Question: How do I do these two questions relating to futures? 5. Derivatives and Hedging Total 20 marks Barrick Gold is a Canadian company that reports

How do I do these two questions relating to futures?

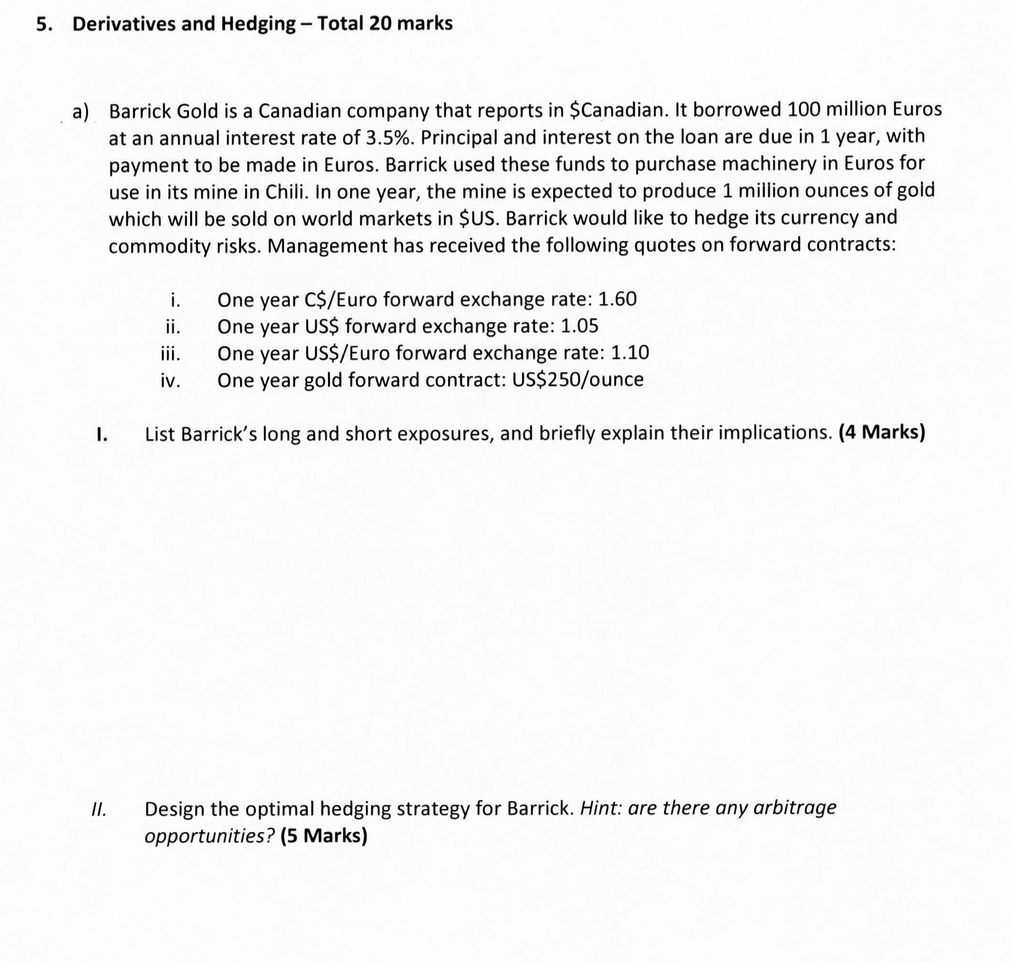

5. Derivatives and Hedging Total 20 marks Barrick Gold is a Canadian company that reports in $Canadian. It borrowed 100 million Euros at an annual interest rate of 3.5%. Principal and interest on the loan are due in 1 year, with payment to be made in Euros. Barrick used these funds to purchase machinery in Euros for use in its mine in Chili. In one year, the mine is expected to produce 1 million ounces of gold which will be sold on world markets in $US. Barrick would like to hedge its currency and commodity risks. Management has received the following quotes on forward contracts: a) i. One year C$/Euro forward exchange rate: 1.60 ii. One year US$ forward exchange rate: 1.05 ii One year US$/Euro forward exchange rate: 1.10 iv. One year gold forward contract: US$250/ounce I. List Barrick's long and short exposures, and briefly explain their implications. (4 Marks) I. Design the optimal hedging strategy for Barrick. Hint: are there any arbitrage opportunities? (5 Marks) 5. Derivatives and Hedging Total 20 marks Barrick Gold is a Canadian company that reports in $Canadian. It borrowed 100 million Euros at an annual interest rate of 3.5%. Principal and interest on the loan are due in 1 year, with payment to be made in Euros. Barrick used these funds to purchase machinery in Euros for use in its mine in Chili. In one year, the mine is expected to produce 1 million ounces of gold which will be sold on world markets in $US. Barrick would like to hedge its currency and commodity risks. Management has received the following quotes on forward contracts: a) i. One year C$/Euro forward exchange rate: 1.60 ii. One year US$ forward exchange rate: 1.05 ii One year US$/Euro forward exchange rate: 1.10 iv. One year gold forward contract: US$250/ounce I. List Barrick's long and short exposures, and briefly explain their implications. (4 Marks) I. Design the optimal hedging strategy for Barrick. Hint: are there any arbitrage opportunities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts