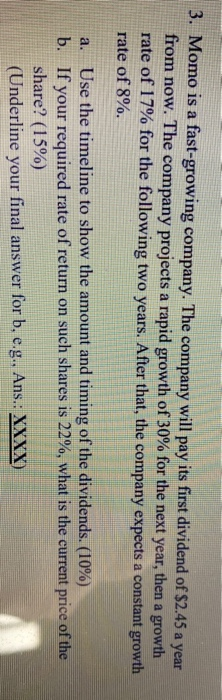

3. Momo is a fast-growing company. The company will pay its first dividend of $2.45 a year from now. The company projects a rapid growth of 30% for the next year, then a growth rate of 17% for the following two years. After that, the company expects a constant growth rate of 8%. a. Use the timeline to show the amount and timing of the dividends. (10%) b. If your required rate of return on such shares is 22%, what is the current price of the share? (15%) (Underline your final answer for b, e.g., Ans.: XXXX) b. If a company uses its WACC as the same discount rate for evaluating all the projects without considering their risk, what problems will occur? Next, what are the solutions? (15%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts